How to hire a skilled finance team and build a strong finance function

New skillsets are changing finance recruitment

80% of finance employees prefer a skills-based hiring process (12 percentage points higher than the industry-wide average). Read the report to learn more.

In the early stages of any business, the responsibility of maintaining a positive cash flow and balancing the books often falls on the founders.

However, as your business grows, you’ll need to hire financial experts to help you expand and navigate complex financial matters. At first, you may decide to outsource these tasks to an accounting firm, but as you scale your business, hiring an in-house financial team will become a necessary next step at some point.

Your finance team will not only take care of accounting but also help you:

Build a sound financial strategy

Make decisions that align with your growth objectives

Attract new capital

Manage your company’s finances

In this guide, you’ll learn how to build a robust finance team from the ground up. In it, you’ll find information about:

The core functions of finance teams

Key roles and crucial skills

Skills assessments you can use to make better hiring decisions

Interview questions you can ask, and more

You’ll also find a step-by-step guide to streamlining your hiring process and hiring an expert finance team.

What do finance teams do?

Your finance team is responsible for your company's financial management and well-being. Its key responsibilities include the following:

Financial planning: This is the process of setting up financial goals and creating a plan for achieving them.

Budgeting: Budgeting is the process of allocating money for specific business needs and ensuring a positive cash flow while reducing or avoiding overspending.

Forecasting: A skilled financial team can predict future expenses and profits and create a plan to stay within budget.

Accounting: The accounting team is the backbone of every finance team. They are responsible for accounts payable and receivable, keeping track of all financial transactions, and keeping your balance books in check.

Reporting and analysis: Based on the numbers, the finance team prepares reports that a company’s decision-makers use to create a plan for the future. The finance team also provides an analysis of the company’s financial health to help with forecasting and budgeting.

Compliance: Every business must comply with financial regulators and laws. The finance team does this by preparing annual reports and maintaining accurate financial records.

Risk management: Finally, the finance team identifies, assesses, and manages financial risks and prepares recommendations for corrective actions to mitigate them.

What are the most essential roles in a finance team?

When hiring an entire finance team, you must know what professionals to look for. We’ve compiled a list of the most essential roles in a finance team below.

Accountant

The accounting team is the core of your finance team.

A good accountant will keep track of your business’s financial transactions and advise you how much money you can spend and how you can structure your spending. For example, you may want to splurge on new equipment, but your accountant might advise you to hold off until the next quarter or reevaluate your plan if you don’t have the funds for it.

Apart from that, an accountant’s main responsibilities include bookkeeping, auditing, and advisory services, so it’s essential to hire the right people for the role.

Financial analyst

Financial analysts are responsible for analyzing financial data and helping you make better financial decisions based on the conclusions they draw from it.

They’ll also prepare forecasts and make strategic recommendations on acquiring new capital and investing in new opportunities.

Financial advisor

A financial advisor is someone who can help you make informed financial decisions.

While they often offer personal advice to individuals, they may also work as full-time employees and offer financial guidance. They can help you define budgets, manage revenue and investments, and help you build a plan for the future.

The duties of a financial advisor can overlap with those of a financial analyst, controller, and manager, so hiring one person for those roles may be useful if you’re working for a smaller enterprise that doesn’t yet have the resources to hire separate professionals.

Financial controller

Financial controllers are responsible for keeping your business afloat and maintaining fiscal integrity. They’ll ensure your business can stay profitable, so not taking their advice might put your organization at risk.

Financial controllers also ensure your business stays compliant and adheres to regulations. They also manage your company’s overall accounting and financial procedures.

Chief financial officer

The chief financial officer (CFO) is responsible for handling all financial matters of your business and managing your finance team.

For this, they oversee all departments' financial matters, provide invaluable advice for business growth, and strategize on how to procure more capital and achieve your objectives.

Depending on your company’s size, you might also hire a financial manager who works under the CFO. Understanding the difference between the two is important when building your finance team.

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

Skills to look for when hiring a finance team

You need to know what skills to look for when hiring your finance team. There are several hard and soft finance skills that you should search for.

Here are some of the crucial hard and soft skills to search for when building your finance team:

Market awareness

Everyone within your finance team should have an excellent awareness of your business environment.

This includes having a deep understanding of market trends and industry dynamics and staying informed about economic factors, competitor activities, and market opportunities.

Hiring candidates with a strong knowledge of your market will enable you to make informed business decisions and build a robust financial strategy.

Financial project management

Financial project management involves the planning, organization, and execution of financial processes, so hiring someone who has those skills is essential if you want to lay a strong foundation for your future finance team.

Accounts payable and receivable

Your finance team will be in charge of the timely and accurate preparation, analysis, and presentation of financial accounts.

Employees also need to be great communicators, because they need to provide stakeholders with clear insights into the business's financial health, based on accounts payable and receivable data.

Mergers and acquisitions (M&A) expertise

Successfully executing mergers and acquisitions (M&A) requires great attention to detail, strategic thinking, and planning.

Employees with this skill will have all the legal and administration knowledge to perform these complex tasks, which are crucial for larger companies.

Communication

Having the ability to explain financial jargon in plain language is a crucial skill for any financial professional.

Regardless of their specific communication type, you want to hire candidates who can communicate clearly with all departments and build successful relationships with stakeholders.

Problem-solving

Problems always arise, so having people who can find solutions quickly is a highly valuable skill for finance teams.

When you have a financial problem, you want to turn to your financial experts for the right solutions. However, these solutions must be based on data, so strong analytical skills are also essential.

Attention to detail

Attention to detail is an essential skill to have, no matter what industry you work in. When you’re working with numbers and datasets, however, it becomes even more crucial.

The ability of each member of the financial team to look for information, gather insights, and spot errors quickly is vital for the success of your business.

How to build a successful finance team: A step-by-step guide

Below, you’ll find our blueprint for building an efficient finance team from the ground up.

Step 1: Define the structure of your future finance team

The size of your company will define your finance team's structure. Larger organizations will have bigger teams with more specialized roles, while smaller companies will have fewer team members and each person will take on a larger scope of responsibilities.

Here’s how you can structure your finance team based on your company’s size:

Small businesses: Smaller organizations will benefit from a flat structure, where team members collaborate and work on various projects simultaneously. If you’re a start-up, it’s most likely that the CEO will take control of this team, while an accountant works on all financial transactions and provides guidance to the CEO.

Medium businesses: Medium-sized businesses will typically need a larger finance team with team members who specialize in accounting, treasury, and risk management. A CFO or a finance manager will oversee the work of the team.

Large businesses: Large businesses will have a strict hierarchical structure, with the CFO at the helm, supported by his deputies or other managers. Each team within the finance department might have a manager or even a management team to oversee all finance-related operations: budgeting, auditing, resource planning, reporting and analysis, and more.

Step 2: Identify the roles for which you need to hire

Once you decide on your structure, you must determine what types of finance specialists you need to hire. Again, this decision will be based on the size of your company and on the specific needs of the finance function.

Hiring an accountant is essential, even for a start-up, so that’s the first role you must consider. If you’re just starting, hiring a freelance accountant to do your books might be more lucrative. As you grow, however, you’ll want to start building your in-house finance team.

Step 3: Define key finance skills for each role

Next, you need to define the skills that each role requires. Here are some examples:

Role | Key skills |

Accountant | Attention to detail Critical thinking Accounting software like Xero or QuickBooks Online |

Financial analyst | Budgeting Attention to detail Data analysis |

Chief financial officer (CFO) | Leadership and people management Business judgment Business ethics and compliance Communication |

Step 4: Source finance candidates

After you know what type of candidates you’re looking for, it’s time to find them. Consider these options:

LinkedIn: You can find a lot of finance professionals on LinkedIn. Even if they’re not searching for a job, it doesn’t hurt to approach them with a great offer; passive candidate recruitment is a viable option for many roles.

Job boards: If you need a freelance accountant or bookkeeper, consider hiring a freelancer. Job board websites like Upwork can be a good option, or you might want to consider specialized finance job boards, such as eFinancialCareers, FinanceJobs, or GAAPWeb.

Finance associations: Another way to find finance professionals is through associations like the Association for Financial Professionals (AFP).

Referrals: If you’re already an established company, you can build an employee referral program to find new talent.

Step 5: Evaluate finance skills

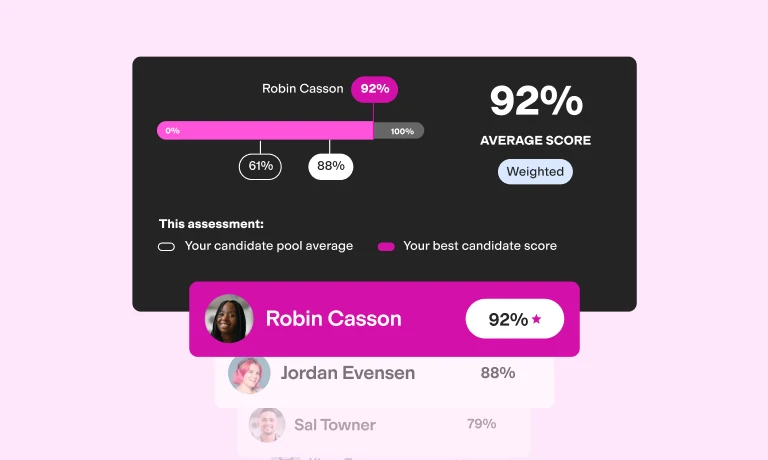

After you source your candidates, it’s time to evaluate their skills. This is where pre-employment skills testing can help you in finding talented professionals with practical knowledge and expertise.

90% of finance employers reduce mis-hires when they practice skills-based hiring, and 94% improve retention.

You can use pre-employment skills testing for financial roles to identify skills gaps and find people who will perform well on the job. This method also helps you avoid hiring biases and reduce turnover rates.

Using TestGorilla’s evaluations will help you save time and money and hire the best finance team in no time. Our top suggestions for finance skills tests are:

Financial management: Use this test to evaluate candidates’ ability to manage finances in order to maximize business profits and minimize risk.

Financial modeling in Excel: Find candidates who can create and update financial models using Excel.

Financial accounting (IFRS): Make sure your accounting team knows how to record, classify, and summarize accounting transactions according to the International Financial Reporting Standards (IFRS).

Financial math: Having employees who can do computations efficiently and accurately is essential for any finance team.

Financial due diligence: When hiring financial controllers and managers, make sure they know how to assess your business’s financial health, identify associated risks, and manage them accordingly.

Communication: Hire candidates who can listen carefully and communicate clearly.

Problem-solving: When it comes to financial matters, your finance team needs to be able to find solutions to emerging problems quickly and efficiently. Use our problem-solving test to find candidates that are excellent problem-solvers.

Step 6: Use the right finance interview questions

After you assess applicants’ skills with the help of skills tests, it’s time to invite your best talent to an interview.

Here are some questions you can ask to gain a deeper understanding of candidates’ expertise:

Can you explain the difference between cash flow and profit?

Describe a time when you had to explain a complex financial concept to a non-financial person.

What steps do you take to ensure accuracy in your financial reports?

Describe a complex financial project you managed. What were the challenges and outcomes?

Tell me about a time when you identified a significant financial error. What did you do to correct it?

How do you evaluate the financial performance of a company?

What methods do you use to assess investment risks?

How do you approach financial strategy planning in uncertain economic times?

How do you balance long-term financial planning with immediate financial needs?

How do you align financial strategies with the overall goals of a business?

What is your experience in managing financial teams?

How do you foster a culture of financial integrity and transparency in an organization?

Can you discuss a time when you had to implement a significant financial system or process change?

How do you approach and manage financial risk?

What would you do if a key stakeholder disagreed with your financial strategy?

If you need more ideas for interview questions, check out our:

Step 6: Hire and onboard new employees

Once you’re ready to make a hiring decision, extend your offer. After your new employees accept it, make sure to enroll them in an onboarding program.

Having an onboarding program is a sure way to show your new employees what you expect of them and make them feel welcomed and accepted.

Step 7: Use the right finance tools

Give your finance team the right software to do their best work. Some of our top picks are:

Financial analysis and reporting: Microsoft Excel, Tableau, PowerBI by Microsoft

Budgeting and financial planning: Budgyt, Sage Intacct

Accounting: Xero, QuickBooks

Enterprise Resource Planning (ERP): NetSuite, SAP

Hire the best financial team with TestGorilla

Building a finance team for your business can feel like a daunting task. However, following the step-by-step process outlined in this article, you’ll hire finance professionals in no time.

The most important step is to find candidates with the right skills and expertise for the job. With the help of our pre-employment skills tests, you’ll be able to hire professionals who have the right skills that align with your company goals and culture.

Get started with your free plan today and start building a skilled and reliable financial team. To find out more about how TestGorilla can help you evaluate candidates’ skills for any role, sign up for a free live demo with a member of our team.

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.