How to use pre-employment testing for financial roles

Skills-based hiring in finance

80% of finance employees prefer a skills-based hiring process (12 percentage points higher than the industry-wide average). Read The State of Skills-Based Hiring in Finance to learn more.

Table of contents

- Why employers use pre-employment testing

- The purpose of financial employment testing

- Different types of pre-employment tests for financial roles

- Financial employment testing: When to test

- Top skills and abilities to look for in banking and finance professionals

- TestGorilla finance tests can help you make better hires, faster and bias-free

Organizations in the finance sector are being challenged by disruptive technologies, evolving consumer trends, and constantly changing regulations. Financial firms have to ensure that they attract the right talent to keep up with such rapid transformations.

Skills gaps can cause significant issues for businesses of all kinds, but it’s become more essential than ever to attract the right candidates in the finance sector. With that comes a responsibility to ensure that those applying to fill niche financial positions can perform well on the job.

That’s where pre-employment testing comes in. In the finance industry, the right talent delivers a competitive advantage. From bank tellers and financial analysts to staff accountants or branch managers, here’s everything you need to know about pre-employment testing for financial roles.

Why employers use pre-employment testing

Brands of all niches and sectors use pre-employment testing. That’s because well-designed tests can provide recruiters with real insights into candidates’ skills and are proven indicators of future performance. They add objectivity to recruitment.

Otherwise said, the results that pre-employment tests provide are proven to have a real-world impact in the workplace.

When candidates are tested, recruiters can more easily identify those that are likely to perform well on the job. There are other advantages as well—pre-employment testing helps recruiters:

Save time and money during recruitment

Boost in-house morale

For this reason, pre-employment testing is becoming an essential part of the hiring funnel. After writing a strong external auditor job description or posting a job for any kind of financial role, pre-employment assessments let you take the next step to a successful hire.

For financial institutions, there is often an ongoing battle to source and recruit the best talent. In a sector that’s largely driven by technology, skills tests make it easier to find and hire candidates with the necessary skills.

The purpose of financial employment testing

For candidates who have applied for a role in a finance organization, tests are playing an increasingly important role. Many banks and accountancy firms will not even go through applicants’ resumes until testing has been conducted.

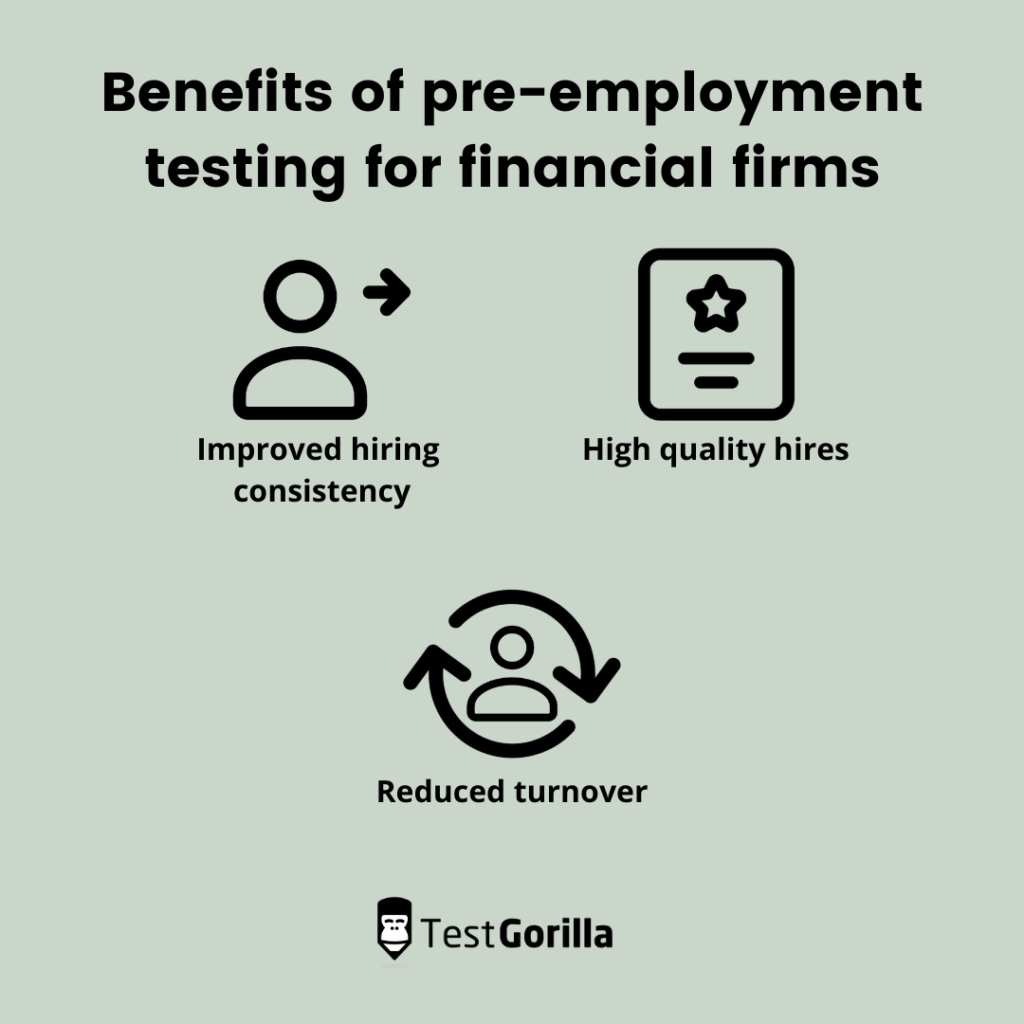

If candidates have taken pre-employment finance tests, those that score low will find that their application is much weaker, and they’ll likely be rejected. For the financial firms themselves, pre-employment testing brings several advantages:

Improved hiring consistency

On average, an ad for any kind of corporate job will attract around 250 applications. Only one person out of these 250 applicants will be offered the position. With so many applicants to choose from and resumes to read, it can be too easy to overlook the best candidates. Organizations may become vulnerable to exaggerated work histories or even blatant falsehoods about skills and ability. According to Monster’s 2019 State of the Recruiter survey, 85% of recruiters find that candidates exaggerate their skills on a resume.

In finance roles, this can be extremely dangerous.

By using pre-employment testing, recruiters can cut through the chaff more efficiently and identify the best candidates to shortlist and interview. From there, test results can be used to guide the interview stage of the selection process. Testing potential hires helps you make sure that your applicants meet your baseline expectations of financial skills and performance potential, which, in turn, enables you to guarantee that teams are being built with consistency.

High-quality hires

Testing candidates makes it much easier to see those who stand out. Failing a financial skills test indicates that a candidate is simply not the right fit for the position; you can disqualify those and proceed with the rest.

Pre-employment tests can cover a wide range of skills and can also be used to ensure personality and culture fit. By analyzing the results of skills and personality tests, it becomes much easier to hire only the best candidates. The result is stronger teams, which are more productive, and also more diverse and inclusive.

In the finance sector, tests can also be used to assess how well candidates respond to change. In the constantly evolving finance niche, adaptability is crucial.

Reduced turnover

The recruitment process can be long and costly. The longer it takes, the longer an organization is without a key employee. Managing a recruitment budget is one of the core responsibilities of HR teams, but the turnover rate also has to be considered.

94% of finance employers improve retention when they switch to skills-based hiring. Source: The State of Skills-Based Hiring in Finance

The hiring team needs to make sure that it only hires the top candidates. However, it also needs to ensure that the chosen candidates are likely to stay in the role. Rapid turnover can make the costs of recruitment balloon, and that’s bad news, both for the hiring team and the organization itself.

Pre-employment testing in the finance sector isn’t about focusing solely on a candidate’s skills with numbers. They can also assess situational judgment, communication skills, and more. The results of those tests are going to make it easier to identify the candidates that are likely to be a) excellent in the role and b) long-term employees.

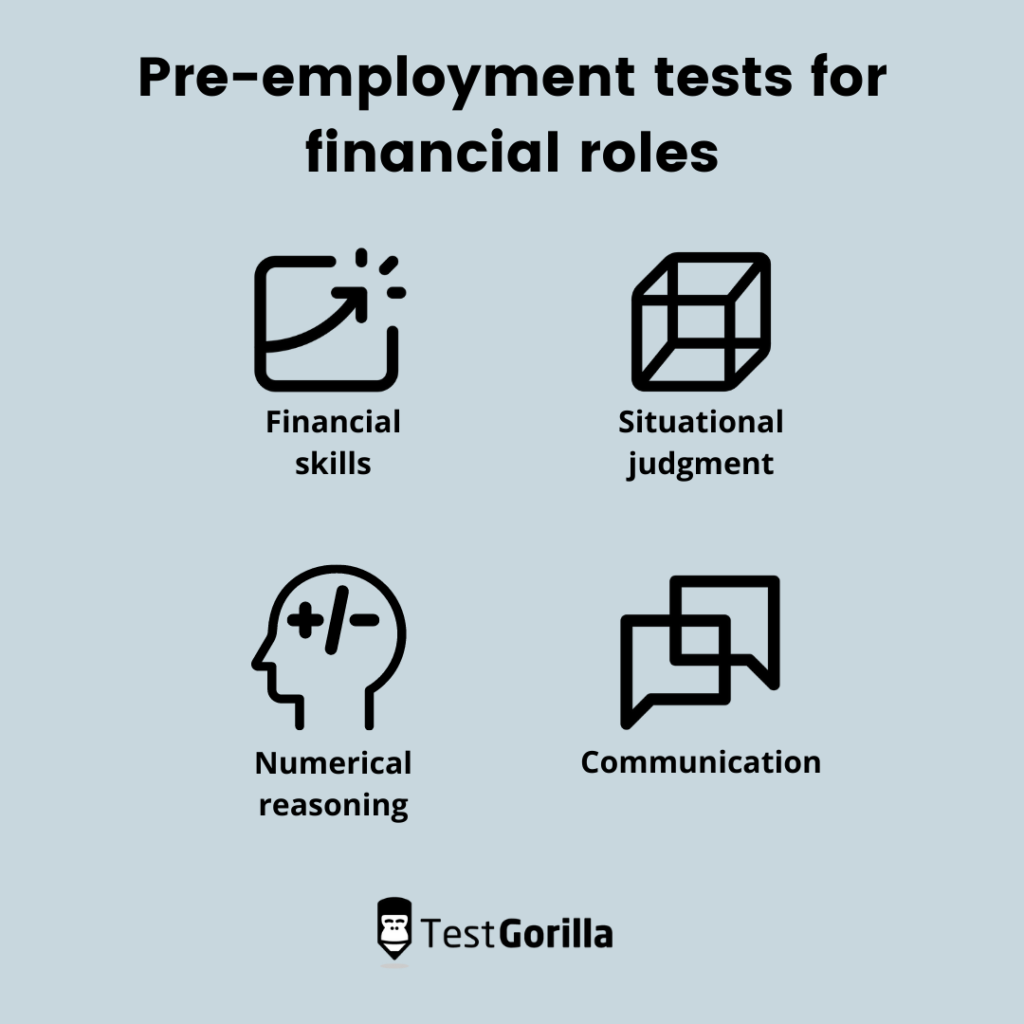

Different types of pre-employment tests for financial roles

You might think that pre-employment finance tests are all about testing a candidate’s numerical skills. Of course, that does play a part in the testing process, but it’s not the only area being tested. Here are the tests that hiring teams should be using when recruiting in the financial services sector.

Financial skills

The specific responsibilities of the vacancy you’re recruiting for will determine the suitable types of tests to use. There are now financial skills tests that will let you test candidates for particular skills.

Suppose the role you’re looking to fill is related to financial accounting and involves accounts payable or accounts receivable duties. In that case, you could use an Accounts Payable test or an Accounts Receivable test. Likewise, you can use one of TestGorilla’s finance tests for general financial accounting (US GAAP and IFRS) and financial modeling in Excel.

Recruiters must be aware that pre-employment testing for financial roles can—and should—involve in-depth and highly targeted tests. Relying on a generic finance test will not help you identify top candidates for more technical financial positions.

Situational judgment tests

More employers than ever are using situational judgment tests (SJTs) to evaluate candidates. The intent behind SJTs is to identify candidates who will be the right fit for the business culture and high responsibility roles.

In SJTs, candidates are presented with a scenario that is likely to occur in the day-to-day responsibilities of the advertised position. This could be a theoretical problem that needs to be solved together with a colleague or a mistake made with a late invoice. Then, the candidate must choose from a series of multiple choice answers.

Examples of some of the SJTs we have available include:

These tests will be evaluating the candidate in terms of their values, judgment, and critical thinking abilities. For finance roles, recruiters can customize the questions to focus on leadership, integrity, initiative, and teamwork. These are the competencies that are often essential in finance roles.

Numerical reasoning

Perhaps the most obvious type of test for financial roles, a numerical reasoning test allows recruiters to gain insights into how well candidates can work with and analyze numbers and data. There will be arithmetic problems, but the focus of this kind of test isn’t in-depth math skills and knowledge.

Instead, our numerical reasoning test evaluates the candidate in terms of how well they can cope under pressure (the tests are often set to a time limit) and how well they can analyze large volumes of data or interpret numbers, fractions, percentages, and tables. If a potential hire has exaggerated their numerical skills, this is the test that will help you identify that.

Communication

One of the most important pre-employment tests, the communication skills test, is essential for a wide range of roles in the financial services industry. This test can help select candidates who are likely to excel at team collaboration or customer service. Whatever the role, communication skills are going to play a part.

That’s why recruiters filling those roles will almost always include a pre-employment communication test. This will often be included alongside a personality test and an aptitude test to get a better picture of a candidate’s potential.

Financial employment testing: When to test

One of the biggest questions for hiring teams that want to integrate pre-employment tests into the recruitment process is when they should use them.

Some recruiters will use tests only after candidates have been shortlisted. However, recruiters who introduce testing at an earlier stage gain multiple benefits. It takes a lot of time to go through resumes, especially if there are hundreds of applicants. One of the most valuable tactics is to introduce testing as soon as an application is submitted.

Doing this makes it much easier to immediately disqualify candidates who are simply not suited for the role. If there are 250 application forms and resumes to go through, that’s going to take a lot of time. Introducing immediate testing lets HR prioritize top candidates quickly.

This can save time and lower the cost of recruitment. That’s good news for the financial organization itself, but it’s even better for recruiters. Introducing testing earlier in the hiring process dramatically shortens the recruitment life cycle.

Then, you simply need to conduct interviews using targeted interview questions (such as our bank teller interview questions or financial analyst interview questions) to identify and hire the best match.

The result is that recruiters will fill positions quickly, ensuring that the organization has the employees and skills it needs to grow.

Top skills and abilities to look for in banking and finance professionals

In an industry that evolves so quickly and consistently, finance professionals need to demonstrate a wide range of skills and competencies. Pre-employment testing for financial roles requires analyzing and mapping out the specific skills necessary for each role. That way, tests can be customized to reflect the reality of the position.

As a result, recruiters for finance roles will often look for some combination of the following:

Formal finance qualifications: Often the basic requirement for a finance-based position, it’s essential that the candidates have the necessary industry-recognized formal qualifications.

Communication skills: This is where a pre-employment assessment excels. Almost every role in a financial organization will involve communicating with others. By conducting a communication skills test, recruiters can more easily identify the candidates who won’t struggle to convey their ideas, understand and interpret information and instructions correctly, and overcome challenges.

Analysis and problem-solving skills: Finance firms will be looking for candidates that are capable of lateral thinking. Recruiters will want to see that candidates can analyze data and be able to reach the right conclusions. Problem-solving is going to be a core skill that’s required for multiple finance roles.

Technology skills: The finance sector is being driven by technology. Recruiters need to ensure that shortlisted candidates can use those technologies. From accounting software to automation tools, testing for tech skills is something you need to consider implementing in your hiring process.

Financial accounting skills: Accounts payable, accounts receivable, and general financial accounting skills (US GAAP and IFRS) are essential in all financial accounting roles, and recruiters can leverage finance tests to find the right candidates for a position in financial accounting. To this, it might be relevant to add a test for financial modeling in Excel.

Management: While this will not be expected of every role, it can be a valuable metric to measure. If a candidate shows management potential during the testing stage, they may prove ideal for a fast-track career progression. That’s good news for turnover rates and the future of the organization and might be essential if you’re looking to hire a financial controller or manager.

Of course, if you test for every competency, this will only slow down the hiring process and overwhelm candidates. You must take the time to develop an in-depth understanding of the requirements of the role you’re hiring for. You can then add custom questions to the tests you administer so that you can easily measure candidates’ potential in regards to the specific requirements of your company.

TestGorilla finance tests can help you make better hires, faster and bias-free

Job seekers who apply for finance roles will often have similar qualifications, education levels, and experience. Pre-employment psychometric tests ensure that highly qualified and skilled candidates will stand out from the crowd.

More popular than ever, pre-employment testing is one of the easiest ways to whittle down the number of applicants for any finance role. Applicants can be easily screened, which makes shortlisting easier and more objective.

Using skills tests makes it significantly simpler for recruiters in the finance sector to identify the best candidates. Pre-employment tests speed up recruitment, reduce turnover costs, and dramatically reduce recruitment process costs

Related posts

Hire the best candidates with TestGorilla

Create pre-employment assessments in minutes to screen candidates, save time, and hire the best talent.

Latest posts

The best advice in pre-employment testing, in your inbox.

No spam. Unsubscribe at any time.

Hire the best. No bias. No stress.

Our screening tests identify the best candidates and make your hiring decisions faster, easier, and bias-free.

Free resources

This checklist covers key features you should look for when choosing a skills testing platform

This resource will help you develop an onboarding checklist for new hires.

How to assess your candidates' attention to detail.

Learn how to get human resources certified through HRCI or SHRM.

Learn how you can improve the level of talent at your company.

Learn how CapitalT reduced hiring bias with online skills assessments.

Learn how to make the resume process more efficient and more effective.

Improve your hiring strategy with these 7 critical recruitment metrics.

Learn how Sukhi decreased time spent reviewing resumes by 83%!

Hire more efficiently with these hacks that 99% of recruiters aren't using.

Make a business case for diversity and inclusion initiatives with this data.