Financial Accounting (IFRS) test

Summary of the Financial Accounting test (IFRS)

This Financial Accounting test evaluates a candidate’s ability to record, classify, and summarize accounting transactions according to IFRS standards, helping you hire experts with practical financial accounting skills.

Covered skills

Recording and documentation

Classification and summarizing

Reporting and presentation

Interpretation and financial analysis

Use the Financial Accounting test online to hire

Bookkeepers, accounts assistants, financial accountants, financial managers, tax advisors, auditors, and other roles that require a good grasp of financial accounting concepts.

About the Financial Accounting test

Our Financial Accounting test (IFRS) evaluates a candidate’s ability across various accounting topics, ranging from managing balance sheets and income statements to overseeing company cash flow and equity. Workers skilled in financial accounting can track income and expenditures, ensure statutory compliance, and aid senior leaders in complex business decision-making.

All the questions are skewed to practical application, assessing applicants’ ability to prepare books that reflect the reporting entity's true and fair financial position.

Candidates who perform well on this test are confident critical thinkers who can:

Accurately record balances, income, and expenditure

Interpret and summarize financial data for reports and forecasts

Present financial reports to different audiences, including senior management

Analyze complex records and make reasoned, objective recommendations

Handle complex accounting transactions in both full International Financial Reporting Standards (full IFRS) and International Financial Reporting Standards for small and medium entities (IFRS for SMEs)

Check out multiple-choice example questions from this Financial Accounting test for more hands-on insight or for a practice test with a few sample questions.

The test is made by a subject-matter expert

Miruru W.

A practicing Certified Public Accountant (CPA), Miruru has over 25 years of experience in financial reporting, financial management, and tax advisory services.

When he is not carrying out audits in accordance with international standards in auditing and financial reporting, you might find Miruru conducting reporting and financial management assignments in a diversity of sectors, including but not limited to agro-processing, farming, petroleum import, retail, construction, and real estate.

Crafted with expert knowledge

TestGorilla’s tests are created by subject matter experts. We assess potential subject-matter experts based on their knowledge, ability, and reputation. Before being published, each test is peer-reviewed by another expert, then calibrated using hundreds of test takers with relevant experience in the subject.

Our feedback mechanisms and unique algorithms allow our subject-matter experts to constantly improve their tests.

What our customers are saying

TestGorilla helps me to assess engineers rapidly. Creating assessments for different positions is easy due to pre-existing templates. You can create an assessment in less than 2 minutes. The interface is intuitive and it’s easy to visualize results per assessment.

VP of engineering, mid-market (51-1000 FTE)

Any tool can have functions—bells and whistles. Not every tool comes armed with staff passionate about making the user experience positive.

The TestGorilla team only offers useful insights to user challenges, they engage in conversation.

For instance, I recently asked a question about a Python test I intended to implement. Instead of receiving “oh, that test would work perfectly for your solution,” or, “at this time we’re thinking about implementing a solution that may or may not…” I received a direct and straightforward answer with additional thoughts to help shape the solution.

I hope that TestGorilla realizes the value proposition in their work is not only the platform but the type of support that’s provided.

For a bit of context—I am a diversity recruiter trying to create a platform that removes bias from the hiring process and encourages the discovery of new and unseen talent.

Chief Talent Connector, small business (50 or fewer FTE)

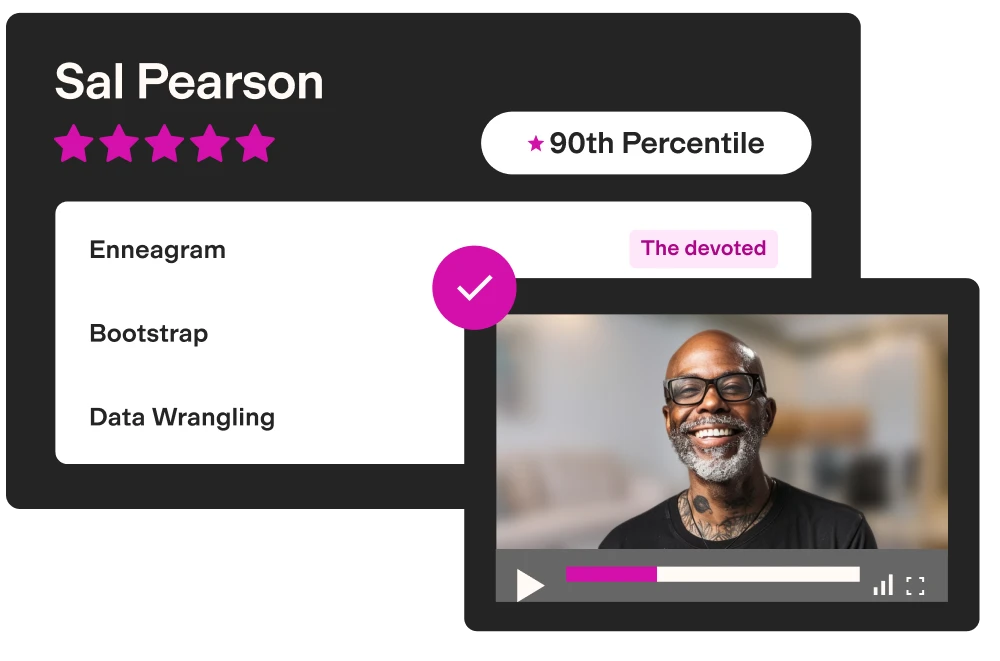

Use TestGorilla to hire the best faster, easier and bias-free

Our screening tests identify the best candidates and make your hiring decisions faster, easier, and bias-free.

Watch what TestGorilla can do for you

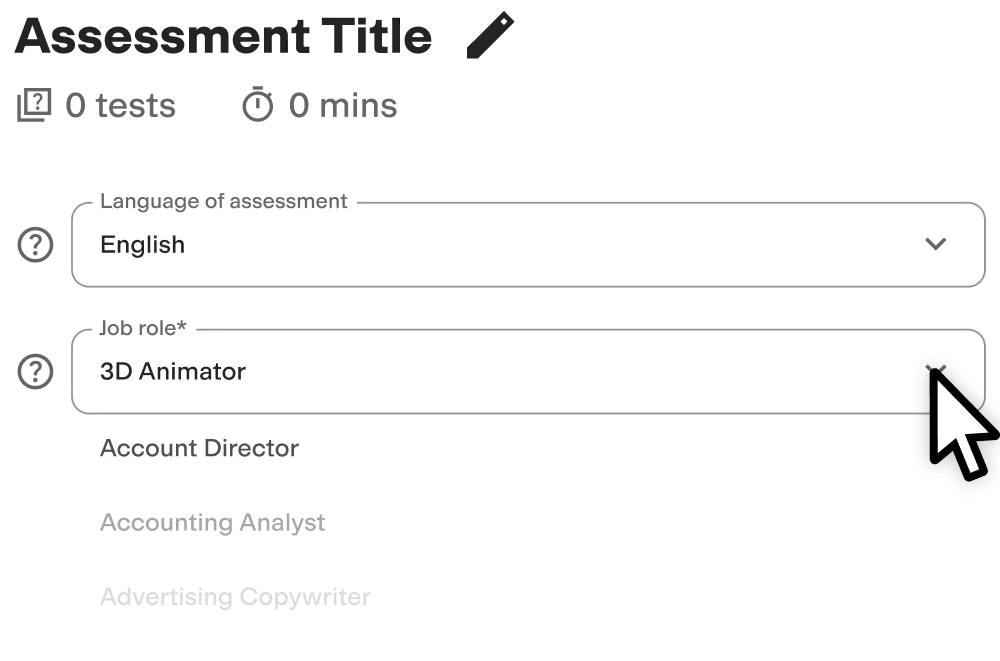

Create high-quality assessments, fast

Building assessments is a breeze with TestGorilla. Get started with these simple steps.

View a sample report

The Financial Accounting (IFRS) test will be included in a PDF report along with the other tests from your assessment. You can easily download and share this report with colleagues and candidates.

Why are financial account skills important to employers?

Employers hire people with accounting skills to manage complex and time-consuming financial tasks, including compiling balance sheets and preparing income, cash flow, and owner’s equity statements. But even more importantly, they look to financial accountants to provide the leadership and management team with trustworthy financial information to enable sound decision-making.

IFRS accounting, in particular, helps businesses simplify balance sheets and reporting for international business and cross-border transactions, reducing administrative work and costly mistakes.

With expert accounting managers and advisors, employers can:

Ensure transparency: IFRS accountants use simple, open, and standardized accounting terminologies that all parties can understand

Save money: IFRS accountants can find legal cost-saving measures when filing taxes and managing sold goods

Stay compliant: IFRS accounting experts ensure accurate debit and credit recording, tax compliance, and notation of activity statements

Forecast with confidence: Accounting skills help staff break down financial data such as debt, net income, expenses, and asset values to support stronger, more accurate business decision-making

What is the IFRS system?

The International Financial Reporting Standards system is an internationally recognized set of accounting standards. It helps public firms maintain transparent records and statements that are accessible worldwide.

More than 160 countries globally use the IFRS system. However, if you’re hiring only within the USA, we advise using our Financial Accounting test following Generally Accepted Accounting Principles (GAAP).

The three components of the IFRS system

The IFRS system is based on three principles:

Transparency: IFRS uses standardized terms for accounting operations to underpin more informed economic decision-making

Accountability: The system reduces the information gap between people who provide capital and those entrusted with that money, helping to regulate financial accounting globally

Efficiency: IFRS decreases international reporting costs and ensures all investors understand reports, improving capital allocation and removing unnecessary risks

What job roles can you hire with our Financial Accounting online test?

Our IFRS test for financial accounting is ideal for recruiting a wide range of roles in finance, including:

Bookkeepers who handle large quantities of financial data, break down and translate information for tax returns, and itemize long-term asset value, net income, expenses, and ongoing revenue

Accounts assistants who support decision-makers with clear IFRS records that identify how much money comes into a business, where it goes, and possible risks

Financial accountants and managers who use complex data and calculations to help businesses identify risks, opportunities, and sound investment decisions

Tax advisors who apply their in-depth knowledge of accounting and financial legislation to help businesses uncover potential tax savings

Auditors who analyze a business’s financial performance, break down records accurately, find areas for improvement, and give advice on regulatory compliance

Credit analysts who gather financial data to help business owners become more reliable to potential lenders and creditors

International fintech giant Revolut is one of several financial institutions using TestGorilla to hire top banking support talent. Specifically, the firm used talent discovery tests to reduce time-to-hire for multilingual financiers by an extra 10%.

Create a multi-measure assessment: 4 tests to pair with our test for financial accounting

With TestGorilla, you can create custom multi-measure assessments with up to five different multiple-choice skills tests. It’s the perfect way to get a comprehensive view of each candidate’s skills, aptitudes, and traits.

We suggest the following to learn more about the finance experts you’re attracting:

Communication test: Measure a candidate’s ability to understand and use clear verbal and written language professionally. This test helps you find conscientious communicators who can translate complex data for different audiences.

Financial Math test: Assess applicants on how well they solve complex financial math problems that arise in accounting and advisory roles. Find out how accurately job seekers use equations, formulas, and computations to build reports and forecasts.

Critical Thinking test: Discover talented people who confidently process confidential information and create financial action plans under pressure. Accountants with strong critical thinking skills stay objective and look carefully at the bigger picture.

Culture Add test: Hire accounting talent who align with your company values and aren’t afraid to innovate. Candidates with great culture add potential help to energize your company with proactivity and enthusiasm.

Tip: Check out our complete list of accountant-specific tests and, based on the position you’re hiring for, determine which selection of two to three technical tests you should include in your assessment.