Tellers represent their financial institutions to customers. From helping customers perform transactions to sorting complaints, they play a critical role in the institution’s success.

Hiring a teller is a big deal. The job of a teller is crucial because they interact directly with customers and act as the face of your company. They must be courteous and have the essential communication skills to interact with customers effectively and understand their problems.

You should ensure you find the best tellers without incurring high costs or wasting time. Hence, you must have a keen eye for talent and the technical know-how to recruit a teller effectively.

If you’re looking to hire top-notch tellers for your institution, this is the guide for you. Here, we will discuss the duties of a teller, their skills, and helpful tips on how to hire a teller for your business.

Table of contents

What is a teller?

A teller, often known as a bank teller, is a person who carries out transactions for customers in a financial institution. They work in banks and credit institutions and are responsible for satisfying customers’ needs and providing good customer service.

Tellers communicate directly with customers to understand their requests and handle them accordingly. They help customers finalize financial transactions, account setups, and verification processes.

Besides dealing with transactions, bank tellers are also responsible for providing excellent customer service. This means they must attend to customers in a friendly way while maintaining a high degree of professionalism.

At times, the job role of a teller might be specific to their title. There are different types of tellers, each with its own particular function. The following are a few kinds of tellers:

Head teller

Currency exchange teller

Loan teller

Drive-through teller

Universal teller

A head teller oversees the management of cash levels, handles complex customer transactions, and trains junior tellers. They supervise a team of tellers, assigning duties and ensuring that they provide exceptional customer service.

Currency exchange tellers focus on performing foreign operations. They handle foreign currency transactions, monitor exchange rates, and provide information about commissions and fees.

A loan teller assists customers with loan transactions. This could involve loan applications, loan payments, and tracking loan records. Loan tellers make sure that loans are disbursed to the customers and that they don’t have issues repaying their loans.

Drive-through tellers attend to customers’ needs without them needing to leave their cars. Customers simply drive to the drive-through window and interact with the teller to process their transactions.

A universal teller performs all the basic roles of a teller, including handling transactions and providing customer service. However, they may also sell the bank’s products and services to the customers.

Typically, tellers must have a high school degree. They don’t necessarily require previous experience, particularly for entry-level positions. However, head tellers and other senior tellers in financial institutions must have some experience before applying.

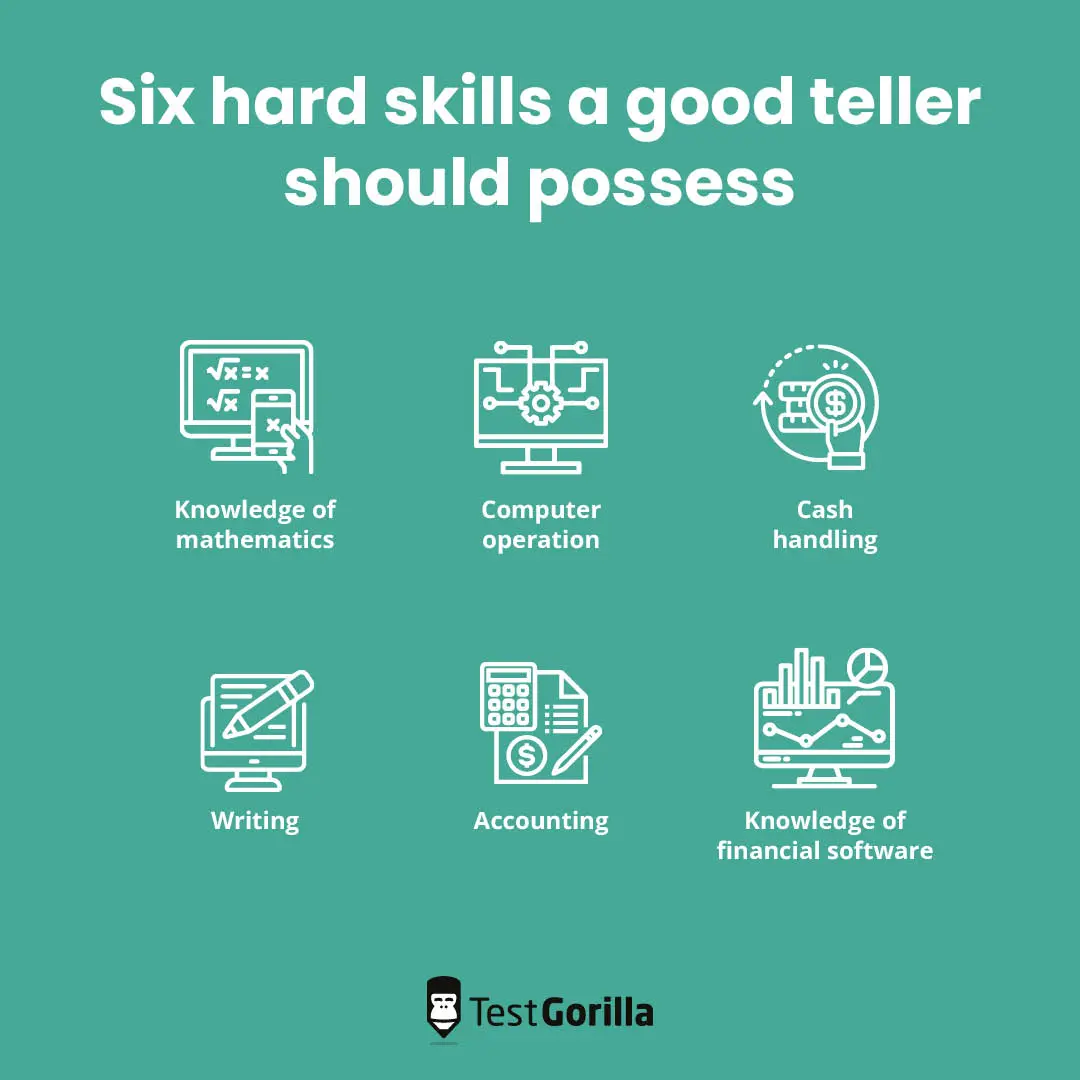

Teller hard skills

The role of a teller requires hard skills, such as knowledge of mathematics and banking operations. As such, to identify exceptional tellers, you must know what these skills are and look out for them during recruitment. Here are some hard skills a good teller possesses:

Knowledge of mathematics

A bank teller must have an in-depth understanding of mathematical operations, including addition, subtraction, multiplication, and division. Since they work with a lot of figures, they must know how to perform calculations accurately.

In addition, bank tellers need adequate math skills to balance accounts. For example, to get the total amount of expenses in a given period, they must add up all the expenses in that period.

Computer operation skills

The job of a bank teller relies heavily on computer systems. They need computers to handle many of their tasks, from cashless transactions to customer account setups. Therefore, they must know how to operate a computer to be productive.

Computer operation skills enable tellers to perform searches, open accounts, log complaints, and process transactions.

Tellers must also have a firm understanding of how to navigate websites, especially their institution’s sites. This lets them access the customers’ accounts to address any issues quickly and correctly.

Cash handling skills

The day-to-day activities of a bank teller involve regularly handling cash. When helping customers with transactions, the teller must be able to account for the cash they have access to.

A teller with great cash-handling skills can account for all the money they process. This means they disburse the exact amount to customers during withdrawals and deposit the correct amounts as well.

Writing skills

Without a doubt, writing is a significant part of a bank teller’s job. From recording bank transactions to logging customer complaints, writing skills are critical for tellers to succeed.

Bank tellers with good writing skills can spell correctly and link written words to form meaningful sentences. These skills also help them write reports, assist customers in filling in their details, and compose emails.

Accounting skills

Although most transactions are carried out on financial software, tellers need to know how to keep track of the numbers. Accounting skills enable bank tellers to keep a record of financial transactions.

These skills let them balance financial accounts for customers and track money flow into and out of their accounts.

Furthermore, good accounting skills make it easier to identify issues with transactions. For example, if there is a failed transaction, the teller can spot where the problem is and provide a working solution.

Knowledge of financial software

The banking world has evolved to the point where most transactions are carried out online. This means that without adequate knowledge of how financial software works, bank tellers won’t perform their duties efficiently.

Financial software is specific to institutions, so tellers must be familiar with their organization’s applications. They often undergo training after receiving the post to ensure they know how to operate the institution’s software and can use it to attend to customers’ needs.

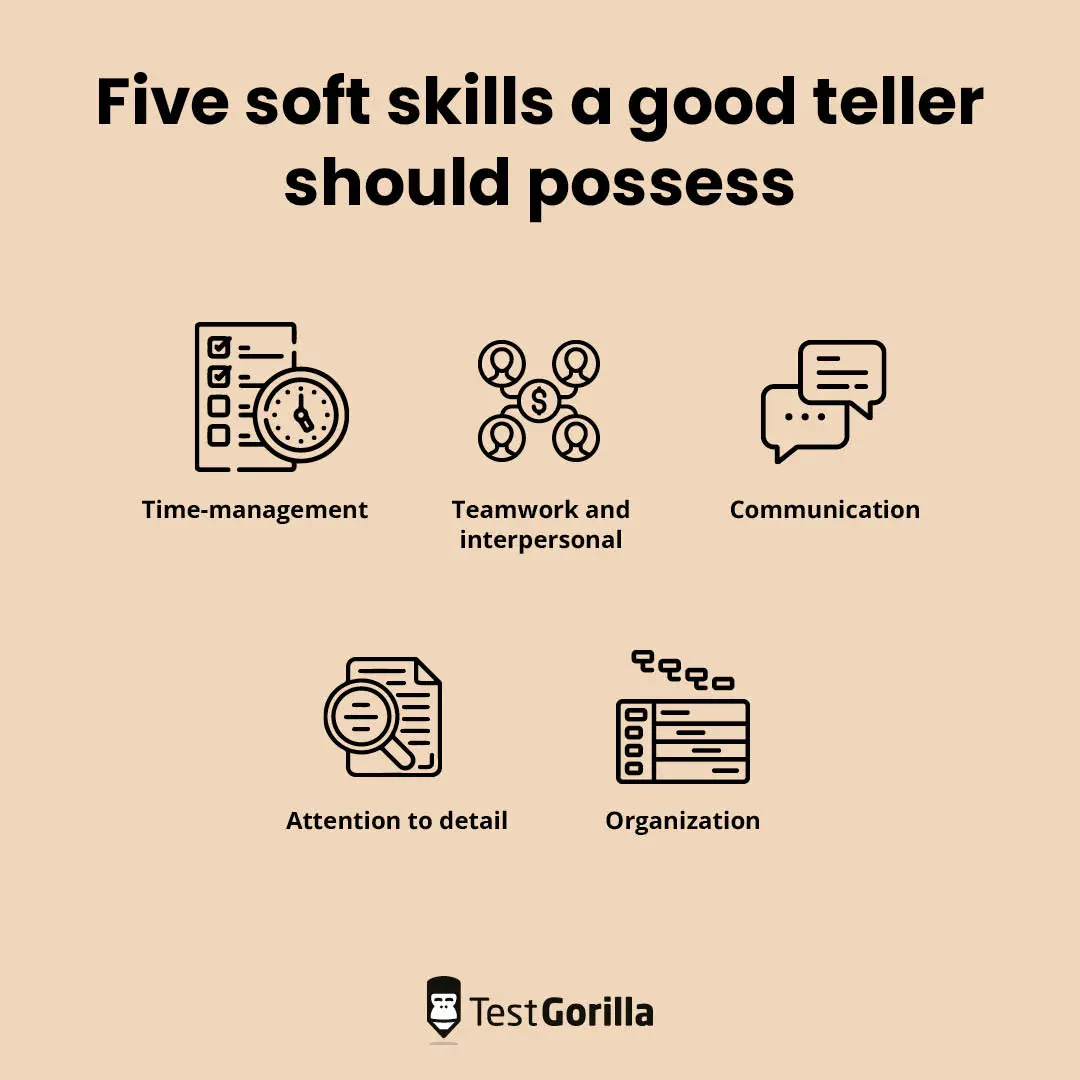

Teller soft skills

Tellers with soft skills like communication, problem-solving, and attention to detail are more effective when handling many kinds of tasks. They can analyze customers’ issues from various angles to arrive at a solution.

It’s safe to say that soft skills are vital to consider during recruitment. Below are some soft skills to look out for when recruiting a teller.

Problem-solving skills

Since the job of a teller involves handling customers’ complaints, they need problem-solving skills to function effectively. These skills enable the bank teller to think outside the box and find a solution to an issue.

Tellers with problem-solving skills can think critically about a problem and understand it thoroughly. Thus, they can solve customers’ problems efficiently.

Time-management skills

Tellers attend to numerous customers daily, each of whom demands the best service they can offer. This means that the bank teller needs to resolve each customer’s issues quickly and effectively so that other customers aren’t kept waiting too long.

This is where time management comes in. Time management enables the bank teller to make the best use of their time without rushing when attending to customers. Tellers with good time management strike a balance between problem-solving and fast-paced service.

Teamwork and interpersonal skills

Teamwork and interpersonal skills are vital bank teller abilities that enable them to interact well with both customers and coworkers. Tellers must be able to work with their teams to share ideas and suggestions or even ask for help to resolve an issue.

Furthermore, tellers need interpersonal skills to relate with customers. This enables them to build trust right away, boosting the company’s image through superior customer service.

Communication skills

Good communication skills are the basis of effective customer service. These skills enable bank tellers to interact with customers to understand their problems and procure solutions for them easily.

Tellers with good communication skills are excellent listeners. They first listen to what the second party has to say to understand the situation before speaking. They also need good communication skills to share ideas with their teams and interact with coworkers.

Attention to detail

When it comes to handling cash, attention to detail is a crucial skill that all tellers must have. Attention to detail prevents the teller from making costly mistakes while verifying customer details or the integrity of transactions.

An exceptional bank teller pays attention to even the smallest details. This makes it easy to identify the source of an issue and tackle it effectively. Moreover, tellers with attention to detail are meticulous when drafting reports and recording transactions.

Since they work with numbers most of the time, they need a sharp eye for spotting errors. They must also be able to point out transactional irregularities.

With good attention to detail, the teller can deliver top-notch services with minimal errors, even under pressure.

Organization

You can tell a lot about how productive a bank teller is based on how organized they are. An organized bank teller plans their tasks ahead of time, develops a working schedule, and maintains an arranged workspace.

Tellers with disorganized workspaces may spend more time searching for a file or document while attending to a customer. This reduces the quality of their service since it wastes time and leaves the customers dissatisfied.

Therefore, checking for organization tells you more about how effectively the teller performs their tasks. Organized tellers can prioritize tasks and problems and attend to pressing issues quickly.

How to test teller skills

Identifying candidates with excellent teller skills might be challenging, especially if you rely on resumes alone. The main purpose of a resume is to describe the candidates’ skills, so they may write anything to impress you.

According to StandOutCV, around 55% of candidates have lied on their resumes at least once while applying for a post. This means that most of the time, you can’t fully trust what a resume says. However, you can trust the results of a pre-employment skills test.

Pre-employment tests are structured assessments hiring managers and recruiters administer to their candidates so that they can prove their skills. These assessments are a form of skills-based hiring and help you identify those fit for a role.

Pre-employment tests help you not only spot the best tellers but also reduce bias during hiring. With these tests, you don’t have to worry about unconsciously favoring one candidate over another since only those who answer the questions correctly can pass the test.

Although using pre-employment testing is essential, finding the right platform is equally important. Effective pre-employment testing platforms can help boost your candidates’ experience and offer a variety of tests to suit all your needs.

TestGorilla ticks all the boxes when it comes to pre-employment testing. This skills-testing platform has numerous tests to assess each teller skill, including problem-solving, attention to detail, mathematical understanding, and teamwork.

With our assessments, you can identify tellers with the talent and expertise you’re searching for. Below are some tests you can administer to assess teller skills:

1. Accounting skills test

The Accounting (Intermediate) skills test checks candidates’ ability to keep books of accounts, prepare financial statements, and interpret financial information. If you’re hiring a bank teller, the accounting test is a perfect addition to your assessment.

This test helps you find tellers with an understanding of standard accounting principles. Candidates who pass the accounting skills test can make year-end adjustments, understand account statements, and keep financial records.

2. Communication skills test

Our Communication skills test measures how well applicants can understand and exchange information with others. This test evaluates speaking, listening, reading, and writing skills, which are vital for effective communication.

Candidates who succeed on this communication test can listen effectively and understand and interpret written information. You can rest assured that they’ll conveniently liaise with customers to solve any challenge should you employ them.

3. Time Management test

This test determines whether candidates can make good use of their time. It uses realistic scenarios to assess if they can manage their time in a professional environment.

Additionally, our Time Management test measures how well candidates can prioritize, plan, and execute tasks within a given period. Those who do well on this test can meet deadlines and multitask while delivering high-quality services.

4. Problem Solving test

TestGorilla’s Problem Solving test evaluates how well candidates can analyze and solve problems. With this test, you can identify tellers who can look at a particular situation critically to provide the best solutions.

Our test measures how well applicants can apply logic to make decisions. It also checks their ability to prioritize issues and maintain order while solving problems.

5. Mathematics test

You can apply our Intermediate Math test to hire tellers who can work with numbers to perform accurate calculations. This mathematics skills test checks candidates’ ability to carry out calculations involving percentages and decimals.

The test goes beyond basic mathematical operations like addition, subtraction, and multiplication. It also measures candidates’ ability to perform slightly more complex operations, like those involving ratios and time duration estimation.

Administering this mathematical test will ensure you hire tellers with sound logic who are capable of reconciling figures with minimal supervision.

6. Attention to Detail test

The Attention to Detail test by TestGorilla assesses how well candidates can pay attention to visual information. It examines their ability to filter information, compare statements, and verify the consistency of information.

With this test, you can identify and hire tellers with great analytical skills who can handle complex information.

Teller job description template

The job description paints a first impression of your business and the open role to candidates. As such, it has a significant impact on whether they will apply for the position. A good job description states what it takes to obtain a post and the benefits of securing the position.

It’s always a good idea to conduct a job analysis before you write your job description. This helps you better understand the position, skills required for the post, and salary applicants will expect.

Below, we’ve drafted a template to help you write an enticing teller job description:

Job title

The job title is the main header of the job description. It should be short while clearly stating the role you’re hiring for. For your teller job description, you could use the title “Head teller needed at [COMPANY NAME].”

Company overview

The company overview is a four-to-five-sentence section that introduces the candidates to your organization. Here, you must clearly describe what your business does. This enables the candidate to determine if they’d be a good fit for your company.

You could also include your goals, location, and some important individuals in the organization. We’ve written an example below:

[COMPANY NAME] is a banking institution located in Tucson, Arizona, founded by [NAME OF FOUNDER]. We offer banking and loan services to our customers, ensuring that we build trust with them through exemplary service.

[COMPANY NAME] aims to ensure that Tucson is financially secure. We are actively working toward this goal by building a team of financial experts working together as a single unit.

Job overview

This section should state the roles of the teller and how they align with your organization’s goal. It should be precise but informative so that candidates can understand the position quickly. Here is an example to illustrate:

As [COMPANY NAME]’s teller, you will deliver excellent customer service and attention to our clients respectfully and professionally. You are responsible for helping customers with transactions and tackling any issues they might have.

Duties and responsibilities

Here, you will outline the duties you expect the bank teller to perform. You can also include the person they would report to. When writing the responsibilities, use gender-neutral sentences and list everything your organization will demand from the teller, like in the following example:

As the bank teller, you will be responsible for helping customers with transactions and keeping necessary records of transactions. Your duties include:

Receiving deposits from customers and making sure to credit the correct amounts to their accounts

Processing checks and ensuring they are genuine before cashing them for customers

Answering customers’ inquiries concerning their accounts or transactions

Processing customers’ withdrawal requests

Balancing your cash drawer at the beginning and end of each working day

Qualifications and skills

In this section, state the qualifications and level of experience you’re looking for. Remember, tellers don’t usually need experience to get a job. But if you are hiring for a senior teller role, they must have some experience.

The example below is for a company hiring a head teller:

Eligible candidates will have the following qualifications and skills:

At least two years of experience working as a bank teller

Strong communication skills

Excellent customer service skills

Proficiency in accounting

Ability to pay attention to detail and maintain organization

Good time-management skills

Ability to handle and account for cash

Familiarity with financial software

Company benefits

The company benefits section is where you list your organization’s offers. These include the position’s salary, any opportunities you offer, insurance, connections, and other incentives. Here is an example of how to write your company benefits section:

As a teller in [COMPANY NAME], you will have access to the following:

Medical and dental insurance

Opportunities for career development

Retirement benefits

Employee discounts

Paid time off

Tuition reimbursement plans

Where to find a teller

After drafting a stellar job post, the next step to recruiting proficient tellers is identifying your target audience. To find talented tellers, you should post the job opening on a platform where it can reach qualified candidates.

Choosing the right platform for your job posting increases your chances of recruiting a perfect bank teller. Thus, it is an essential step in teller recruitment.

Platforms like Indeed, ZipRecruiter, and LinkedIn are ideal for finding great tellers. When posting the open job role on these platforms, it’s best to show job seekers the benefits of working with your company to attract attention to the job post.

Posting jobs on Indeed is free. However, you have to pay to sponsor the job posting. Sponsored job posts reach a wider audience and thus have the capacity to attract even more talent.

On ZipRecruiter, the cost of plans starts from $299 per month. However, these plans come with a variety of features. These include the ability to distribute your job post to several sites and a powerful AI that helps your posts rank.

LinkedIn is a popular platform for job postings. It has a free hiring plan for recruiters who hire once or twice a year. For recruiters who hire more frequently, it offers paid plans suited for various hiring needs.

How much does it cost to hire a teller?

From publishing your job posting to training new employees, the total cost of hiring a teller depends on multiple factors. Hence, when crafting your hiring plan, it’s best to know this information before you start recruiting.

According to a Glassdoor study, it costs $4,000 to hire a new employee. However, this cost could vary with the role. One factor that differentiates the cost of hiring a teller from that of hiring other employees is their salary.

When hiring a teller, you need to consider how much to pay them over a given period. To know the exact salary to offer, you must first determine the type of teller you want to hire.

Different kinds of tellers earn different salary ranges. For instance, head tellers earn more than other types of tellers and, thus, cost more. Below are the salary ranges for various types of tellers in the US:

A head teller earns $38,051 annually

A currency exchange teller earns $37,161 annually

A universal teller has a salary of $31,423 per year

Generally, a full-time bank teller earns an average of $26,061 yearly. Therefore, candidates expect a salary of around that amount.

Teller interview questions

Conducting an interview, although often hectic, is a delicate process. Interviews provide a chance for you to see how candidates act, speak, and carry themselves in person.

Typically, in-person interviews last between 45 and 90 minutes, depending on how many questions you ask the candidate. However, some interview sessions could be shorter, especially if you administer tests before the interview.

Giving candidates tests before the interviews provides you with some information on their abilities ahead of time. On the other hand, interviews let you meet and compare various candidates to dig deeper and identify those fit for the role.

During an interview, you discover more about what the candidate can do, their personality, and their experience. It’s recommended to draft your interview questions beforehand to prevent any mishaps during the interview process.

Planning your questions before the interview provides you with a blueprint of the process. It also improves the effectiveness of the interview and the candidate experience since you don’t have to think up questions on the spot.

Here are a few teller interview questions you can ask your candidates:

What skills do you possess that make you fit to be a bank teller?

How can you provide excellent customer service?

Can you describe how you handle large amounts of cash?

What financial software can you operate?

A bank teller job requires a lot of multitasking, and sometimes you might need to handle more than one client at once. How do you tackle this?

Aside from these, you can also ask candidates interview questions about customer service and how well they pay attention to detail. Check out our bank teller interview questions for more ideas on what to ask during interviews.

Hire your next teller the ideal way

Knowing how to hire a teller saves you a lot of stress. You make better decisions during the recruitment process when you know exactly what to do. However, you can take your hiring process a step further with pre-employment tests.

Pre-employment tests make it easy to spot great bank tellers without wasting time or effort. TestGorilla gives you access to these tests and more. With our platform, you can design a bias-free teller assessment that suits your open role.

To get started with TestGorilla, all you have to do is sign up for free. Then you’ll have access to our test library and hundreds of skills tests you can choose from.

Related posts

Hire the best candidates with TestGorilla

Create pre-employment assessments in minutes to screen candidates, save time, and hire the best talent.

Latest posts

The best advice in pre-employment testing, in your inbox.

No spam. Unsubscribe at any time.

Hire the best. No bias. No stress.

Our screening tests identify the best candidates and make your hiring decisions faster, easier, and bias-free.

Free resources

This checklist covers key features you should look for when choosing a skills testing platform

This resource will help you develop an onboarding checklist for new hires.

How to assess your candidates' attention to detail.

Learn how to get human resources certified through HRCI or SHRM.

Learn how you can improve the level of talent at your company.

Learn how CapitalT reduced hiring bias with online skills assessments.

Learn how to make the resume process more efficient and more effective.

Improve your hiring strategy with these 7 critical recruitment metrics.

Learn how Sukhi decreased time spent reviewing resumes by 83%!

Hire more efficiently with these hacks that 99% of recruiters aren't using.

Make a business case for diversity and inclusion initiatives with this data.