Top 25 accounts payable interview questions (and sample answers)

Are you looking for an easy way to hire an accounts payable expert for your team?

You’ve come to the right place.

Hiring an account payable specialist can be complicated, involving multiple rounds of interviews to evaluate how suitable your candidates are for the open role. But there are two ways you can simplify this process.

First, you need an effective way to assess your candidates’ accounts payable skills. You can do this with a skills assessment, which will enable you to quickly see who has the right skills for the job.

Next, during the interview phase, you need the right interview questions for accounts payable specialists.

TestGorilla can help you with both of these steps:

In our test library, you’ll find hundreds of skills tests you can use to evaluate your candidates – including our Accounts Payable and Advanced Accounting tests

To help you conduct interviews, we’ve put together 25 accounts payable interview questions

At the end of the article, you’ll also find our top tips on how to hire accounts payable specialists, along with advice on how to structure your hiring process. With the right skills assessment tools, it’s easy to hire an expert accountant or accounts payable specialist for your team.

Table of contents

- 7 general accounts payable interview questions and answers

- 13 accounts payable interview questions and answers related to technical definitions

- 5 behavioral accounts payable clerk interview questions and answers

- When should you use those accounts payable interview questions?

- How to hire an accounts payable specialist: Top tips and a step-by-step guide

- Find the best accounts payable expert for your team with TestGorilla

7 general accounts payable interview questions and answers

Let’s start with seven general accounts payable specialist interview questions. Below, you’ll also find sample answers to help you evaluate your candidates for an accounts payable (AP) role.

1. What does accounts payable mean?

Accounts payable refers to the amount a business owes its suppliers or vendors for their services or goods.

The amount is usually outstanding, meaning that the services or goods have not been paid for yet. The total of the outstanding payments owed to vendors will appear on the company’s balance sheet.

If the accounts payable amount increases or decreases, the cash flow statement will show these changes in the total.

2. Explain what a balance sheet is.

Balance sheets are financial documents that show a business’s assets, shareholder equity, and liabilities. Investors use them to compute rates of return and assess the capital structure of an organization.

A balance sheet offers clients or investors an overview of the amount owed by a company and the amount the company is owed. Clients can also use them to analyze an organization’s financial ratios.

3. Explain the difference between credit and debit.

Credit refers to an entry in accounts that increases equity or liability accounts and decreases an expense or asset account. Debit refers to an entry in accounts that decreases equity or liability accounts and increases expense or asset accounts.

Any transaction will typically affect two accounts. Whereas one account will record a debit, the other will register a credit entry. Credits and debits should always be the same, keeping the transaction in balance. Therefore, debits and credits are critical for maintaining balance for accounting transactions.

4. What does “debit balance” mean?

A debit balance is what a customer who has borrowed funds to buy securities owes to a broker or other lender. The term “debit balance” specifically refers to the total amount of money clients or customers need in their accounts after buying the security so that the transaction can take place without any problems.

5. What are the advantages of liquid financial assets?

A company can convert liquid financial assets into cash quickly and easily. The value of some liquid assets may even appreciate over time.

6. What is the main disadvantage of liquid financial assets?

The main disadvantage of liquid financial assets is that their value is only as high as the entity that underlies the asset.

7. What are the two main types of assets?

The two main types of assets are fixed assets and current assets. A fixed asset refers to tangible things that businesses expect to own and use for the long-term, while current assets are those a company intends to sell or use within a year of being reported.

In other words, fixed assets exist physically, like vehicles, land, machines, and equipment for manufacturing, in contrast to some types of intangible assets like trademarks and intellectual property. Current assets can include cash or accounts receivable, stock or cash equivalents, and liquid assets.

13 accounts payable interview questions and answers related to technical definitions

Let’s now look at 13 interview questions for accounts payable specialists to test your candidates’ knowledge of essential technical terms.

1. Explain what WCC means.

WCC means “working capital cycle.” It refers to the length of time taken for the net current assets of a company to convert into cash. A long cycle means an enterprise takes a long time to tie up capital without a return.

Organizations should look to keep the working capital cycle short, freeing up cash and increasing a company’s agility.

2. Which phases does the working capital cycle include?

There are four key phases that the working capital cycle includes. These are:

Cash flow: The inflows and outflows of cash from your enterprise that ensure the cash balance is healthy

Receivables: The terms of payment for the money owed for services and goods

Selling inventory: The le

ngth of time taken to sell the inventory

Billing suppliers: The length of time available to make a payment to suppliers

3. Explain what reconciliation is.

Reconciliation is a process that involves comparing two different accounting records to ensure their figures are correct. The process can also help to confirm that general ledger accounts are accurate and error free.

4. What are liabilities?

In accounting, liabilities are sums of money a business or person owes someone or another company. They are normally settled when the business or person transfers economic benefits, such as services, goods, or money.

Liabilities are found on the balance sheet and can include home loans, personal loans, expenses, and accounts payable.

5. What are financial assets?

Financial assets are liquid assets that get their value from a contractual right. Key examples of financial assets include mutual funds, bank deposits, cash, bonds, and stocks. They don’t need to have a physical form and may not have physical worth as physical assets do.

6. What is equity?

Equity refers to the amount of money shareholders would receive after debts were paid, if liquidation were to occur and the assets were sold. It is the value of a shareholder’s stake in an organization, as shown on the company’s balance sheet.

7. Explain what FBT is.

FBT is short for fringe benefit tax. It’s a type of taxable income for employees, specifically for fringe benefits. Although some fringe benefits are not subject to taxation, such as health insurance and life insurance, others are taxable, including work-related compensations for employees and employee stock options.

For instance, if an organization provides employees with laptops, the taxable income relates to the amount the laptop is used for personal uses.

8. Explain what EFT means.

EFT means “electronic funds transfer” and refers to an electronic transfer of funds or money through an online network.

Companies can transfer electronic funds between accounts within the same bank or to a different bank, and there are many different examples of payment systems.

9. Explain what wire transfer means in the accounts payable field.

A wire transfer refers to the process of electronically transferring funds from one person or organization to another. The process is handled by banks or agencies that specialize in administering wire transfers.

10. What does TDS mean?

TDS means “tax deducted at source.” It refers to the process of deducting tax at the source when a deductor must make a payment to a deductee, and the balance will be transferred to the deductee. The deductible amount remains with the government.

11. What does AIS mean?

AIS is short for an accounting information system. The term refers to a structural process that businesses use to compile and store, manage and process, and then report the organization’s financial data. Accountants, accounts payable clerks, business analysts, chief financial officers, and managers use AISs to ensure accurate financial reporting.

12. Explain what an invoice is.

Invoices are documents that record transactions carried out between sellers and buyers for the goods or services offered.

13. Explain what GAAP means.

GAAP is an acronym used in accounting to refer to “generally accepted accounting principles.” Organizations compiling financial statements must use the GAAP acronym when doing so.

The generally accepted accounting principles are the standards outlined by the Financial Accounting Standards Board, whose main aim is to enhance the consistency and clarity of financial details and records.

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

5 behavioral accounts payable clerk interview questions and answers

In this section, you will find five behavioral accounts payable specialist interview questions and possible responses.

Behavioral questions enable you to assess your candidates’ past experience and performance, while situational questions give you insight into how they would react in a new situation.

1. What steps do you take before you make a payment?

Some of the processes that accounts payable clerks might mention in response to this question include to:

Check for holds when the income and expense statement is being coordinated and validated

Start the process of approving the invoice after the completion of workflow implementation

After invoice approval, start the payment

Complete the accounting process once the invoice has been endorsed

2. Which process do you use to approve an invoice for payment?

There are a few main steps that accountants and accounts payable specialists should take for invoice approval and payments:

Ensure the invoice’s details are accurate and check the products or services

Verify the dates of the invoices and ensure no overlap exists

Double-check the services or work undertaken with the project manager

Confirm the details of the vendor

Record the deadline of the invoice payment

Schedule the payment in your accounting information system

3. Which information do you need for invoice approval for payments?

Candidates for an accounts payable role should respond by identifying the types of information that are essential for invoice approval.

For instance, they should know that they need to:

Check whether your business has received the goods or services

Always verify the invoiced amount

See if any discounts or cost reductions might apply

4. Which documents do you use for invoice verification?

This question refers to the three-way match, a technique used for payment verification and ensuring the invoice is valid. The invoice’s details should match the purchase order and the receiving report.

The accounts payable specialist (or accountant) should compare these two documents with the invoice to confirm its accuracy and validity.

5. Which accounting software have you used in previous roles?

Although candidates may not have used the exact same accounting software your organization uses, look for evidence that they can adapt to new software and are eager to learn.

For example, they may have used software like Zoho Books, QuickBooks, or FreeAgent. If your organization doesn’t use these, the interview is the perfect opportunity to figure out whether they’re willing to learn to use your accounting software.

When should you use those accounts payable interview questions?

Always remember to use those accounts payable clerk interview questions after shortlisting your best candidates with the help of a skills assessment.

This means that you won’t waste time interviewing unskilled or unqualified applicants, or struggling to figure out whether the resumes you’ve received accurately reflect your applicants’ accounting skills.

If you use skills tests at the top of your recruitment funnel, you can be confident that all accounts payable specialists you’re interviewing have the skills you’re looking for.

How to hire an accounts payable specialist: Top tips and a step-by-step guide

To hire the best person for your accounts payable role, you need a streamlined hiring process. Here’s how to build one:

1. Define the accounts payable role and write a clear job description

Write a clear and concise accounts payable job description, where you outline the job responsibilities, required skills, and your company's mission and culture. This enables you to attract candidates who are a good fit for your business and the role.

2. Assess applicants' skills

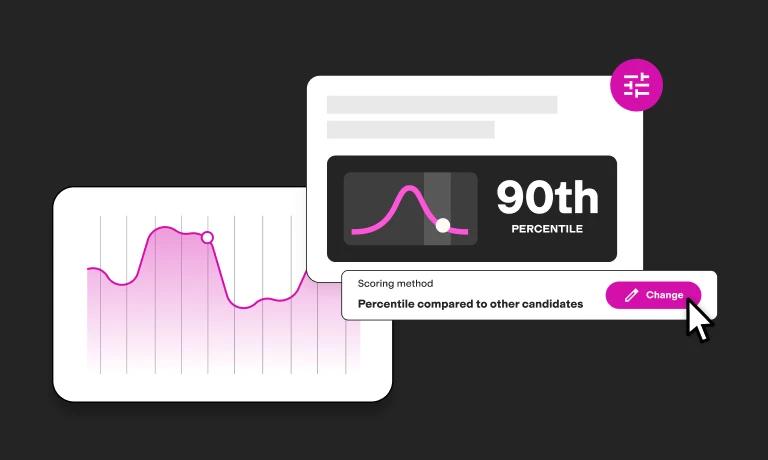

Before you begin interviewing candidates – and, ideally, instead of screening resumes – you can use skills tests to get a fair and objective evaluation of their skills. You can even assess their motivation and alignment with your company culture.

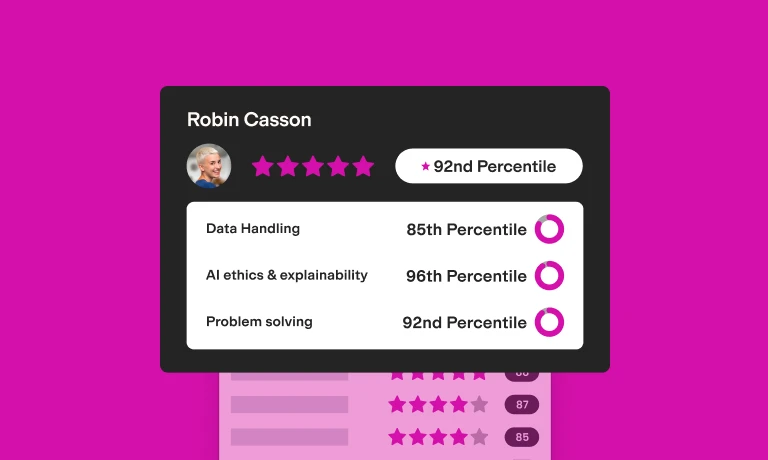

With TestGorilla, you can combine up to five skills tests to evaluate an accounts payable expert.

Below are some of the tests we recommend; pick the five that make the most sense for the specific role:

Accounts payable: This test is directly related to the role and enables you to quickly see who has the necessary accounts payable knowledge.

Financial accounting (US GAAP): Find applicants who understand the US Generally Accepted Accounting Principles (US GAAP) and can use them to record, classify, and summarize financial transactions.

Communication: Make sure candidates know how to communicate clearly and effectively in a professional setting.

Problem solving: Look for candidates who can resolve discrepancies and address unexpected issues. Problem-solving skills are key for dealing with invoice mismatches or payment delays.

Time management: Meeting deadlines is crucial for accounts payable specialists. Find applicants who know how to manage their time effectively.

Culture add: Make sure your applicants are aligned with your company culture and can contribute to it.

Motivation: Fill out a short survey to find out whether what your candidates are looking for aligns with what you have to offer.

3. Analyze results and identify your best talent

Once you receive test results, you'll be able to quickly spot the best talent in your talent pool.

Invite those candidates to an interview – and remember to keep the others informed that you haven't retained their applications.

4. Use the right interview questions for accounts payable specialists

The interview process is an excellent opportunity to get in-depth insights into your candidates' accounts payable experience, skills, and behavior. You can use the questions to evaluate candidates' experience with handling invoices, managing payments, and working with financial software.

Use the information you gather during interviews to supplement the skills assessment process.

5. Make a hiring decision

By now, you’ll have enough information to pick the best accounts payable specialist for your company. Make a hiring decision and extend an offer to the best candidate.

And that’s it! By now, you’ll have a skilled accounts payable specialist on your team.

Find the best accounts payable expert for your team with TestGorilla

Hiring isn’t always easy. We get that. But you can significantly reduce the time and energy you spend to recruit accounts payable clerks and experts by adopting a tried-and-tested hiring process.

For the best results, use a combination of skills assessments and the right interview questions for accounts payable specialists – like the ones above.

If you do this, finding the best accounts payable expert for your team will be easier than you think.

Take a look at our library of skills tests and start working on your list of interview questions to hire the best talent for your organization. Get started for free today.

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.