How to assess underwriting skills and find a professional candidate

Underwriting is a data-driven, challenging role that requires experts in finance, risk assessment, and expert communication. Assigning underwriting duties to a new hire who doesn’t have skills such as numerical reasoning can be a mistake.

Although you can complete onboarding processes to welcome a new underwriter to your team, some areas of expertise may be difficult to teach.

What’s the best method to ensure your candidates have the required skills to work with your business and its clients? How can you ensure your candidates can calculate risk and propose premiums that match your clients’ credit histories?

With this article's tips and skills tests, you won’t have trouble hiring a professional underwriter. Here, we explore how to assess underwriter skills and recommend the underwriting skills tests you can use.

What is an underwriting skills assessment?

An underwriting assessment is a candidate evaluation tool featuring several skills tests. These tests help assess a candidate’s ability to complete complex underwriting duties, such as the risk of loaning to a borrower.

With a skills assessment, your goal as a recruiter to find underwriters is easier because you can evaluate several skills, such as:

Essential financial ability

Skills in financial model maintenance

Numerical reasoning knowledge

Ability to work with data

You also receive objective skill-related data quickly without completing extensive hiring steps, such as resume screening.

You can also assess skills such as financial modeling using tools like Excel and verbal reasoning with an underwriting assessment. These skills are fundamental for candidates who need to:

Build in-depth financial models that meet realistic expectations

Communicate efficiently with clients and colleagues

Explain financial concepts without using jargon

Analyze significant amounts of data using sound judgments

The outcome of these assessments and the data they provide is that you’ll know which candidates are skilled enough to protect your clients from financial losses.

They also work perfectly as inspiration for question ideas during an interview with your candidates. You can use the data to find specific points for discussion to explore your candidates’ skills more deeply.

For example, a candidate might answer some questions about financial modeling correctly but fail to understand specific concepts, such as using Excel. You can use this information to ask questions in the interview to learn more about your candidates’ experience of using Excel in this context.

Why are underwriting skills important?

You should find a candidate with exemplary soft skills, such as active listening, and hard skills, like financial expertise for many reasons.

Insurance premiums exceed $1tn US dollars each year, and underwriter skills ensure that the insurance premium pricing process works for each of your clients. However, your company can achieve many other valuable outcomes with skilled underwriters.

Underwriting soft skills ensures clients achieve their goals

Underwriting soft skills, such as attention to detail and analytical skills, ensure underwriters can evaluate information from multiple sources. For example, they can assess credit reports and deliver specific insights, such as premium amounts.

In the case study of a client that needed underwriters to deliver information about business risk appetite, these underwriting soft skills were fundamental.

With attention to detail, data analytics, and analytical skills, the underwriter recommended suitable contacts and provided potential options for the client to achieve their business goals.

The outcome of these actions was that the client solicited the aid of the underwriter’s contacts and achieved excellent profits and more business autonomy.

Underwriting hard skills mitigate losses for your insurance company

With skills such as mathematical abilities, underwriters can mitigate losses for their insurance company.

Math skills reinforce accuracy when underwriters try to determine the chances of financial losses. Math skills are also fundamental for ensuring the underwriter can ensure accuracy with quantitative numbers.

For example, a loan insurance company underwriter or an investor must review their client’s credit history or rate of return for investment using formulas such as the net present value. The results underwriters can achieve with these skills include to:

Understand whether the client is eligible for a loan approval

Guarantee that risk calculations are correct for their borrowers

Therefore, it’s fundamental to consider whether candidates have underwriting, such as formula knowledge, math skills, statistical knowledge, and data analysis. This knowledege keeps your company’s financial standings high.

Underwriting software knowledge helps to automate processes

With underwriting software knowledge, clients can complete tasks faster and with less human error. There are multiple underwriting software tools, such as Zoral, Aim, Allfinanz, and LifePipe, and many can reduce operating costs in many ways.

If we look at the case study of a finance company in the US, we can see how these software tools help underwriters achieve these goals.

The company wanted to increase its loan portfolio and enhance its sophisticated manual underwriting processes. Underwriters in the company used their technical software knowledge and expertise to automate the underwriting process and achieve the following outcomes:

70% reduction in manual underwriting

More consistent underwriting performance

16% loan acceptance rate increase

These results suggest that hiring underwriters with technical underwriter software knowledge is worthwhile. It leads to profit increases and smoother underwriting processes for your company.

What skills and traits are essential for underwriters?

You already know a few underwriter skills, such as math abilities and attention to detail. However, several more abilities and traits can ensure you hire an underwriter who performs technical tasks like background checks and liaise with clients confidently. Consider the following examples.

Critical thinking skills

Critical thinking subskills, such as sorting data, assessing information, organizing facts, and assessing submissions with objectivity, are fundamental for underwriters. They:

Ensure candidates can interpret the information they receive to make decisions on financial risk

Decrease the chances of making biased decisions about whether to accept a submission

These skills are valuable because candidates need to solve problems when making decisions about risk, including incomplete or inaccurate data or market condition changes. They ensure underwriter candidates can identify inaccurate data in financial history documents or letters of explanation and consider whether it is reliable.

Critical thinking skills are also fundamental for candidates who need to determine if there are any discrepancies in the data or errors the clients make when creating projections with their calculations.

Communication skills

Communication skills, including written communication, active listening, verbal skills, and etiquette, can help underwriters communicate clearly.

Active listening ensures they fully understand their client’s financial concerns and can meet their expectations. Meanwhile, verbal communication allows them to:

Build strong relationships with clients and establish trust

Explain the results of their analyses

Communicate complex financial information to stakeholders

For example, if an underwriter rejects a client’s loan application, they are legally obligated to explain why they did so and must use written communication to confirm this.

Alternatively, your candidate might need to write a disclosure letter to explain the financial risks to clients. In that case, written communication can make presenting the results of their analyses easier. This action helps your company adhere to legal requirements.

The outcome of these skills and actions ensures your clients can make better, informed decisions related to their investments to manage their risk more efficiently.

Numerical reasoning skills

Hiring underwriter candidates with numerical reasoning skills, such as interpretation aptitude for figures, is vital to help them analyze financial data. For example, underwriters who handle submissions in the medical industry may need to assess medical claims data and consider the severity of specific health conditions.

These skills ensure they draw the correct conclusions about the risk levels associated with insuring specific clients.

Numerical reasoning skills enable candidates to achieve the following goals in an underwriting role:

Evaluate potential rewards for specific insurance strategies

Create plans to manage particular risks

Protect your company from potential financial losses

Problem-solving skills

Problem-solving skills, such as analyzing data, are important for underwriter candidates who make decisions based on a client’s level of risk. These skills are essential because underwriters can identify facts and determine the client’s chances of filing a claim. They also require problem-solving skills to:

Select the best pricing options for clients

Analyze and ensure complex legal documents comply with specific regulations

Determine and recommend additional policies to clients

The primary outcome of these actions is that underwriters can enhance the business-borrower relationship and ensure they offer policies that suit the company and the client.

This benefit means that borrowers are less likely to accumulate debt, and your business minimizes the financial risk when it chooses clients to lend money to.

Skills and traits tests

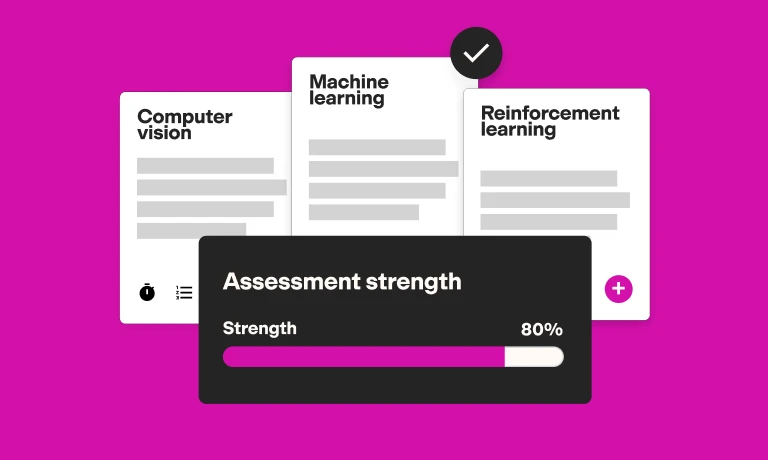

If you need help determining where to begin when evaluating these essential skills for underwriters, we have an easy strategy to assist you. Consider the data-driven skills tests below and check the subskills they help you evaluate to build your assessment.

Critical Thinking skills test

Our Critical Thinking skills test evaluates your candidates’ abilities in deductive reasoning and using analytical skills to make excellent judgments. The test applies to various roles and will assist you if you’re hiring an underwriter. Some of the subskills you can assess with this test include whether candidates can:

Notice and interpret a cause-effect relationship

Notice assumptions

Interpret data

An underwriter candidate with these critical thinking subskills will understand how risk is related to borrowing for the client and the business. For instance, they will realize that a low credit score equates to a high risk for the company.

Candidates will also know how to be objective when evaluating a borrower’s submission. With critical thinking skills, they will encounter no problems interpreting the data and deciding whether to approve a loan for a client.

Communication skills test

Assessing your underwriter candidate’s communication skills takes minimal time with this free Communication test. It will help you review your candidates’ skills in:

Active listening

Non-verbal cues interpretation

Written communication

Verbal communication

If your underwriter candidate completes the Communication skills tests and receives a high score, they can use a professional communication style to share and receive information from your clients. They will easily interpret your clients’ written communication and listen carefully when meeting with clients face-to-face.

For example, an underwriter might need to explain policy changes to a broker or a client. In that case, they can complete this duty with excellent communication skills.

Numerical Reasoning skills test

Since numerical reasoning is fundamental for underwriter candidates, you should evaluate this skill using our Numerical Reasoning skills test. This test is ideal for assessing many numerical reasoning subskills, such as:

Percentage and fraction interpretation

Number patterns interpretation

Graph interpretation

Table interpretation

Underwriter candidates with these skills will know how to forecast risk and interpret numbers related to credit scores.

For instance, the test might show that your candidates have skills in interpreting numbers. This result means they can look at the information on a life insurance application and determine if a client is likely to make a claim. It also proves they can calculate coverage amounts based on the client’s income, age, and additional factors.

Problem-Solving skills test

Including our Problem-Solving skills test in your underwriting assessment will help you discover if your candidates can:

Use logic to interpret data and make decisions

Assess information to draw conclusions

Identify factors that cause a problem and resolve it

If your candidate needs to balance the needs of the clients and the company, analyze significant data amounts, and understand changing regulations, this test is ideal.

It will show you which candidates can use specific skills to handle these problems, such as breaking them into solvable parts first and managing each element in turn.

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

Underwriting skills assessment FAQs

Need extra answers to questions about underwriter skills assessment and skills you should look for in your candidates? Consider the answers to the following frequently asked questions here.

What are the hard skills in underwriting that recruiters should assess?

Some of the hard skills in underwriting you should consider assessing include customer service and investor guidelines knowledge. Consider whether your candidates have financial modeling knowledge and can work with data using numerical reasoning skills. This skillset will ensure candidates can propose the correct policies for clients.

What are the soft skills that recruiters should assess?

The essential soft skills for underwriters you should evaluate when hiring a candidate include excellent analytical skills and great attention to detail.

Candidates must also have negotiation skills and time management abilities to manage applications and work with clients. If your candidates also have interpersonal soft skills, they will work efficiently with your team.

What is a skills test for underwriters?

A skills test for underwriters is a set of questions on one test that provides an objective method to evaluate your candidate’s underwriter skills.

OThe questions take various formats on the test, such as multiple choice, to assess your candidates thoroughly. Multiple skills tests for underwriters combined form an underwriter assessment.

How TestGorilla can help you find a skilled underwriter

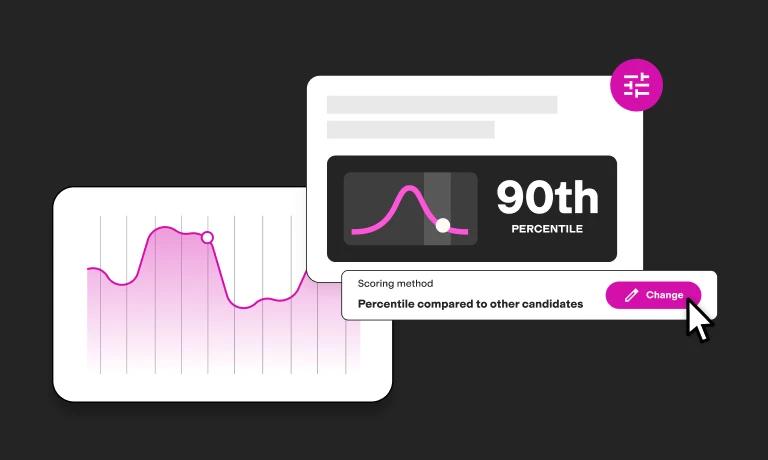

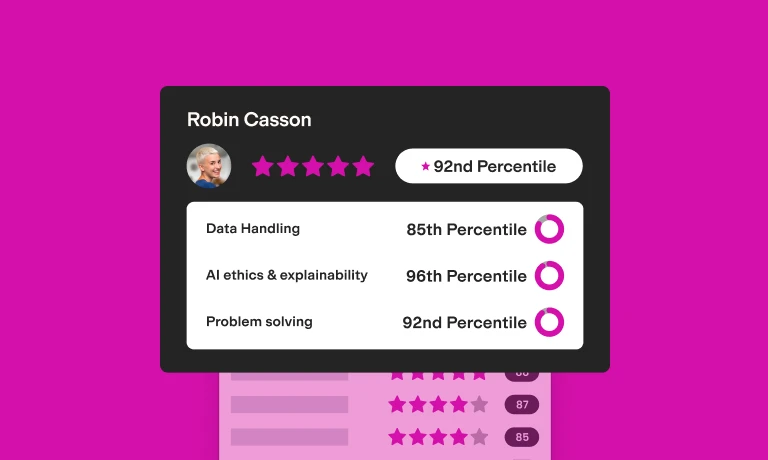

TestGorilla can help you find a skilled underwriter with data-driven, expert-crafted skills tests that you can use in an assessment, providing the following advantages for your candidate evaluation process:

Up to five tests and 20 custom questions per assessment

Select five tests for your underwriter assessment and add custom questions to test multiple skills.

From cognitive and hard skills tests to multiple-choice custom questions and essay questions, you can customize your assessment to evaluate the skills and abilities you consider essential for your candidates’ potential role.

Assessments function on mobile platforms

With our features, you can build a skills evaluation on mobile platforms, allow your candidates to take the assessments on their chosen device, and make test-taking easier for candidates.

The result is a perfect candidate experience to ensure they talk about your business and its brand with others.

Anti-cheating features

It’s possible to mitigate cheating with our candidate snapshots and alerts. These features will tell you if candidates close the full-screen format, which ensures you hire candidates who pass the assessment on their own merits.

Find a professional underwriter with TestGorilla

Is hiring a professional underwriter on your agenda? You’ll have no problem finding the right candidate when you choose TestGorilla.

You can reduce time-to-hire metrics, enhance your employee experience, and even scale your hiring process with our tests. Whether you need to find one underwriter or three, you can do this quickly and add value to your team with TestGorilla.

You’ll discover more than 300 tests in our test library, including underwriting tests, that you can use to find a professional. Complete the demo signup process to learn how TestGorilla works, and then try some of our free tests to use TestGorilla when hiring top talent.

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.