When hiring for an insurance agent role, you’re searching for a specific skill set and, depending on your industry, potentially specialized abilities.

Although you could complete a resume screening method to assess your candidates, this outdated and unreliable hiring method can waste time, especially considering how long it takes to weed through dozens of applicants.

By administering a skills assessment comprised of relevant tests for your role, you can quickly and easily create a shortlist of candidates with suitable, high-level skills.

In this article, we discuss the skills and traits you should be looking for in prospective hires and the skills tests we recommend using to build an effective insurance agent assessment.

Table of contents

- What is an insurance agent skills assessment?

- Why are insurance agent skills important?

- Which skills and traits are important for insurance agents?

- Skills and traits tests

- Insurance agent skills assessment FAQs

- How TestGorilla can help you find skilled insurance agents

- 3 tips for using skills assessments to hire insurance agents

- Find top insurance agents with TestGorilla

What is an insurance agent skills assessment?

An insurance agent skills assessment helps you test agents’ competency in relevant areas, such as numeracy and their ability to provide excellent service. It supports you in making efficient, data-backed choices when recruiting new agents for your team.

Your insurance agent assessment can include multiple hard skills tests as well as custom questions for a more comprehensive candidate evaluation.

You can use these hiring tools to select suitable candidates for the interview stage and remove unskilled insurance agents from the process.

Some examples of relevant skills for insurance agents that you can evaluate with your assessment include:

Financial modeling expertise

Financial planning

Customer service collaboration

Mathematical abilities

Why are insurance agent skills important?

Let’s take a look at a couple of the positive likely outcomes of using skills assessments to hire high-performing insurance agents:

1. Sales success

Insurance agents with sales skills can better sell insurance policies to clients. They’ll be able to identify the client’s requirements and emphasize the key selling points of your company’s insurance policy.

For example, agents might use these skills to explain why homeowner insurance is essential, providing coverage in the event of fire or theft. They’ll also be able to close deals effectively while enhancing the client’s experience. These processes lead to sales success while enhancing your company’s reputation.

2. Soft skills enhance customer relationships

Insurance agents can develop excellent customer-business relationships by using soft skills like communication.

They’ll be able to communicate effectively with their clients to explain complex policies and ensure they meet their requirements by using active listening skills. Although helping clients with claims isn’t their main duty, they may support them with these issues and answer their questions verbally.

The likely result is content customers who endorse your insurance company and stick with you for a long time.

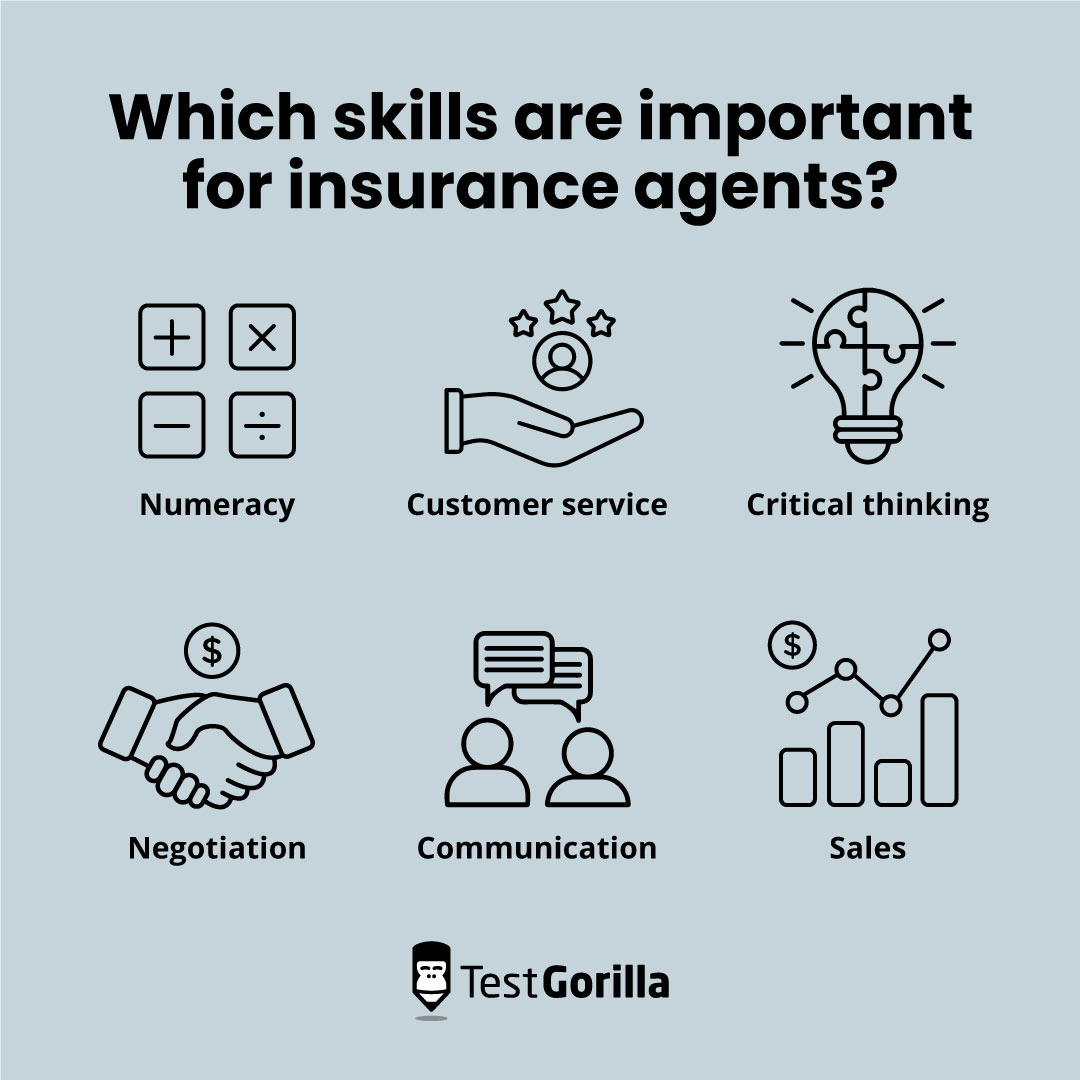

Which skills and traits are important for insurance agents?

A mix of skills and traits are essential to succeed as an insurance agent. Refer to the skills in this section to ensure your candidates can handle the role’s demands.

Numeracy skills

Numeracy skills include performing accurate mathematical calculations using formulas. They also include data analysis and equations skills, which help agents assess risk and determine coverage amounts.

For instance, an insurance agent may use numeracy skills to make calculations when setting premium rates. These equations enhance the insurance company’s financial stability and reduce risk by showing the likelihood of events that cause a client to make a claim.

Customer service skills

Customer service skills incorporate elements of problem solving and communication. They involve active listening to understand each client’s unique situation and experiences. Thus, your candidates with customer service skills are able to connect with clients on a deeper, more personal level.

For example, a pet insurance company’s agent should use customer service skills to understand their clients’ emotions and support their policy needs. As a result, they can provide personalized premiums and the right assistance to clients, enhancing customer satisfaction.

Critical thinking skills

Critical thinking skills include analytical abilities and deductive reasoning. They also include skills in understanding cause-and-effect relationships and recognizing assumptions.

Candidates may use critical thinking skills to help identify the best policies for their clients. These actions remove any confusion for clients seeking the best insurance policy, and a seamless process can encourage your clients to refer other customers to your business.

Negotiation skills

Negotiation skills include abilities in controlling and driving discussions. They also involve influencing others and using emotional intelligence.

Insurance agents may use negotiation skills when working with underwriters on their client’s behalf. They negotiate for their client by using interest-based approaches that help underwriters determine whether to approve a claim. This process ensures clients get the best possible terms and favorable premiums.

Communication skills

Communication skills not only include verbal communication, but active listening and interpreting non-verbal cues as well.

A skilled candidate can choose language that removes jargon and breaks down complicated terms when discussing policies with clients. For example, when explaining what “exclusions” means, they may specify that the term refers to elements the policy doesn’t cover. This skill enhances transparency between themselves and the client, ensuring the client understands the complex information they receive.

Sales skills

Sales skills include abilities in aligning sales strategies to a client’s needs with the goal of selling services or products to them. These skills also involve building strong relationships and connecting with customers.

Promising candidates can use sales skills to discuss their insurance policies in an engaging, transparent manner. For instance, travel insurance agents may assess their client’s travel insurance needs and align their strategy to this. They may explain why having travel insurance is beneficial, such as for trip cancellation or medical expenses, and support customers in selecting the most appropriate coverage.

These skills ensure customers receive the best policy and the company closes more sales. It also builds trust between the company and the client.

Skills and traits tests

The US Bureau of Labor Statistics states that the employment of insurance agents will grow by 6% by 2031. As the market becomes more competitive, the number of roles increases, so evaluating your candidates’ skills is crucial to narrowing your candidate pool. Keep reading for our test recommendations that you can use to check if your candidates’ skills are a good fit for the role.

Financial math skills test

Our Financial math skills test evaluates your candidates’ skills in completing computations to identify financial results. It also assesses if candidates can:

Apply time value of money to business

Use mathematical progression

Use equations when completing mathematical calculations

This test is an excellent option if you need to review candidates who will work with numbers to calculate risks for your insurance business.

Customer service skills test

Our Customer service skills test assesses your candidates’ ability to interact with customers and find methods to meet or exceed their needs. It also evaluates if candidates can:

Understand your customer’s perspective

Communicate with customers

Complete customer service operations

This test offers a comprehensive skills assessment strategy to determine if candidates can deliver excellent customer service to build relationships with your clients.

Critical thinking skills test

Use our Critical thinking skills test to learn if candidates can:

Make sound judgments

Use deductive reasoning

Understand cause-and-effect relationships

Recognize assumptions

The test will remove any concerns about a candidate’s critical thinking ability when interacting with customers and making business decisions, as the results will objectively show you how well candidates can make sound conclusions.

Sales skills test

Our Retail sales skills test can be used to learn more about your candidate’s ability to:

Maintain relationships with customers

Assess customer needs

Understand the product they are selling

Use personal communication skills

The results will clarify whether your candidates are an ideal match for your company because those who perform well have the skills required to prioritize the customer relationship, describe policies engagingly, and close sales.

Learn more: How to evaluate skills from a sales assessment and test

Insurance agent skills assessment FAQs

If you’d like more information about insurance agent skills assessments, review some frequently asked questions and answers listed here.

What is a basic insurance agent test?

A basic insurance skills test assesses several basic skills. Some examples of these tests include the Basic triple-digit and Basic double-digit tests, which are in-depth assessment tools suitable for assessing a junior insurance agent. They feature several entry-level questions that candidates need to answer and provide results related to mathematical skills.

What questions should you ask in an insurance agent assessment?

With TestGorilla’s custom question feature, you can include up to 20 additional questions about specific skills in your assessment. For example, you might ask about your candidates’ ability to close deals with clients or use customer service skills to satisfy clients. You could also ask about their experience or traits to learn more about the qualities they’ll bring to your team and company culture.

What are soft skills tests within an insurance agent assessment?

Soft skills tests within an insurance agent assessment are tools to assess your candidates’ soft skills, such as communication or time management. These tests will reveal their proficiency in interacting effectively with other team members, solving problems, and staying organized.

What are hard skills tests within an insurance agent assessment?

Hard skills tests are tools you can include in an insurance agent assessment to analyze your candidate’s technical abilities. For example, a role-specific test you might include in your assessment is the Numerical reasoning test, which reveals your candidates’ numerical proficiency and whether they have the technical expertise for your role.

What are personality tests within an insurance agent skills assessment?

Personality tests within an insurance agent assessment evaluate your candidates’ prominent personality traits. Examples of these tests include our DISC and Big 5 (OCEAN) tests. These tests are excellent options to determine ahead of time which traits your prospective hire will add to your team dynamic.

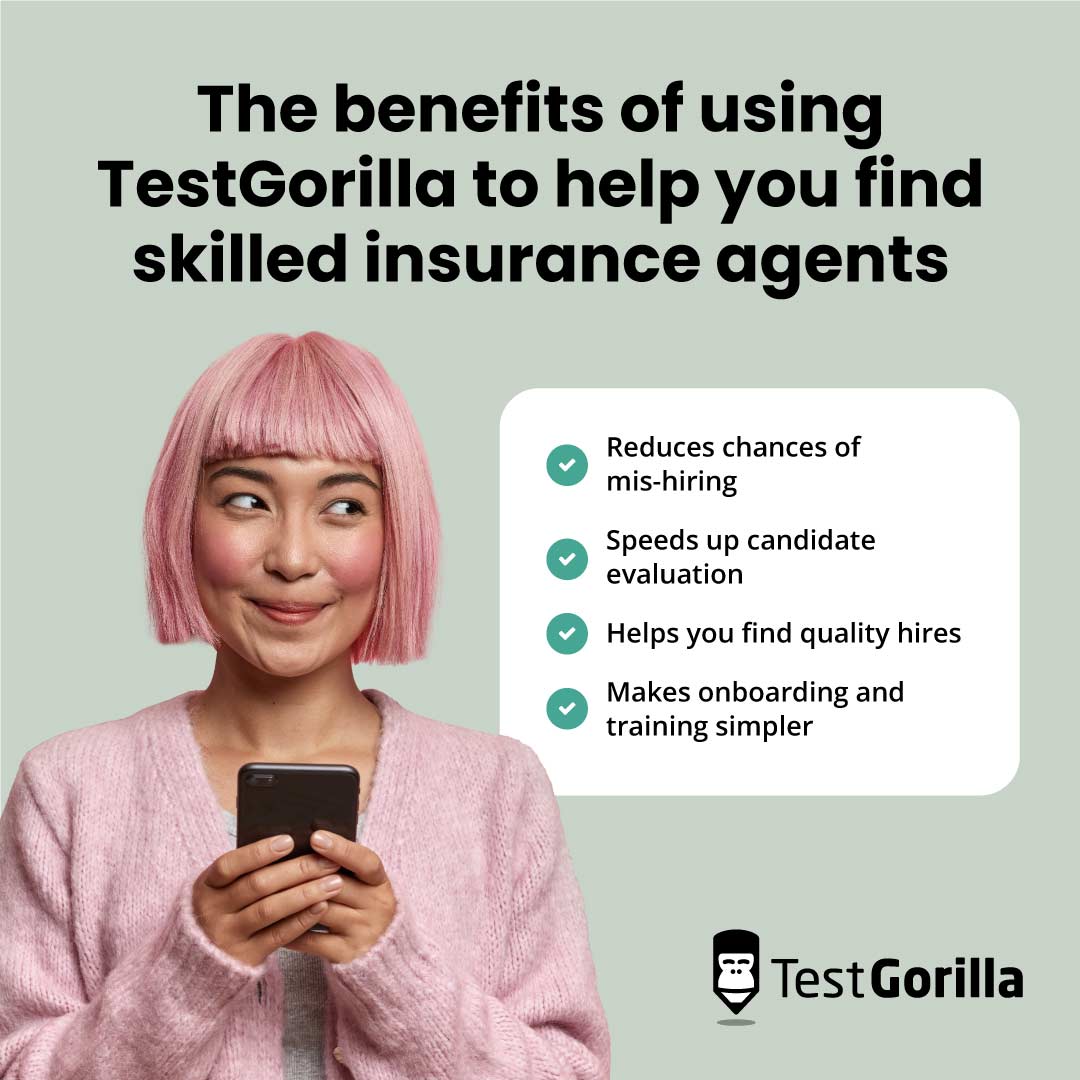

How TestGorilla can help you find skilled insurance agents

TestGorilla supports your hiring process by quickly and objectively identifying the most skilled insurance agents from your applicant pool, along with many other advantages that make hiring smoother.

Learn more about the benefits of using TestGorilla below:

Reduces chances of mis-hiring

Our skills assessments greatly reduce your chances of mis-hiring a candidate who lacks the necessary skills or isn’t a good fit for your role.

You can compare the test percentages of all your candidates, allowing you to easily spot the candidate with the best insurance agent abilities. Even if two candidates have similar skills, you can choose the candidate who has performed the best overall, reducing costs linked to mis-hiring.

Speeds up candidate evaluation

You can speed up the candidate evaluation process by simultaneously sending all your assessment invitations. Whether you invite candidates from your applicant tracking system or through TestGorilla, you can avoid time-consuming evaluations like resume screening.

This approach means you can quickly select the best talent for the interview stage and focus on other areas of your hiring process.

Helps you find quality hires

TestGorilla helps you find quality hires by ensuring you focus on candidates with the best skills. Those new hires can quickly settle into their roles and are more likely to perform better from the start.

By hiring quality candidates who perform well off the bat, your insurance company will likely close more deals and increase sales.

Makes onboarding and training simpler

Our tests reveal each applicant’s strengths and weaknesses, ensuring you know what your candidates will need to work on if you hire them. This feature helps you create onboarding and training sessions that are customized to your new hire’s abilities.

3 tips for using skills assessments to hire insurance agents

Consider the following three tips when using skills assessments in your hiring process:

1. Use insurance agent assessments after sourcing candidates

Make sure you invite candidates to complete your assessment as soon as you receive their applications. Avoid waiting until after the interview or screening resumes first. This way you can expedite your hiring process and find the best insurance agent in less time.

2. Check the time taken to complete the tests

You’ll see how long it took for candidates to complete the tests when you receive their results. Consider this factor when narrowing down your candidate pool. For instance, you might choose the insurance agent who performed well on the tests and completed them in the shortest time.

3. Review the candidates’ responses to custom questions

Your candidates’ responses to custom questions can help you create a shortlist of applicants to invite to an interview. For example, you might remove candidates who mention they lack sales skills or prioritize candidates who were able to clearly get their ideas across in a video-style custom question.

Find top insurance agents with TestGorilla

If you’re ready to assess your candidates’ personalities, skills, and cognitive abilities so you can hire the best insurance agent for your company, TestGorilla is here to help.

Creating an assessment of skills tests takes three simple steps: build the assessment, invite candidates, and analyze the test results. Try TestGorilla for free to see how it works, or request a free demonstration from our experts for more information.

Make TestGorilla your candidate evaluation tool to hire the best insurance agents for your team, avoid mis-hiring, and reduce your time-to-hire metrics.

Related posts

Hire the best candidates with TestGorilla

Create pre-employment assessments in minutes to screen candidates, save time, and hire the best talent.

Latest posts

The best advice in pre-employment testing, in your inbox.

No spam. Unsubscribe at any time.

Hire the best. No bias. No stress.

Our screening tests identify the best candidates and make your hiring decisions faster, easier, and bias-free.

Free resources

This checklist covers key features you should look for when choosing a skills testing platform

This resource will help you develop an onboarding checklist for new hires.

How to assess your candidates' attention to detail.

Learn how to get human resources certified through HRCI or SHRM.

Learn how you can improve the level of talent at your company.

Learn how CapitalT reduced hiring bias with online skills assessments.

Learn how to make the resume process more efficient and more effective.

Improve your hiring strategy with these 7 critical recruitment metrics.

Learn how Sukhi decreased time spent reviewing resumes by 83%!

Hire more efficiently with these hacks that 99% of recruiters aren't using.

Make a business case for diversity and inclusion initiatives with this data.