Financial manager interview questions: What to ask (and do) for better hires

We’ve all been there – with a degree from an Ivy League college, a ton of credible names on their resume, and the confidence of a young Marlon Brando, some financial manager applicants seem like a shoo-in. But how can you be sure that confidence isn’t covering a gap, like a lack of business judgment?

The answer lies in how you assess them during the interview and screening stages.

We spoke to four industry experts to get their insights on exactly what to look for when interviewing a financial manager. Plus, we include six ready-to-go interview questions, crucial insights into hiring techniques, and handy links to skills-based employment tests, like our Market Research test.

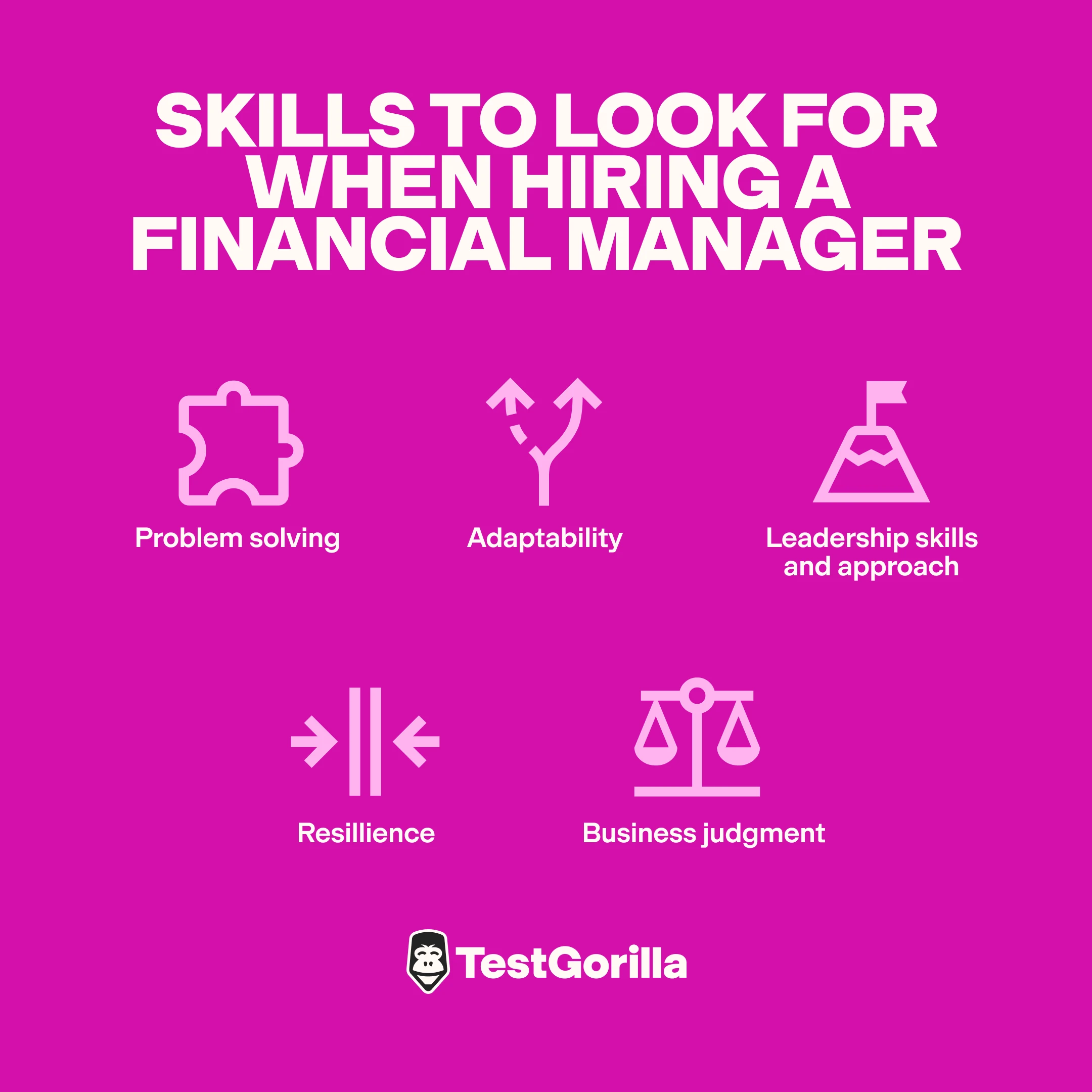

What financial managers actually need to be good at

Financial managers shouldn’t just be good at math. Their success depends on a much broader skill set, one that blends analytical expertise and technical knowledge with strategy, communication, and people management.

But, how these traits show up in different roles often depends on the experience level of the individual and the scope of responsibility.

For example, those earlier in their career (in junior roles) tend to focus on task execution and people management. These employees are still developing their strategic lens, so the ability to use their team’s skills to deliver day-to-day business needs is crucial.

As they gain experience, financial managers might take on more strategic responsibilities that shape a company’s financial future, using deeper analysis, risk management, forecasting, and more. They bridge the gap between numbers and narrative, interpreting numbers and advising leaders on how to achieve strategic business goals.

You may also like: Looking to hire a market research analyst? Our handy guide includes everything you need to know for your next hiring campaign.

What experts focus on in their financial manager interview questions

When we spoke with the experts, we discovered there are specific skills they look for when hiring financial managers, and specific questions they ask to target those skills.

Here are the skills they look for – and how we think you can try to surface them during interviews.

The ability to “solve this problem”

Šarūnas Bružas, CEO at Desktronic, proposes giving candidates real-world problems instead of theoretical ones, “I do not set theory questions to them, I give them an actual problem. I observe how they resolve it, the instruments they choose and the clarity of their work.”

Try giving candidates a semi-falsified problem to work through in the interview. It’s a great way to assess their industry knowledge and financial expertise.

Here’s a template you can adapt: “Imagine [insert a falsified business challenge]. How would you diagnose the issue and decide which actions to take?”

For example, if you’re in the fast-moving consumer goods (FMCG) industry, something like “Last month, our profits dipped by 15% even though our sales team swears they ‘crushed it.’ How would you get to the bottom of this?”

Adaptability

Olivier Wagner, Founder and CEO at 1040 Abroad, likes to make sure candidates can adapt to changing circumstances. He suggests asking, “How do you create a financial forecast for a business whose income streams are erratic?”

This question doesn’t just assess adaptability. Wagner says, “This question tells me about their insight into scenario planning, sensitivity analysis, and flexibility.”

His approach is to look for answers that explain how applicants balance conservative and optimistic models. This small pivot will give you deeper insight into a candidate’s strategic mindset and risk tolerance, plus how comfortable they are with modifying their approach quickly.

Leadership skills and approach

Instead of asking, “What’s your leadership style?” try taking a leaf out of Bružas’ book, who takes a more hands-on approach.

He says, “I established group scenarios and observed how they could deal with other people and affect the team. An effective leader needs to establish trust quickly and achieve outputs.”

You can try this approach in group interviews by posing scenarios to the group. One scenario might be, “You’ve just discovered an error in a financial report. It’s due in an hour. Figure out what to do as a team.” Then, you can see what happens and who demonstrates the kind of leadership you’re looking for.

Or, if you’re interviewing candidates individually, you might ask a similar question about their leadership experience: “Tell me about a time when you led a team to resolve a sticky issue, like discovering an error in a financial report an hour before it was due.”

Resilience

High-stakes decisions expose financial managers to pressure and stress. This is why our personal recommendation is to assess their resilience.

Many interviewers use cookie-cutter questions – like “Can you tell me about a time you experienced a career setback?” – to assess how candidates respond to stressful situations. This won’t tell you how they deal with pressure that’s specific to the situations they might encounter in the role.

To truly assess resilience, try “Walk me through a time you faced a financial or compliance crisis. What was your first step?” This is a multi-purpose question, hitting indicators of resilience, honesty, and strategic thinking under pressure.

Business judgment

Jason Vaught, Director of Content & Marketing at SmashBrand, likes to ask, “Can you describe a financial decision you made which went contrary to the recommendation of your accounting or analytical department, and what was the business result?”

He goes on to say, “Most persons can describe decisions made in accordance with financial results, but the good financial leader knows that figures are directions, not descriptions. I want to know, first, whether the applicant has self-confidence enough to determine whether he is going to have business judgment, how he handled the risk and what was the follow-up.”

Having the confidence to go against the grain and stand by a well-reasoned decision, even when it’s unpopular, is the hallmark of a strategic leader.

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

Financial manager red flags

There are also some red flags you need to look out for when interviewing financial manager candidates.

Here are some specific ones.

They forget their values

There’s a big difference between someone making commercially smart decisions and compromising on integrity to get the result they want.

Olivier Wagner, Founder and CEO at 1040 Abroad, likes to watch for red flags in judgement. He says, “A major warning sign is that candidates talk about 'making the numbers work' and do not talk about compliance or ethical standards. If an interviewee talks of cutting corners, ignoring control and presenting figures that are too rosy for the purpose of satisfying leadership, this reveals a lack of good judgment.”

If candidates display this red flag, follow up with questions to assess their ethics.

They don’t read

Harry S. Truman once said, “Not all readers are leaders, but all leaders are readers.” Candidates who read for pleasure tend to have sharper critical thinking skills, think more creatively, and communicate more fluidly than those who don’t.

Ryan Derks, of Derks Companies, has an unorthodox approach to looking for this red flag in financial manager candidates. He says, "It's a bit of a strange one, but I always ask, 'What business or self-help books have you read that had the greatest impact on how you view business or your future career and life?’

“I like [this question] because ... it shows that they have [the] curiosity to explore new ideas and try to improve their own life.”

A candidate who doesn’t read might lack a growth mindset or the hunger to keep learning long after formal education ends – a bad sign. Don’t reject these candidates right away, but do ask follow-up questions to probe their attitude toward learning.

They equate tenure with capability

Longevity doesn’t equal capability. Someone can spend a long time in a role and not develop much. This may be why less than one-third of job postings now ask for a specific number of years of experience.

It’s a red flag if candidates over-rely on ticking off the number of years they’ve worked in the field but can’t provide evidence of the skills they earned during this time.

If they do this, ask follow-up questions that force them to provide concrete examples of their skills in action – like how they dealt with a compliance crisis.

How to approach your financial manager interview

Here’s our advice for where to put your interview in the hiring process and how to improve the candidate experience.

Understand that candidates don’t want too many interviews

One Reddit user commented, “I applied at a job, they told me there were 5 interviews. The first with the manager, then the director, then a panel with manager, director and 2 others, then I’d have to do one with the VP and finally if I made it that far (I would have) I’d have a final panel interview so they could ‘make their final decision and talk numbers.’

“I literally laughed at the manager on the phone…”

Focus on finding a happy medium between the number of interview steps required to find the right candidate and not going so overboard that candidates drop out halfway through.

Here’s what we recommend.

Screen with skill tests – and then interview

Screening your applicant pool with skill tests is game changing. This can help you find strong candidates right away without you unintentionally disqualifying candidates who have the skills you need but lack the “right” resume credentials..

With skill tests, financial manager candidates can be objectively scored on various relevant skills. This makes it much easier to gain clear, comparable insights into their abilities, which may be why 76% of the employers we spoke with use skills tests – and why 84% who’ve hired with skills tests are satisfied with those hires.

For instance, our Market Research test assesses their approach to the market research process: planning and initiating research, using qualitative and quantitative methods, and sharing data.

We recommend pairing this test with some other tests to form a role-specific assessment. You might use these tests:

Our platform will even benchmark candidates for you according to their results, so you can easily shortlist top candidates.

Then, you can interview your shortlisted candidates. If you’re interviewing candidates face to face, this will ensure that you’re interviewing only qualified candidates – saving you and your applicants precious time.

→ Planning to use interviews to screen your financial manager applicants? Check out our AI video interviews.

Give the green light to your hiring process

Conducting a strong financial manager interview is both an art and a science, and the questions are the all-important glue that holds it together. They’re what turn a standard interview into a meaningful conversation – one that reveals not just what a candidate knows, but how they solve problems, adapt, lead, and use ethics.

But interview questions are only part of the equation. Skill assessments can help you assess financial managers’ abilities in action.

To learn more about our skills tests and other offerings, sign up for a free TestGorilla account. Alternatively, book a free demo with our friendly team.

Contributors

Olivier Wagner, Founder and CEO at 1040 Abroad

Šarūnas Bružas, CEO at Desktronic proble

Ryan Derks, Derks Companies

Jason Vaught, Director of Content & Marketing at SmashBrand

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.