An accounts payable skills test is the best way to screen your candidates

Accounts payable (AP) is often viewed as “just data entry.” But those who work alongside it know better.

As one certified public accountant (CPA) put it, “Not everyone is capable of doing [AP]. It is more than just making sure things get paid. It takes attention to detail and an understanding of expense codes and approval processes.”

This perspective gets closer to reality. Done well, AP protects cash flow, data integrity, and vendor relationships. Done poorly, it creates hidden costs that ripple across the business.

That’s why hiring for accounts payable matters so much. And yet, too many hiring managers use unreliable methods, such as resumes and gut instinct, to select AP talent.

The smarter approach is simple: Start with an accounts payable test for hiring, then conduct an interview.

Why resumes fail in accounts payable hiring

Here’s the usual process: You post an AP role, and resumes flood in, all claiming “advanced Excel skills” and “attention to detail.”

But these vague claims don’t prove whether candidates can handle the real challenges of accounts payable work.

As Courtney Epps, owner of OTBTax, tells TestGorilla, “Resumes do not always demonstrate [candidates’] ability to accurately and efficiently complete the role - particularly when under pressure. We want to ensure that candidates can properly match invoices, demonstrate attention to detail, use basic Excel formulas, and are familiar with cloud-based accounting platforms, such as QuickBooks or Xero."

Relying on resumes here is like selecting a vendor based solely on their elevator pitch: Saying all the right words doesn’t mean they can actually deliver when it counts.

Mis-hires cost a lot (and not just financially)

When resume-based screening fails to identify capable candidates, the consequences pile up quickly.

Consider what happens when you hire someone who can’t keep up with the workload. Late payment penalties – of $25–$100 per missed payment – start accumulating. Vendors lose confidence when payments are delayed. Month-end close drags on because small errors snowball into hours of reconciliation.

The ripple effects extend beyond numbers. A weak hire pulls the entire team off course. Skilled staff spend more time fixing coding mistakes than focusing on analysis. Managers end up supervising one struggling employee instead of guiding the whole department. Morale dips as strong contributors feel like they’re cleaning up more than they’re advancing.

There’s also the risk no one sees at first. A mis-coded invoice can surface during an audit, and a missed duplicate can strain cash flow. These aren’t clerical blips – they’re control failures that put the credibility of your finance team at risk.

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

How skills-first testing transforms AP hiring

Thankfully, this cycle of costly mis-hires is preventable. Simply replace resume screening and gut instincts with skills-based testing, and your hiring success will skyrocket.

That’s not just lip service: Our 2025 State of Skills-Based Hiring report found that 90% of companies using skills-first methods report fewer mis-hires, while 91% see improved retention and 81% cut their time-to-hire.

This is because skills tests measure whether each candidate has the core competencies to excel in a given role. In turn, you separate genuine talent from those who only look good on paper.

For accounts payable roles, in particular, Epps tells TestGorilla that the best skills tests are “scenario-based with time limits [to] mimic the real-life scenarios encountered within the job.”

The perfect accounts payable test combines elements of an accounting support skills test, finance screening test, and invoice processing test.

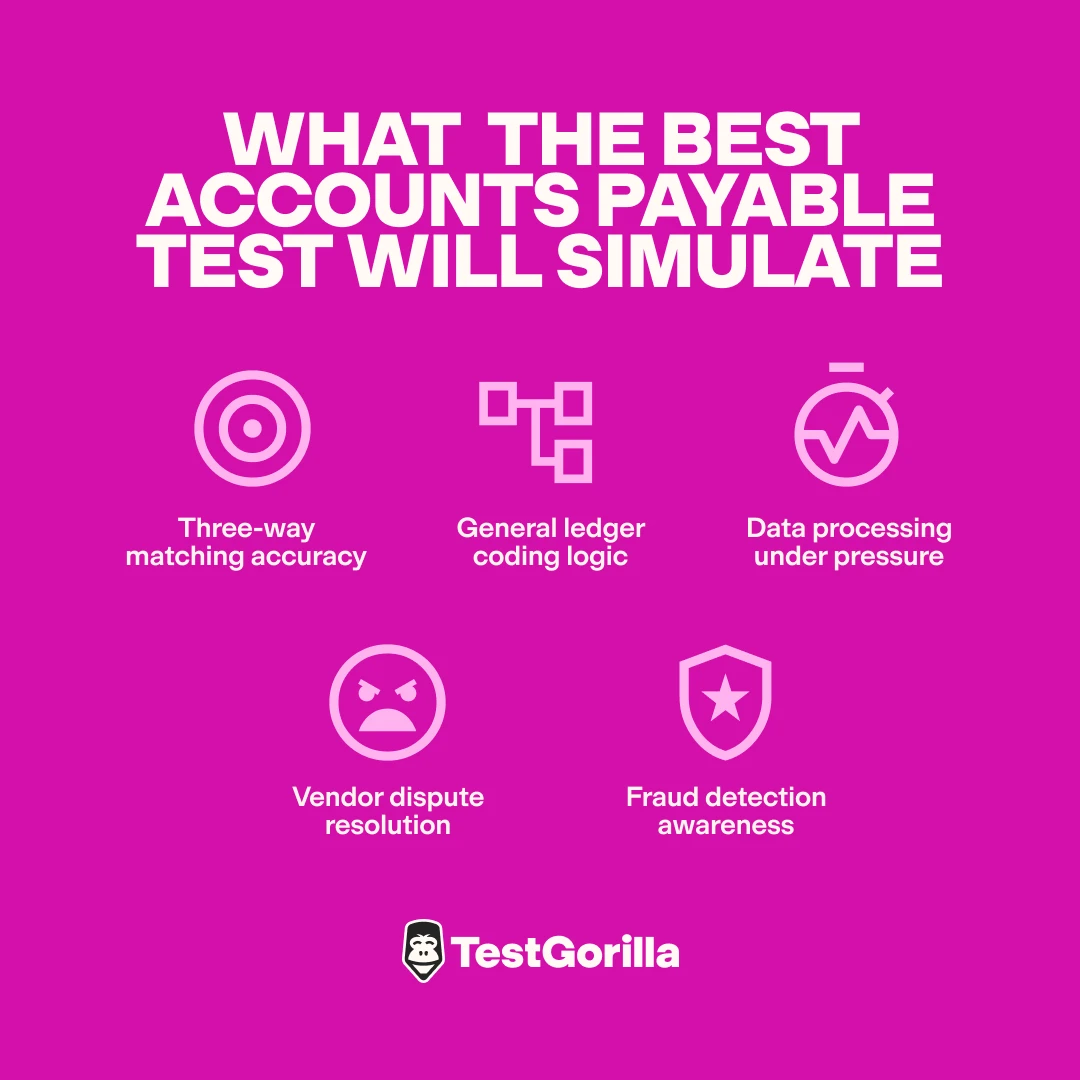

But it goes beyond technical knowledge and reveals how candidates think, how they communicate, and how they act under pressure. The best test will simulate:

Three-way matching accuracy: Spotting quantity mismatches, pricing errors, and missing approvals across purchase orders, delivery receipts, and vendor invoices – and then explaining how to resolve them.

General ledger coding logic: Categorizing expenses, applying the chart of accounts, and justifying coding choices.

Data processing under pressure: Entering invoices quickly and accurately, even with incomplete or messy details.

Vendor dispute resolution: Writing clear, professional responses about payment discrepancies that protect company interests while preserving supplier relationships.

Fraud detection awareness: Identifying duplicate invoices, unauthorized purchase orders, or unusual vendor requests that could indicate financial fraud.

These evaluations uncover hidden gems – candidates who may not have years of AP experience but demonstrate exceptional logic, problem-solving, attention to detail, and reliability.

The result? A fairer, sharper hiring process where you see how candidates perform in the situations that matter most.

When and how to assess accounts payable skills

The difference between effective screening and wasted effort often comes down to timing.

Most teams test either too early (before basic qualification) or too late (after multiple interview rounds). The strategic sweet spot sits right after resume review and before interviews.

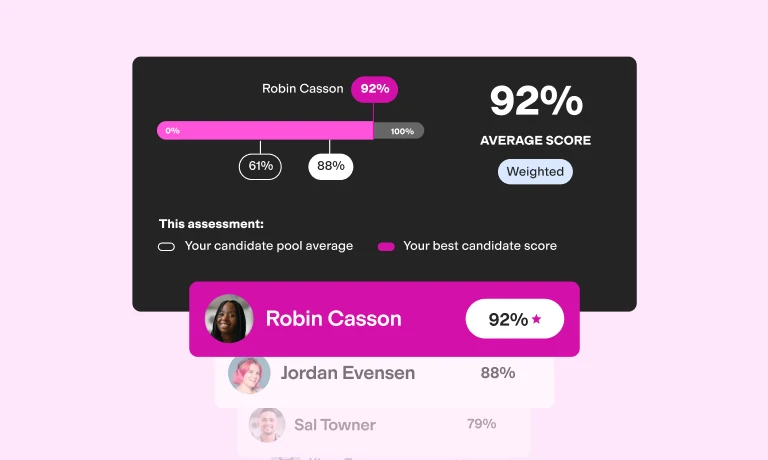

This positioning transforms your entire hiring funnel. Instead of interviewing 12 candidates hoping to find two who can actually do the work, you screen 50 with an AP test for candidates and interview only the 4–6 who prove their competence.

TestGorilla’s fully online Accounts Payable test makes the evaluation stage a breeze. Candidates complete realistic scenarios that mirror actual job challenges – vendor ledger reviews, three-way matching exercises, and dispute resolution correspondence. The screening reveals not just technical accuracy, but also the judgment and communication style that predict long-term success.

However, don’t rely on just one test. We recommend pairing your pre-employment test for accounts payable candidates with complementary evaluations, such as cognitive ability and personality assessments. This combination highlights both technical competencies and behavioral traits that predict long-term AP success.

You can then use the insights you gain from additional evaluations to guide your accounts payable interview questions, enabling you to dig deeper into their experience, tendencies, and more.

How to interpret AP skills test results

Evaluating AP candidates is one half of the equation – understanding the results of those evaluations is the other. An accounts payable skills test isn’t about who finishes at the top of the scorecard. It’s about identifying signals of future success or red flags that predict failure.

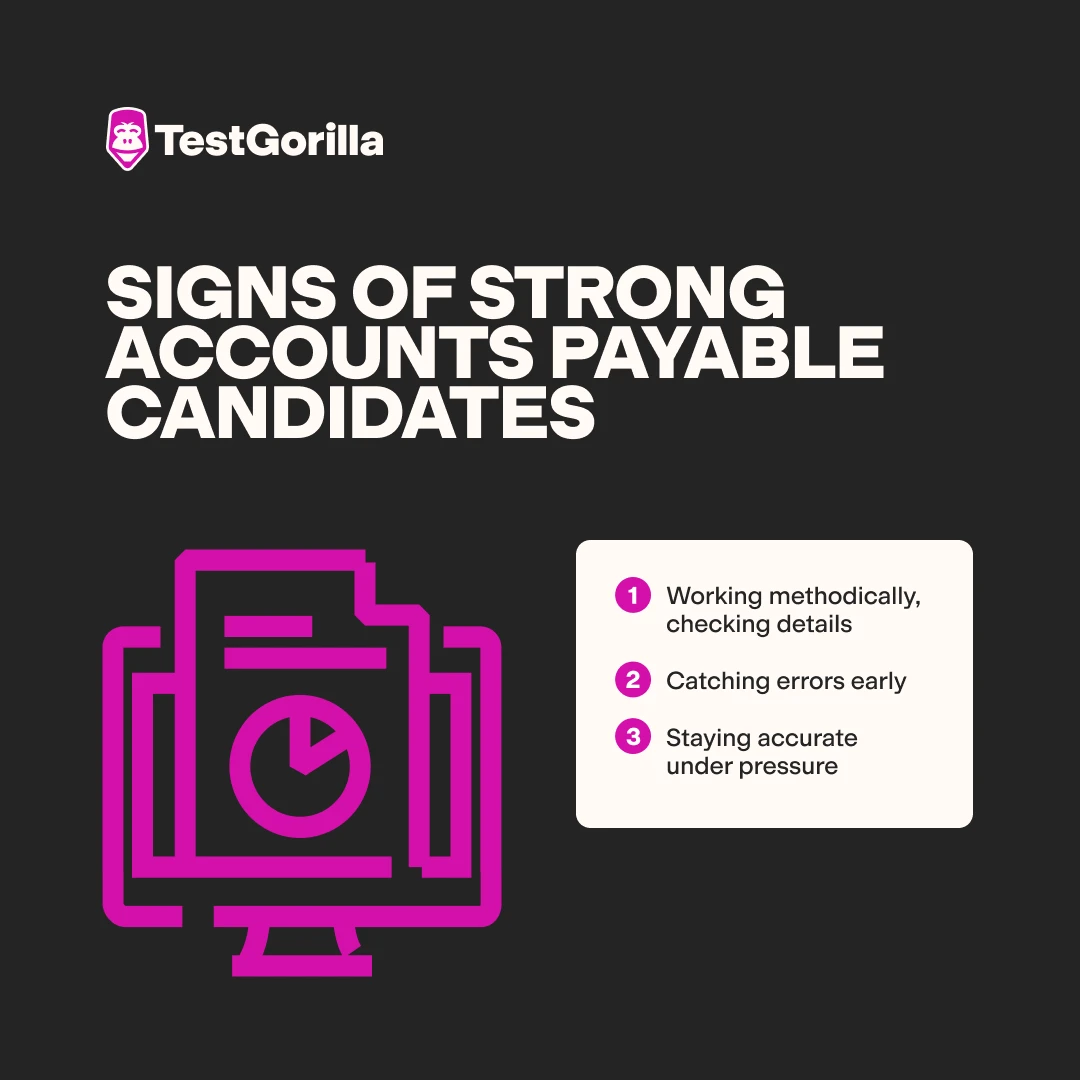

Signs of strong performers include:

Working methodically and checking details against contracts and orders

Catching their own mistakes before they spread

Staying accurate under pressure, even when invoices are messy or incomplete

These habits reveal more than technical know-how. They demonstrate judgment, discipline, and the ability to maintain vendor confidence during stressful month-end closings.

But not every skill gap is a dealbreaker. Missing an Excel formula or needing enterprise resource planning (ERP) system training is coachable. But fundamental flaws – such as skipping verification steps, losing focus under pressure, or failing to grasp basic accounting logic – rarely go away with training.

Communication patterns matter just as much. Candidates who explain their reasoning and ask clarifying questions show the professional judgment that protects both revenue and relationships. Those who give vague or incomplete answers often create slowdowns and friction later.

Think of interpreting results as a playbook for next steps:

High accuracy but weak communication → Probe collaboration and vendor-facing skills in the interview.

Strong logic but slow speed → Consider if training or workload design can bridge the gap.

Solid overall performance with one technical gap → Decide if it is a skill you can teach quickly or a blocker to success.

Consistent errors in fundamentals → Treat as a signal of poor fit, regardless of experience claimed.

The benchmark should not be a pass rate set in isolation. The most effective measure is your own top performers. Have them take the test and use their results to set a realistic bar. That way, you avoid rejecting good candidates who simply work differently while preventing costly hires who look sharp on paper but lack the judgment to succeed.

From better hires to stronger business

When Courtney Epps tested candidates with a vendor ledger containing five errors, the difference was clear right away. “Since utilizing assessments, we have improved the speed of staff onboarding, overall decreased errors, and successfully onboarded quality hires for the long term.”

That’s the power of skills testing: It shows you, before the interview, who can manage invoices, spot errors, and communicate clearly. By screening for these capabilities early in your hiring process, you focus only on candidates who can succeed in the role (and avoid costly, frustrating mis-hires along the way).

The principle is simple: Treat hiring for accounts payable as a control decision, not a clerical one. Place your AP role assessment between “Apply” and “Interview,” and refine it as your processes evolve.

Ready to put this into practice? Create a free TestGorilla account or book a demo today – and start building AP teams that protect cash, compliance, and credibility from day one.

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.