An accounts payable job description template that doesn’t fall flat

Writing an accounts payable job description seems like a no-brainer since the role has a narrow scope centered around repetitive tasks. Simply list the duties, add your requirements, and include key job details (like location). Then post and wait for applicants to start hitting “Apply.” What could go wrong?

If this routine is familiar to you, you’ll no doubt know the pain of wading through a flood of badly matched online job applications in search of the most promising applicants – with little success.

According to 2025 research by LinkedIn, 73% of HR professionals receive applications that fail to meet their criteria, and those looking to hire AP specialists know this pain all too well. That’s a problem since, according to Robert Half, this position is in the top 10% of 2025’s most in-demand finance and accounting roles.

The issue? Most AP job descriptions fall flat, which diminishes the quality of applicants they bring in. Below, we share some expert insights into why this is and share an accounts payable job description template that works. We also explain how to use our Accounts Payable test to find the most skilled candidates for your role.

Accounts payable job descriptions are failing to deliver. Here’s why, according to the experts

We spoke with experts and found that when AP job descriptions fail to bring in quality applicants, it's usually due to the following.

Mistake #1: Meaningless lists of responsibilities

You don’t need to spend much time browsing accounts payable (AP) vacancies to see that they typically contain lists of responsibilities like processing invoices, ensuring timely payments, and reconciling vendor statements.

DesignRush General Manager, Gianluca Ferrugia, says, “One of the biggest mistakes I see in Accounts Payable job descriptions is cluttering them with technical jargon or laundry lists of responsibilities without giving context.”

Generic lists don’t give applicants anything to help them assess their fit. There’s also nothing “extra” in them that captures the attention of the most skilled candidates – so those candidates move on, leaving you with a pool of less skilled candidates.

Mistake #2: Vague language around skills and traits

Vague language confuses potential applicants and can lead to mismatched expectations.

“Candidates like openness,” advises Gianluca, “since it helps them figure out if they are a good fit.”

The most capable candidates are looking for clarity about what skills and traits they need. If that’s not immediately clear from your job description, they won’t apply.

Ambiguity can show up throughout job descriptions. Buzzwords like “AP specialist rockstar” are often prone to ambiguity. Some commonly used terms, including generic skills (such as, “good organization skills”), can also add little insight without additional context.

Mistake #3: Glossing over soft skills

Soft skills are often overshadowed by technical requirements in job descriptions for finance roles, but it’s these skills that separate good AP specialists from great AP specialists.

“We always look for experience with ERP systems like NetSuite or QuickBooks,” says Gianluca, “But we also look for soft qualities like attention to detail, problem-solving, and follow-through.”

According to founder and CEO of expandCFO.com, Chris Arndt, who’s hired and trained many people for AP roles, soft skills should be the sole focus when hiring for client-facing AP roles:

“I believe the real value in hiring for an A/P role is in the person's other tendencies and traits. [That means finding] a person that is naturally detail-oriented, and can communicate clearly via email, and is generally a positive person. If they have these traits, then you can easily train them on the technical skills.”

Expert-informed tips on writing a job description for AP roles

Here are some solid tips for how to write a job description for AP roles.

Be open and precise about what (responsibilities, skills, and outcomes) the job involves

According to Gianluca, when his company writes AP specialist job descriptions, “We don't just say ‘process invoices’ or ‘reconcile statements.’ Instead, we say, ‘You'll own the end-to-end AP cycle, helping make sure vendors are paid correctly and on time, and working with internal teams to fix problems before they happen.’ People who want more than just tasks are drawn to that kind of language.”

Here’s what we take from his words: These job descriptions should leave no room for ambiguity.

Avoid listing vague (and subjective) skills, like “Good organizational skills,” by telling job seekers exactly what they must be able to do that requires good organization (e.g., “Ability to manage and process [X] invoices per week while maintaining accuracy”).

You should write the key responsibilities in clear language using full sentences that start with a verb to describe each of the role’s specific accounts payable duties and responsibilities.

You can even go further by showing candidates what happens when they fulfill their responsibilities: the results or the outcomes their contributions bring. This is what Gianluca does in his job descriptions to draw in candidates who “want more than just tasks.”

Pro tip: Gianluca also encourages the inclusion of essential details – saying, “We also tell [candidates] how many invoices they will have to deal with each week.” This level of openness ensures there are no mismatched expectations.

Illustrate your ideal candidate to lure in the applicants you want

Gianluca claims that one line has helped his company find better candidates. Here’s that line:

“We're looking for someone who treats AP as more than just data entry; this is a job where speed, accuracy, and communication matter every day."

According to Gianluca, “That one line helped get rid of those who weren't a good fit and brought in people with the proper attitude.”

In other words, it showed their applicants the true nature of the role and drew in the kinds of candidates who’d succeed in it.

Embed requests in your job description to filter out the candidates lacking the necessary soft skills

Chris goes even further to find the candidates with the qualities he wants, following the principle, “Hire for will, and train for skill.”

He says, “To filter for candidates with these traits, you can embed certain requests in your job description that will quickly weed out most applicants.” He gives this example: “Instead of allowing applicants to just click a button to apply, at the bottom of the job posting, ask them to send an email with certain details in order to apply.”

“Any candidate that follows these specific requests is likely very detail-oriented,” he says (detail-orientation is one of the traits he looks for).

Pro tip: Another great request to include in your job description could ask candidates to take a skill assessment as part of the application process.

Target future-proof skills and personal qualities

According to Accounts Payable Automation Trends 2024, from 2023 to 2024, the number of AP teams with partially automated processes jumped from 62% to 74%.

In addition, although 60% of AP departments still manually enter invoices, 76% of all respondents said they plan or want to achieve full automation in the next 12 months.

This means all companies hiring for permanent AP roles should be looking for candidates who can handle change and continue adding value as more AP tasks become automated.

Future-proof qualities to look out for in candidates include:

Flexibility and adaptability (for confronting change, learning new tech and processes, etc).

Skills for maintaining strong vendor relationships.

Ability to resolve issues quickly and effectively.

You should find ways to target these qualities in your job description – for instance, by embedding them into your skills and responsibilities.

Eliminate unnecessary requirements

Don’t restrict the size of your candidate pool with unnecessary qualifications and experience. Unless the position requires expertise in specific software, most accounts payable duties requirements should be "preferred."

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

AP job description template

Job title: [For example, Accounts Payable Specialist]

Job type: [Full-time, part-time, on-site, hybrid, remote]

Location: [For example, Bellevue, WA]

Department: [For example, Accounts]

About us

We’re a [e.g., national leader in general contracting in the private sector], specializing in [e.g., projects across corporate, hospitality, and retail sectors]. [Include other info on what makes your company stand out, e.g., Our people have enabled us to deliver exceptional results for more than 15 years. Our Bellevue location was recently listed as one of the best companies in the state.]

Job summary

We’re seeking an accounts payable specialist who can own the end-to-end AP cycle, ensuring invoices are received and managed accurately, while maintaining compliance, resolving discrepancies, and building strong vendor relationships.

You’ll work in a professional team that’s [e.g., on the cutting edge of AP technology and committed to continuous improvement].

Key responsibilities

Receive, review and route [type and volume] invoices for approval, ensuring timely processing and preventing payment delays.

Promptly identify and resolve discrepancies using [software] and following company policies, reducing errors and avoiding financial losses.

Build and maintain strong relationships with local suppliers, fostering long-term trust.

Work accurately in compliance with relevant federal, [your state], and [your company] policies and regulations, minimizing risk and ensuring audit readiness.

Key skills and competencies

Ability to spot errors in repetitive data and large volumes of invoices

Multitasking and ability to prioritize workload to meet deadlines

Clear and professional communication skills for coordinating with suppliers and across the company

Independent problem-solving

Ability to adapt to new technologies and processes, including automation

Qualifications and experience

Required:

Familiarity with [e.g., Sage and GCPay]

Proficiency in [e.g., Excel and other MS Office applications]

Preferred:

An understanding of the [e.g., construction] industry

Experience with automated AP processes

Experience managing relationships with external parties

What we offer

Competitive salary with regular increases

Comprehensive benefits package, including health, dental, and life insurance

[Other benefits, e.g., hybrid work arrangement, professional development budget, PTO]

How to apply

As an equal opportunities employer, we use bias-free skills assessments in the early stages of hiring. To apply for this role, [insert instructions on how to seek an invitation to take an assessment].

Adapt this AP job description for the best results

You must adapt this job ad for accounts payable by filling in this template out with information that’s highly tailored to your role and company.

Considering these questions can guide you on what customizations to make:

Who will the AP specialist communicate with on a daily basis?

What are the daily tasks of the position?

What essential skills do candidates need – both technical and broader competencies?

What AP processes are automated and manual?

What level of communication will they have with vendors?

What regulations, policies, and procedures must the successful candidate comply with?

What additional responsibilities does the AP role require, if any?

Weave the answers to these questions throughout the job description.

If you’re unsure of the answer to the questions above or other details about the role, get input from the finance team or the employee who’s departing the role, if possible. This is a small inconvenience, but it will substantially improve the quality of your applicants and reduce mis-hires.

What next? Check out this mini accounts payable hiring guide

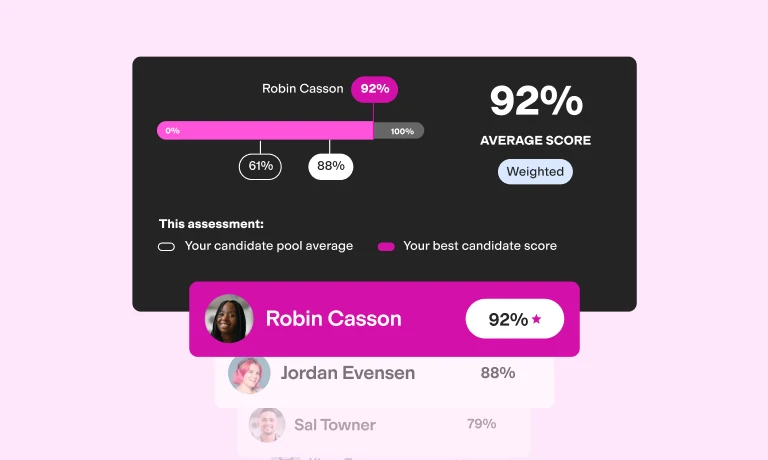

When your job description starts bringing in applicants, you need an equally solid method of narrowing them down. You don’t want to discover your new hire was exaggerating their accounts payable skills mid-way through their onboarding.

You should screen accounts payable candidates with a skills test that looks at their role-specific skills.

For instance, our Accounts Payable test covers recording transactions, reconciling accounts payable, and more.

You can combine our tests with other tests, including soft skill tests, to create a unique assessment.

TestGorilla’s library of more than 400 expert-created tests help you home in on top AP talent in the early stages with skills-based assessments. Here’s why they work:

Skills assessments look at actual ability and provide insight into candidates’ long-term potential.

Skills-based hiring reduces mis-hires and improves retention rates for the vast majority of employers – 88% and 91% respectively.

Assessments are objective to things like educational background, which are often prone to unconscious bias.

TestGorilla skills assessments are backed by science and have been thoroughly validated.

Our platform automatically scores and ranks candidates for you – so you can shortlist ones with the skillsets you need, and interview them with our accounts payable interview questions.

Ready to start hiring for accounts payable roles? Sign up for a free TestGorilla account or book a free demo.

Related posts

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.