It’s a truth universally acknowledged that a company in possession of open roles must be in want of talent acquisition metrics.

If you’re not up on your Pride and Prejudice, it’s basically a long commentary on good versus terrible matchmaking – a surprisingly perfect comparison for hiring. Just as judging a suitor by charm alone can lead to regret (ahem, Mr. Wickham), focusing on the wrong hiring metrics can steer you to disastrous decisions.

We spoke with six experts to get their input on the talent acquisition metrics to track and the ones to avoid in your own matchmaking process.

The talent acquisition metrics you need to stop obsessing about

Some metrics look impressive but don’t offer much – or any – real insight. These “vanity metrics” can give you an illusion of progress, distracting you from the real work of improving your hiring outcomes.

Let’s look at four commonly tracked metrics that aren’t nearly as helpful as they seem.

Volume of applications

When AI can create a resume in seconds or autofill an entire application with one click, application volume loses much of its meaning. “It looks great in reports,” Milos Eric, general manager at OysterLink, tells TestGorilla, “but it doesn't tell you anything about how quickly or how well you hire.”

If anything, it measures how easy it is to apply – not how strong your employer brand is or how qualified your candidates are. And really, a smaller pool of well-aligned candidates almost always leads to better outcomes than a flood of loosely qualified applicants.

Offer acceptance rate

At face value, offer acceptance rate sounds like a clear win: you make offers, and candidates say yes. Everyone’s happy, right?

Not necessarily.

“When it comes to talent acquisition metrics, I don't believe offer acceptance rates reveal much,” says Ben Lamarche, general manager at Lock Search Group. A strong acceptance rate can come from “offering roles to underqualified candidates” – and “that’s not good hiring.” As he puts it, “a high acceptance rate means little if you have a weak pipeline; in fact, it may mask a lesser pool of candidates.”

On the flip side, a lower acceptance rate isn’t an automatic red flag. It may mean you’re competing for exceptional talent who have multiple options.

Plus, focusing on maintaining a high acceptance rate can lead to bigger, expensive problems. When you focus on quantity over quality, you inevitably see higher employee churn. If you offer to any Tom, Dick, or Harry, you’re not hiring deliberately – you’re hiring desperately, and you shouldn’t be surprised when hires don’t always share your company values, work ethic, or motivation.

Time-to-hire

Paul DeMott, Chief Technology Officer at Helium SEO, tells us that among all the talent acquisition metrics, “the most overrated is time-to-hire.”

He explains, “My team has noticed that it is often inversely correlated to long-term quality of talent acquired.” In other words, a fast time-to-hire might feel efficient, but it doesn’t necessarily mean you’re landing the best talent.

And when teams focus too heavily on reducing this metric, they risk rushing decisions and cutting corners in screening. As DeMott notes, this can create “increased turnover rates and greatly increased training costs later” – which completely offset “the initial advantage in speed.”

Cost-per-hire

According to Yad Senapathy, founder and CEO at Project Management Training Institute, the most misleading recruitment metric is cost-per-hire.

“[A] low cost-per-hire may look attractive,” he explains, “[but] if that ‘low’ number represents a candidate [who] will ultimately be less productive over the course of their tenure, then the organization will experience a larger loss.”

The problem is that cost-per-hire focuses on what you spent to make the hire, not what you gained by bringing the candidate on your team. Trying to squeeze as many hires as possible out of your budget – or to save as much money upfront – can easily be outweighed by lower performance, slower onboarding, or early turnover.

The talent acquisition metrics that actually improve hiring outcomes (+ how to track them)

Instead of measuring metrics that don’t move the needle, track these six:

Job ad engagement

Instead of tracking how many people apply, look at how candidates interact with your job ads. Metrics such as views, time spent reading, click-through rate (CTR), application starts, and drop-off points provide strong insights into what’s pulling candidates in and what’s turning them away.

This information can help you improve your job descriptions, identify the best sourcing strategies and channels, and allocate your recruitment budget more effectively.

You can track job ad engagement through the analytics tools built into your applicant tracking system (ATS) or the job boards you use. For deeper insights, tools like Google Analytics or heatmapping software can show you how candidates interact with your job ads.

Candidate experience

The candidate experience reveals how your hiring process feels from the other side and where it’s breaking down. Poor communication, unclear next steps, or drawn-out stages are signs of friction that can cost you top-tier talent.

While candidate experience includes qualitative feedback, you can measure it consistently.

As Lamarche notes, you just have to pair it with at least one other “strong qualitative metric, like candidate feedback.” Stefan Stojanovic, Director of Recruitment at DigitalSilk, uses several metrics to track candidate experience: “candidate [net promoter scores], time to first response, time in stage, and where candidates drop out of the process.” Together, these show whether candidates feel informed, respected, engaged, and likely to recommend your company to others – or frustrated and put off by your organization.

To track candidate experience effectively:

Use post-application and post-interview surveys

Monitor response times and time spent in each stage

Review patterns in candidate drop-off

Check public feedback on sites like Glassdoor and LinkedIn

These metrics can show you where to simplify your process, speed up decisions, and keep qualified candidates in the funnel.

→ For more ideas, check out this guide: 7 candidate experience best practices that impress job seekers.

Hiring manager experience

Hiring manager experience shows whether your talent acquisition process actually works day to day. Do they fully engage with every candidate? Are they frustrated or slow to respond? Do they struggle to decide how to move candidates forward? If not, your process needs attention.

You can track it by looking at:

Results from post-hire or quarterly satisfaction surveys

How long it takes them to give feedback

Whether their interview evaluations are consistent

As one user put it on Reddit, “At the end of the day, it comes down to 1 metric: Are your hiring managers happy with your performance? [...] If the HMs aren't happy, then you have a problem.”

Diversity metrics

In talent acquisition, diversity metrics help you assess whether your hiring process gives different groups an equal chance of moving forward. When tracked properly, they make it easier for you to spot and correct bias by highlighting issues in sourcing, screening, and interviewing that might otherwise have gone unnoticed.

That matters because fairer processes lead to better outcomes – for you and candidates. They broaden your access to qualified talent, strengthen the candidate experience and employer brand, and support your company’s wider diversity, equity, and inclusion (DEI) goals.

There’s also a business update: Companies with greater gender diversity are 15% more likely to have financial returns above their industry medians. For ethnic diversity, that figure rises to 35%.

To track diversity metrics in practice, follow these steps:

Collect voluntary self-identification data from candidates to understand who enters your pipeline.

Review pass-through rates at each hiring stage to see where different groups advance or drop out.

Run adverse impact analyses to identify patterns that may point to unintentional bias.

Compare demographic representation levels against industry benchmarks to identify where there’s room for improvement.

Retention rate

“The single metric I value most is retention,” Wynter Johnson, founder and CEO of Caily, tells TestGorilla. And for good reason: Retention is one of the clearest indicators of whether your recruitment campaigns are attracting the right candidates and setting them up for long-term success.

When new hires leave early, it usually points back to issues in the talent acquisition process: unclear role expectations, poor screening, or a mismatch between what was promised and what the job actually involves.

A strong retention rate, on the other hand, suggests that your hires are a good fit for the role, team, and culture. It also indicates that your hiring campaigns accurately represent your open roles and that you’re screening and onboarding effectively.

So, how do you track retention in a way that’s truly useful? Eric advises looking beyond mere tenure:

“We are careful to track what we call career stickiness: how long candidates stay in their next role and their satisfaction [at the] interim mark, six months out. We track it through survey follow-ups and employer feedback loops.”

Quality of hire

Quality of hire is a composite measure that looks at how quickly a new hire gets up to speed, their contribution to team goals, how well they embody your company’s values, and how well they align with your business’s needs.

What “quality” looks like will vary by role, industry, and what’s important to a business.

In fast-moving consumer goods (FMCG), for example, quality will hinge on rapid ramp-up, operational efficiency, and whether deadlines are consistently met in the first few weeks. In hospitality or retail, time to till training, completion of mandatory training, and first-month sales performance may be the most relevant signals.

To track quality of hire, start by defining what matters most to you in a new starter. Then, build a simple scorecard around the behaviors, skills, and outcomes that matter most to your team.

That way, you can measure quality of hire in a way that’s meaningful to you, rather than relying on a generic metric that misses the mark.

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

Improve hiring outcomes with TestGorilla

In Pride and Prejudice, Elizabeth Bennett’s mistake wasn’t a lack of options – she was looking at all the wrong signs. Charm and surface-level appeal hid what determined true compatibility.

Hiring isn’t much different. Vanity metrics can look convincing, but they don’t tell you whether candidates can perform well, grow with your team, and stay long-term. The talent acquisition metrics that matter most help you measure quality, fit, and long-term impact.

And TestGorilla supports talent acquisition success in two key ways.

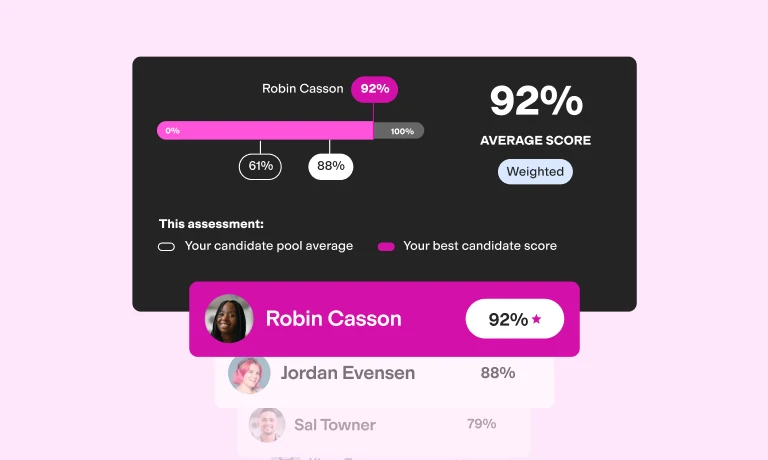

First, our database of 2 million+ pre-vetted candidates lets teams source candidates based on skills rather than resumes alone. We also help teams conduct skills-based assessments to evaluate candidates consistently, so every hiring decision is solid and data-backed. Plus, we offer AI resume scoring, AI video interviews, and much more to enable better, fairer hiring.

Curious to know more? Sign up for a free demo or create a free TestGorilla account today.

Contributors

Milos Eric, OysterLink, General Manager

Ben Lamarche, Lock Search Group, General Manager

Paul DeMott, Helium SEO, Chief Technology Officer

Yad Senapathy, Project Management Training Institute, Founder & CEO

Stefan Stojanovic, Director of Recruitment at DigitalSilk

Related posts

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.