21 tricky staff accountant interview questions to ask when hiring

Staff accountants keep your books clean and your business on track. But hiring the right one isn’t always straightforward. Many come prepared to interviews with polished resumes and textbook answers, but flounder once hired.

The key is asking the right questions during your interviews – ones that reveal real accounting skills, not just memorized answers.

Below, we walk you through the most useful staff accountant interview questions – and what to look for in answers. Plus, we show you how accountant assessments can enhance your interview process.

What to cover in an effective staff accountant interview

Interviewing for a staff accountant role goes beyond checking technical know-how. A structured approach helps you evaluate a candidate’s accounting and problem-solving skills, judgment, and fit for your team.

Start by covering four essential areas:

Technical skills

Focus on core knowledge like GAAP compliance, financial reporting, reconciliations, and preparing balance sheets, cash flow statements, and income statements. Ask about experience with tools, spreadsheets, and real-world financial tasks.

Analytical thinking

Staff accountants with strong analytical skills can break down complex data and solve financial reporting issues methodically. Ask how they’ve handled complex accounting issues in their previous roles.

Ethics and integrity

Since this role deals with sensitive financial statements and company data, you must gauge how candidates handle pressure and make decisions when rules are unclear.

Communication skills

Even technical roles require clear collaboration – especially when explaining variances or pushing back on reporting that doesn’t align with accounting standards.

21 tricky staff accountant interview questions and answers

Technical know-how

1. Walk me through a journal entry for a complex transaction (e.g., depreciation, accrued expenses).

The trick here is to check basic technical fluency – can they explain core accounting steps clearly, not just fill them out in a system?

You want accuracy, a clear explanation, and a basic understanding of accounting principles. Look for how they tie the entry to real reporting tasks – especially in a month-end or audit context. For example:

“For depreciation, I’d debit Depreciation Expense and credit Accumulated Depreciation. Say we bought a $12,000 asset with a five-year life – I’d book $200/month. I’d also make sure this lines up with the fixed asset register and month-end reports.”

2. You discover a batch of entries has formatting errors, right before the report is due. What do you do?

This adds time pressure. You’re testing how they react when something breaks late in the process.

Look for someone who stays calm, identifies what must be fixed now versus. later, and flags the issue. Bonus if they mention how to avoid it next time. A good response might be:

“I’d check how many entries are affected and fix anything that impacts key totals first. If time’s short, I’d send a heads-up and include a note with the report. Afterward, I’d figure out what caused the issue and suggest a new review step.”

3. Describe a time when you had to learn a new accounting system or tool. How did you approach it?

This checks adaptability and resourcefulness. It also reveals if candidates can learn – and how.

You want a candidate who’s proactive, self-driven, and not afraid to ask questions or test things hands-on. Here’s a strong answer:

“When I joined my last job, they used NetSuite, which I hadn’t worked with before. I started with internal guides, used a sandbox to test, and watched tutorials. Within two weeks, I was handling reports confidently.”

4. How would you approach reconciling intercompany accounts?

This sounds routine, but it’s often messy. The test is whether candidates know how to untangle mismatches and flag cross-entity issues.

Check for structure and ownership. They should mention verifying both sides, tracking timing differences, and keeping documentation. For example:

“I’d pull ledgers from both entities and match transactions by date and amount. If they didn’t align, I’d check timing or FX differences and follow up with the other entity. I’d also make notes on what was resolved and what’s pending.”

Analytical & problem-solving skills

5. Tell me about a time you found a significant error in a financial report. How did you handle it?

This question reveals how candidates deal with errors in critical financial statements. It shows whether they have:

Attention to detail for catching mistakes

Ethical judgment for reporting them

A proactive approach to fixing the issue without disrupting workflows

Staff accountants are often the first line of defense when it comes to spotting risks – so how they respond matters.

Top candidates will describe a real scenario where they identified a discrepancy or mistake in a balance sheet, income statement, or other financial report. Their answer should include:

How they verified the issue

Who they communicated with (e.g., managers, finance leads)

The steps they took to correct it

How they ensured accuracy going forward (e.g., updated processes, implemented checks)

You’re looking for ownership, clear thinking, and a strong understanding of accounting practices. Bonus if they mention cross-checking balance sheets and income statements and explain how they worked through a complex accounting issue from start to finish.

If the candidate downplays the error or blames others without offering solutions, that’s a red flag.

6. You’re reconciling the balance sheet, but one account doesn’t match, and the backup is missing. What do you do?

This question tests how candidates work with incomplete info: Do they stay methodical or panic?

You want someone who retraces entries, talks to others, and documents what’s missing – without forcing a fix just to “make it match.” Here’s an example of a strong answer:

“I’d look at related accounts in the financial records, try to recreate the logic, and check with teammates. If I couldn’t resolve it, I’d flag it, write up what’s missing, and keep things transparent in the report.”

7. Tell me about a time you had to clean up someone else’s inaccurate financial work.

This reveals how candidates handle messy handovers, frustration, and ambiguity.

Strong candidates don't complain – they share how they fixed the issue, improved the process, and kept things respectful. Here’s an example:

“I took over an account where bank recs hadn’t been done in three months. I started by matching all statements, then cross-checked entries and rebuilt the workbook with clearer formulas. I shared the updates with the next person, too.”

8. What KPIs or reports do you rely on to track financial health?

This question tests if candidates actually understand financial health.

Strong answers are tailored to business needs. You want someone who can explain why certain metrics matter – not just name reports.

“I look at net profit margin and operating cash flow first – they tell me if we’re making money and managing it well. The balance sheet helps me see how stable we are, especially the current ratio.”

Ethics and accountability

9. A senior manager asks you to backdate an entry for convenience. What do you do?

This tests whether candidates will bend the rules for someone senior, or do the right thing.

Look for someone who explains why they wouldn’t do it and offers a better option – without being rude or confrontational.

For example:

“I’d explain that backdating isn’t allowed because it breaks the audit trail. I’d offer to post the correct entry with a note if needed, but I wouldn’t change the date. If they kept pushing, I’d talk to the higher-ups.”

10. Say you realize an entry you made last week is incorrect but hasn’t been flagged yet. What do you do?

This sees if candidates are honest and take responsibility, even when no one’s looking.

You want quick action, transparency, and a desire to fix the issue – not hide it. For instance:

“I’d double-check to confirm it, then let my manager know right away. I’d post a correction with notes and make sure we updated the original backup, too.”

11. Tell me about a time a change in accounting standards affected your work. How’d you handle it?

This question checks whether the candidate has actually dealt with changes in their work, rather than only reading about them.

You want a specific example that shows how they applied the change, like this one:

“In my previous role, I had to adjust our process after the FASB updated revenue recognition rules. We’d been booking project revenue too early, so I worked with our controller to apply the new criteria. I updated our revenue schedule, shared the change with the team, and revised our templates for future use.”

Communication & collaboration

12. Describe a time when explaining an accounting issue to a non-finance stakeholder caused confusion or pushback. What did you do?

Staff accountants often collaborate across departments. This tests their ability to simplify jargon and communicate clearly without sounding condescending.

Look for someone who clarifies the message, gives context, and stays respectful. Here’s a solid response:

“A product lead didn’t understand why we couldn’t book early revenue. I explained the GAAP rule and showed how early revenue could hurt our metrics later. Once I tied it to the business impact, he got it.”

13. What do you do when your numbers don’t match your manager’s expectations?

This shows how candidates handle disagreements, defend their work, and communicate clearly, especially when the stakes are high.

You want someone who stays calm, double-checks their work, and communicates respectfully. For example:

“First, I’d double-check the numbers on my end to make sure I didn’t miss anything. If everything checked out, I’d walk my manager through how I got there, step by step. I’d ask questions to understand their expectations and see if we’re working with the same data. It’s not about who’s right – it’s about getting it right.”

14. Describe a time you supported an audit or had to prepare documentation for auditors.

Audits require accuracy, transparency, and solid documentation. This question tests the candidate’s experience with compliance and collaboration under scrutiny.

Look for familiarity with audit prep and confidence working with external reviewers, like this answer demonstrates:

“During our year-end audit, I was responsible for preparing balance sheets and cash flow statements with supporting documentation. I ensured all reconciliations were up to date and organized source files in a shared folder. When auditors had follow-up questions, I responded quickly and clearly. We completed the audit on schedule with no major findings.”

Additional tricky staff accountant questions to consider

You’re mid-close, and your manager asks for a last-minute custom report. What do you prioritize?

What would you do if a colleague accidentally emailed a confidential report to the wrong person?

Have you ever suggested a change that improved an accounting process? How did it go?

What’s something in accounting that you used to believe, but now think differently about?

Have you ever worked with outdated or inconsistent financial data? How did you make sure your reporting was still accurate?

What would you do if you noticed an unusually high expense entry that was approved by mistake?

Tell me about a time you were asked to speed up a task, but you knew it would affect accuracy. What did you do?

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

Red flags

Watch out for these signs during staff accountant interviews:

Dodging responsibility: Candidates who blame others or gloss over mistakes may lack accountability.

Vague or generic responses: If they can’t explain specific steps they took – especially in tasks like financial reporting or reconciliations – they may not have done the work themselves.

Overconfidence without detail: Big claims with no technical explanation can indicate surface-level knowledge.

Resume mismatch: Answers that don’t align with what’s on their resume (e.g., tools, technical skills, or past roles) can indicate exaggerated experience or limited experience.

If you experience these, don’t dismiss the candidate right away – instead, dig deeper with follow-up questions.

Go beyond staff accountant interview questions to hire with confidence

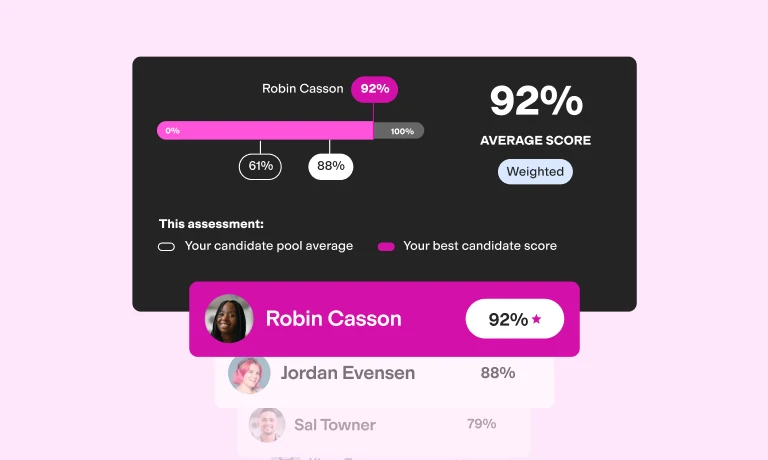

Interviews can reveal a lot – but they shouldn't be the first step. A candidate might sound confident, but struggle when it comes to applying core accounting skills on the job. That’s why using skills-based screening before the interview is so important.

Consider what Andrew Kyriacou, assistant financial controller at Ocean Outdoor UK, says about this:

“We don’t want to waste the candidate’s time by bringing them in for an hour-long interview and then, say 20 minutes in, realizing that someone who looked good on paper was someone that we probably wouldn’t be able to work with.”

With TestGorilla, you can screen candidates early using objective, role-specific assessments – so you only interview people who’ve already shown they have what it takes. For staff accountant roles, that might include tests for:

Excel skills

Analytical thinking

Attention to detail

Familiarity with tools like QuickBooks or Xero

These tests are consistent, bias-free, and designed to show you who’s truly ready for tasks like financial reporting, problem-solving, and applying accounting standards under pressure.

And while you're looking for the right fit, candidates are often hoping this is their dream job – so it’s only fair to give both sides the clearest picture from the start.

Want to reduce hiring mistakes and save time? Check out our accountant assessments to shortlist your top candidates before the interview.

You can also book a demo today.

Related posts

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.