Stop letting vanity sourcing metrics shape your strategy. Track these instead

Most sourcing teams track more numbers than ever, yet still struggle to answer the basics: Which channels actually work? Why isn’t the pipeline improving?

The problem isn’t the amount of data. It’s the kind of data teams rely on. Dashboards are packed with numbers like traffic, impressions, and application counts, but none of those tell you whether qualified candidates are entering the pipeline or moving forward.

When application volume increases, but the shortlist doesn’t, or outreach looks strong, but no one replies – the data signals activity, not progress. To break this stalemate, you need to focus on sourcing metrics that identify whether your outreach leads to conversations, stronger shortlists, and actual hires.

Below, we break down which metrics matter, why teams misread the ones they already have, and how a skills-based hiring approach gives sourcers clearer signals about what’s working.

The metrics that move pipelines vs. the ones that just look good

Most sourcing metrics fall into two categories: those that show real progress and those that simply create noise.

Vanity metrics are the noisy ones. They’re easy to measure and look impressive on the surface, but they don’t predict whether a candidate will move forward. Traffic spikes, high open rates, and large application pools can all seem to indicate momentum without actually improving your pipeline.

Progress metrics do the opposite. They show whether your sourcing efforts generate qualified candidates who advance. These metrics reveal which channels lead to meaningful conversations, which outreach messages drive replies, and which efforts lead to eventual offers – giving you information you can act on.

Vanity metrics often get celebrated because teams blur the line between sourcing and recruiting. When finding talent and selecting talent are treated as the same function, the activity starts to look like impact.

As Jon Hill, Managing Partner at Tall Trees Talent, tells us, “volume-based metrics still dazzle” but “rarely pay off in actual placements.” Michael Carter, President of Abstrakt Talent Solutions, sees the same issue, noting that application volume is overrated, because “95%+ of the applicants do not qualify.”

In short, vanity metrics show activity. Progress metrics show traction.

And only one of those builds a sourcing strategy that works.

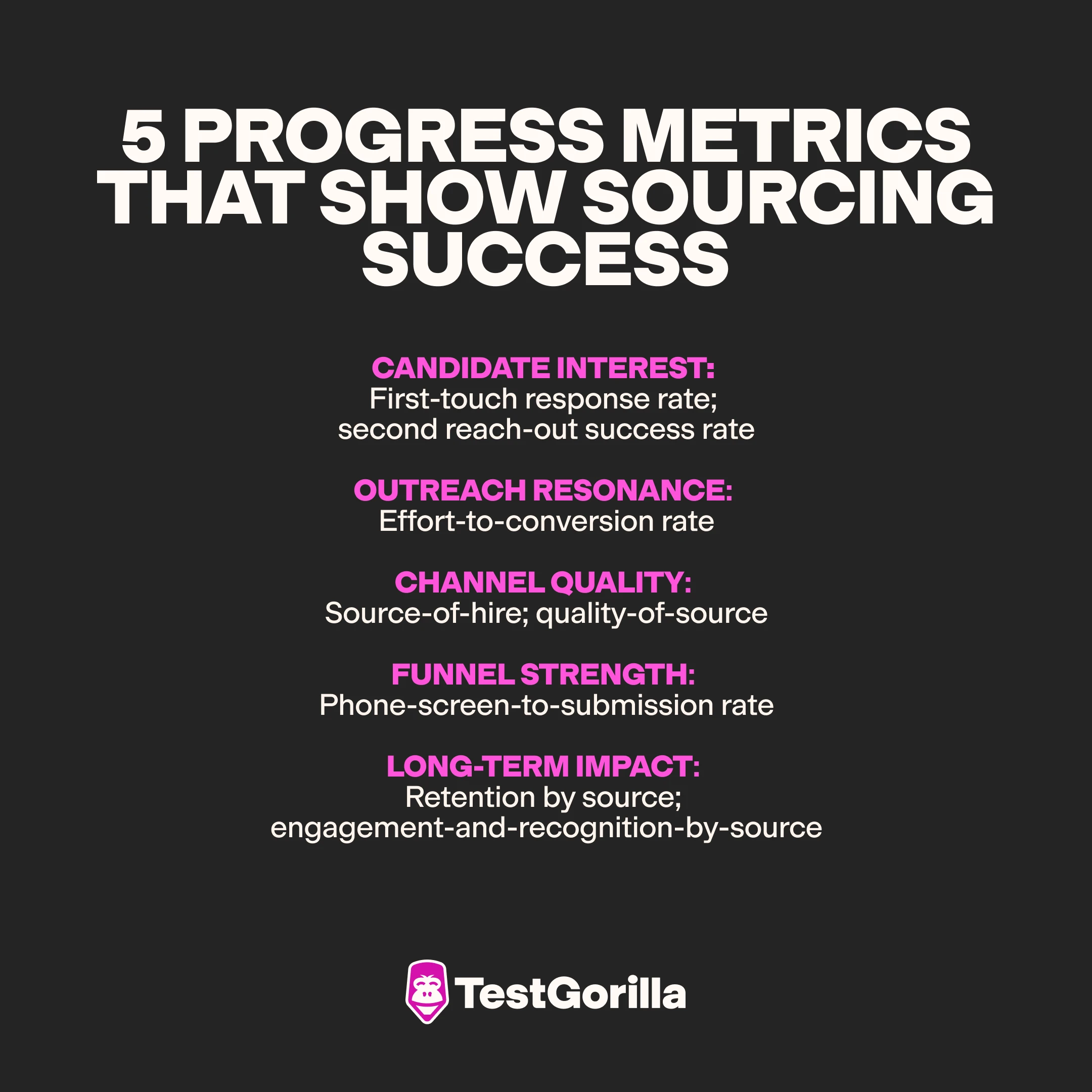

5 progress metrics that show what’s really working in your sourcing

Here’s an analogy: Great sports scouts don’t wait for talent to fall into their lap; they look for real ability and potential early, long before the rest of the field notices. Strong sourcing works the same way: You follow indicators that reveal quality before it’s obvious.

The sourcing metrics that shape successful hiring give you insight into human behavior: how candidates respond, how channels perform beneath the surface, and where your pipeline gains or loses momentum.

Those signals are harder to measure and often overlooked, but they’re the ones that actually improve decision-making. Below, we explore five of them to give you more predictable ways to source candidates who move forward and get hired.

1. Metrics that reveal candidate interest

The first place most pipelines break is at the point of interest: the moment a candidate decides whether to engage. Early-interest metrics help you see whether candidates notice your outreach and whether you’ve targeted the right people.

First-touch response rate gives you the baseline: Did anyone reply to the initial message? The more telling signal comes after that. Do candidates respond to a follow-up, ask a question, or eventually agree to talk? These behaviors show how your outreach is landing and whether candidates feel motivated to engage.

Ben Lamarche, General Manager at Lock Search Group, noticed candidates kept reappearing long after his team’s first outreach. When he dug into the data, he realized the “second reach-out success rate,” a metric most teams ignore, had become stronger than the first-touch metric. The market had shifted: Candidates were hesitant to switch jobs in an unpredictable economy and needed more context before engaging.

By adjusting their initial outreach to provide that clarity upfront, their first-touch response rate jumped. And all because a small, overlooked metric surfaced a change in candidate behavior.

Remember, early-interest metrics are your first clues about candidate engagement. Tracking how those signals build from message to message helps you see where momentum builds – or stalls.

2. Metrics that reveal if your outreach resonates

Early-interest signals show you who’s paying attention. But interest alone doesn’t tell you whether your message actually connects with the people you want to reach. The effort-to-conversion rate measures this: It’s the average number of touches (emails, messages, or follow-ups) it takes before a strong candidate agrees to talk.

When effort rises relative to conversion, it usually means something specific is slipping. Maybe candidates open your message but don’t reply – this suggests the pitch feels too generic. Or they may only respond after several nudges, suggesting the role isn’t coming across as relevant. Polite declines until a later follow-up also indicate your message isn’t addressing candidates’ questions.

As Milos Eric, General Manager at OysterLink, puts it, “As that number goes up, I know we are fumbling the message or targeting.”

Conversely, when the number of touches drops, you see the opposite pattern. Candidates reply after one follow-up instead of four. They ask clarifying questions instead of ghosting. They book a conversation without needing a long explanation. That tells you your outreach speaks to their priorities and feels aligned with their experience.

The power of this metric is that it shows, in concrete terms, whether your messaging pulls candidates in or pushes them away – and when it’s time to rewrite, retarget, or rethink your outreach.

3. Metrics that reveal channel quality

Channel-quality metrics help you answer a basic but often confusing question: Which sourcing channels are actually helping you hire?

Most applicant tracking systems’ (ATSs) sourcing data can’t tell you that, because they group everything into broad buckets like “web” or “social,” and high-performing channels get blended in with several weak ones.

Source-of-hire is the most straightforward fix. This metric tells you exactly where a hired candidate first came from. For example, if your last three hires all started as employee referrals (even if they later applied through your careers page), that’s the true source.

Quality-of-source, on the other hand, looks at how candidates from each channel move through your pipeline. For example, Indeed might send you 50 applicants, but only one reaches an early screening step. Meanwhile, a local industry Slack group might bring in ten applicants, and seven move forward.

In that scenario, the Slack group is clearly the stronger source.

Jon Hill notes that quality-of-source “cuts through all the BS, separating real traction from attention. And when you line it up against other metrics, like cost-per-hire or time-to-fill, it becomes even more powerful.”

In practice, that means a channel that looks expensive at first glance can still be your most dependable one. It may send fewer candidates overall, but the people it does bring in actually move past the first filter – something cheaper, high-volume channels often fail to do.

However, to measure quality, you need your channels to be clearly separated. That’s where source splitting becomes essential.

Lexi Petersen, Founder and CCO at Cords Club, learned this when she ran a survey asking applicants where they actually found the job. Her ATS had lumped all “social” traffic together, masking the fact that Instagram Stories was responsible for a third of her qualified applicants.

Job boards, which her team believed were performing well, accounted for only 8% of hires. Once she separated those sources, the decision became obvious: reduce job board spend and double down on Instagram recruiting content and referral bonuses.

The results showed up across the pipeline: Applicant volume rose from 90 to 150 per role, and interview-to-hire conversion nearly doubled.

4. Metrics that reveal funnel strength

Conversion metrics are valuable because they show the actual story of the pipeline, revealing whether the process moves candidates forward or pushes them out, rather than just treating it as a checklist of steps.

For example, Michael Carter uses the phone-screen-to-submission rate to evaluate recruiter efficiency. As he explains, some recruiters “only submit 30% of their phone screens,” while others “would send almost 90% of the candidates along.”

The latter case might signal that a recruiter isn't vetting candidates thoroughly enough, while a very low rate could mean they are "overcomplicating the role."

This single conversion point helps you see if a slowdown comes from the recruiter's approach, the sourcing channel, or a role mismatch. Ultimately, funnel metrics show where the human side of evaluation needs attention and provide concrete data for when you talk about talent sourcing with your hiring managers.

5. Metrics that show long-term impact

You can’t judge a sourcing channel simply by who applies. Ultimately, you should judge your candidate sourcing channels by what happens after the hire: whether the person stays, performs, and becomes part of the team.

That’s where long-term metrics come in. Retention by source, for example, is one of the clearest signals here.

Charly Huang, HR expert and Senior Business Advisor at AceBallMarkers.com, looks at what new hires are doing “after [...] six months, at one year, to see whether they’re staying in those roles, whether they’re succeeding, whether they’re a good fit for our culture.”

When people from a specific source “stick, prove themselves, [and] fit,” she considers that source effective.

The engagement-and-recognition-by-source metric adds another layer. Huang tracks “how often those employees get recognized in their workplace for their work,” because high recognition often signals a strong match between the candidate and the company.

When you use these long-term metrics, you get hires that last, not a spike in hiring numbers that lasts for a week or two.

The best insights on HR and recruitment, delivered to your inbox.

Biweekly updates. No spam. Unsubscribe any time.

Get past surface-level sourcing metrics with TestGorilla

Candidate sourcing only works when the data behind it is clear. But clarity is hard to get when sourcing, assessment, and ATS data are siloed, and early engagement isn’t linked to later hiring steps.

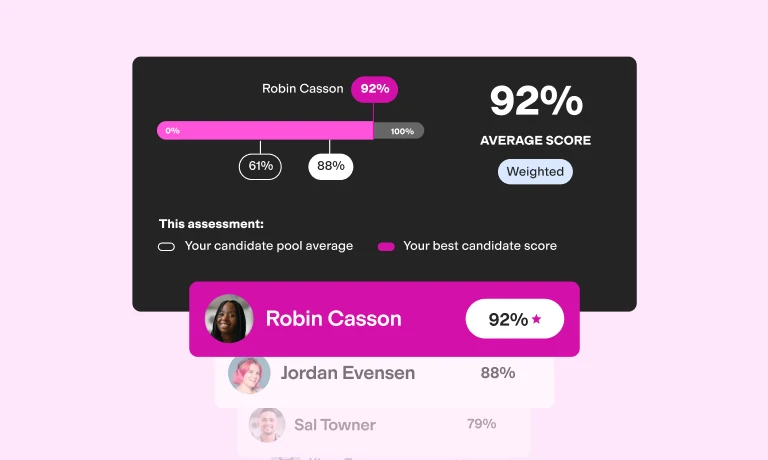

TestGorilla’s sourcing closes that gap by tying sourcing activity to performance signals you can actually use. Instead of adding more numbers to your dashboard, it gives structure to the ones you already track.

AI-powered candidate discovery sources people based on skills and experience, and multi-measure talent assessments (including role-specific skills, cognitive ability, and culture-add tests) give you a consistent read on what candidates can actually do early in the process.

That structured view makes sourcing more predictable, because you’re comparing candidates on evidence rather than impressions. And once you connect those skill signals back to your sourcing data, the picture clears: you see which channels send candidates who move past assessments, which ones lead to solid shortlists, and which ones stall early.

Looking at the full path – from source to assessment to hire – gives teams an honest sense of where the pipeline works, making time and budget decisions easier to ground in evidence.

That’s the goal of good sourcing data: to focus on metrics that reflect human behavior, skill alignment, and long-term success.

Want to see how TestGorilla works in practice? Book a free demo or create your TestGorilla account today.

Contributors

Ben Lamarche, Lock Search Group, General Manager

Milos Eric, OysterLink, General Manager

Jon Hill, Tall Trees Talent, Managing Partner

Michael Carter, Abstrakt Talent Solutions, President

Charly Huang, AceBallMarkers.com, HR Expert & Senior Business Advisor

Lexi Petersen, Cords Club, Founder & CCO

Related posts

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.