Payroll software: A guide for HR professionals looking to automate payroll

Studies show that the right payroll software can save five to 10 hours a month.[1]

But it isn’t just efficiency you gain with payroll platforms; you also mitigate pay-related risks.

The IRS estimates that 33% of employers make payroll errors costing billions of dollars annually.[2] In addition to monetary loss, such mistakes harm relationships with workers. Payroll software drastically reduces the chances of compliance and wage compensation errors that result from manual payroll tracking.

In this article, we explore how this HR technology increases efficiency and productivity while also acting as a shield against compliance risks, freeing HR professionals to focus on what truly matters – their people.

Additionally, we discuss combining HR payroll software with skills testing to facilitate skills-based compensation and ensure your workers are being paid properly.

Table of contents

- What is payroll software?

- Why is HR and payroll software important to human resources professionals?

- The benefits of software for payroll

- 5 best payroll software tools

- 5 best practices for leveraging payroll processing software in your HR department

- 3 examples of companies succeeding with HR payroll software

- Use payroll software to transform HR operations

- Payroll software FAQs

What is payroll software?

Payroll software represents a comprehensive service for managing employee wages. Beyond automating standard calculations of wages and tax deductions, proper payroll management provides useful insights and HR analytics on payroll data, such as labor costs, tax liabilities, and employee trends.

The right software also simplifies the process of adhering to tax regulations, saving unnecessary stress when the time comes to file taxes. It ensures accurate salary disbursements (usually via direct deposits to employees’ bank accounts or paper checks) and seamlessly integrates with other business systems, like HR dashboards, accounting, and time-tracking platforms.

Why is HR and payroll software important to human resources professionals?

Using software for payroll is more than just an administrative convenience for HR professionals; it's a critical component in managing employee satisfaction and branding.

First, payroll software reduces the time spent on tedious administrative tasks.

HR professionals are free to focus on higher-value activities. These include talent management, employee engagement, and attracting quality candidates – core areas that directly contribute to a company's growth and employee satisfaction.

Second, payroll software reduces the risk of errors.

Payroll mistakes can lead to serious legal pitfalls. They can also harm a company's employer branding. When employees are consistently paid correctly, it reinforces trust and reliability in the organization.

On the other hand, frequent errors can lead to negative reviews and a high turnover rate, as dissatisfied employees might choose to leave.

Third, with advanced payroll reports, companies can ensure correct skills-based compensation.

You need to recognize and reward employees appropriately to boost retention and overall productivity. When employees feel valued and fairly compensated, they are more likely to be engaged and committed to their work.

Bottom line: HR and payroll software is essential for modern HR departments.

The benefits of software for payroll

The table below outlines the main benefits of payroll software for HR departments.

Benefit | Description |

1. Saves time | - Automates payroll processes, reducing the effort and time spent on payroll tasks. - Lets you spend your time on business matters and developing working relationships with your employees. - Saves five to 10 hours for HR leaders per month.[1] |

2. Reduces cost | - Minimizes the need for external payroll services and reduces errors that can lead to financial penalties. - Removes the need to hire payroll staff or use paper-based systems – saving hiring costs. - Payroll software can help you save $43,200 per year.[3] |

3. Keeps up-to-date with tax laws and regulations | - Automatically updates payroll tax laws and regulations, ensuring compliance and avoiding penalties. - For example, according to the IRS, the penalty for not paying taxes on time is 5% of the unpaid taxes. - When there's negligence or non-compliance with rules and regulations, the penalty related to accuracy is 20% of the underpaid tax amount due to such negligence or disregard. |

4. Improves insights with detailed pay records | - Provides easy access to comprehensive payroll records for better financial and employee management. - For many businesses, payroll is the biggest expense, accounting for at least 50% of overhead. Small errors can cause huge problems. - Improved analytics through payroll software can help identify the cause of these errors and save money. |

5 best payroll software tools

In this section, we talk about the best software for payroll to implement in your HR tech stacks.

We’ve chosen five software tools that provide excellent payroll services.

Factors we considered

To select the five best HR and payroll software tools, we considered six factors:

Features: The software should offer a comprehensive set of features that cover all aspects of payroll, such as wage calculation, tax filing, direct deposit, pay stubs, tax forms, benefits administration, PTO, or workers’ comp. Most tools also leverage machine learning for better prediction of payroll trends or anomaly detection in payroll processing.

Ease of use: The software should be user-friendly and intuitive, enabling users to set up and run payroll with minimal hassle and training. It should also include a mobile device interface.

Cost: The software should be affordable and transparent, with no hidden additional fees or charges.

Customer reviews: The software should have positive feedback from customers who have used it and are satisfied with its performance and service.

Customer support: The software should provide reliable and responsive customer support via phone, email, chat, or online help center.

Free trial: The software should offer a free trial period, enabling users to test its features and functionality before committing to a subscription.

As a final point, when you’re researching potential payroll software tools, make sure they integrate with your performance management systems.

Such integration provides a more holistic approach to HR management, linking compensation directly with employee performance metrics.

Our top payroll software picks: A summary

Software | Description |

1. Gusto | Cloud-based payroll software designed for small and medium-sized businesses, offering full-service payroll, benefits, and HR tools |

2. QuickBooks | Well-known accounting software that provides payroll services, available as a standalone product or as an add-on to its accounting plans |

3. Paylocity | Web-based payroll and human capital management software tailored for mid-sized and large businesses |

4. ADP | Leading provider of comprehensive payroll and HR products, serving businesses of all sizes across various industries |

5. OnPay | Simple, affordable payroll solution focused on small businesses, handling payroll, taxes, and benefits |

1. Gusto: Best all-in-one product

Gusto is a versatile, cloud-based payroll software tailored for small- to medium-sized businesses, ideally with fewer than 150 employees.

The software simplifies payroll tasks like wage calculation, tax filing, and direct deposit while also offering customizable benefits such as health insurance and retirement plans. Its user-friendly interface enables quick setup and payroll processing, making it a practical choice for HR professionals.

Along with a transparent pricing structure, Gusto also offers a free demo, letting potential users explore its features, and includes a special “Contractor Only” account, free for the first 6 months.

This combination of efficiency, affordability, and comprehensive features makes Gusto an attractive option for HR professionals seeking an all-in-one payroll provider and HR product.

Pros

Easy to use

Unlimited payroll runs in all states

Highly customizable

Excellent all-in-one features

Cons

May not scale well for larger businesses

Users have cited poor customer support

Rating: 4.7 out of 5, 3,838 reviews (Capterra)

Pricing at time of writing: $40 per month plus $6 per employee

2. QuickBooks: Best for integrations

QuickBooks, widely known for its accounting prowess, extends its expertise to payroll services, suitable for small-to-medium sized businesses, including those that frequently engage freelancers.

The standout feature of QuickBooks Payroll is its robust integration capabilities. It effortlessly syncs with various QuickBooks platforms, such as QuickBooks Online, QuickBooks Desktop, and QuickBooks Self-Employed.

This seamless integration makes it an ideal choice for businesses already invested in the QuickBooks ecosystem.

Pros

Efficient handling of essential payroll tasks

Unlimited payroll runs

Strong integration with QuickBooks products

Comprehensive mobile app features

Ideal for small-to-medium sized businesses and freelancer use

Cons

Steep learning curve

Limited direct professional support

Reporting limitations

Rating: 4.3 out of 5, 6,420 reviews (Capterra)

Pricing at time of writing: Starting at $37 per month

3. Paylocity: Best for international teams

Paylocity is highly recommended for mid-sized to large companies, especially those with both domestic and global employees.

This software stands out with its comprehensive features, including expense management, tax support, same-day payments, garnishment management, and global payroll services. They also include employee onboarding software to make your hiring process smoother.

Paylocity emphasizes customization, reduces manual data entry, automates processes, ensures paycheck accuracy, and integrates smoothly with other business systems and compensation management software.

Pros

Comprehensive features suitable for mid-sized to large companies

Customization options to suit diverse business needs

Strong global payroll capabilities

Cons

Pricing not publicly listed, requiring a demo request for details

No free trial

No contractor payment capability

Rating: 4.3 out of 5, 818 reviews (Capterra)

Pricing at time of writing: Available on request

4. ADP: Best for scaling teams

ADP is a prominent provider of payroll and HR services, catering to businesses of all sizes across various industries. It's particularly well-suited for scaling businesses, efficiently accommodating companies with anywhere from 50 to 1000 employees.

ADP expertly handles core payroll tasks such as wage calculation, tax filing, direct deposit, and the creation of pay stubs and tax forms. Their platform provides employee self-service as well through their employee portal, so team members can access pay information whenever they need to.

It also offers a wide range of customizable benefits, including health insurance, employee compensation, and retirement plans, all manageable through its software.

Pros

Suits a wide range of business sizes, ideal for scaling companies

Unlimited payroll runs in all states

Comprehensive payroll and customizable benefit options

High customer satisfaction and reliability

Cons

Pricing information not readily available; requires a questionnaire for a quote

Extra fees for features included for free in other HR software

Steep learning curve

Rating: 4.4 out of 5; 6,382 reviews (Capterra)

Pricing at time of writing: Available on request

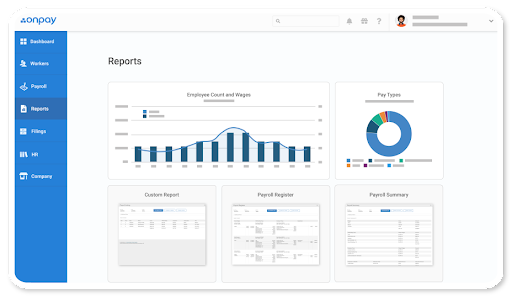

5. OnPay: Best for small businesses

OnPay is one of the top payroll processing choices for small business owners, particularly appealing to fast-growth companies.

Its pricing structure is straightforward and affordable – enabling easy budgeting without the need to switch to more expensive plans as the company expands.

Finally, the simple and straightforward presentation of its software makes OnPay easy for users to jump into quickly.

Pros

Ideal for small, fast-growing companies

Straightforward and affordable pricing

High customer satisfaction and reliability

Cons

May lack comprehensive HR features for larger companies

Rating: 4.8 out of 5, 438 reviews (Capterra)

Pricing at time of writing: $40 per month plus $6 per employee

5 best practices for leveraging payroll processing software in your HR department

Monitoring HR technology trends is key to staying ahead of your competitors. However, although trends may shift, certain best practices in payroll processing software remain timeless.

Following these best practices is important if you want to get the most out of your payroll software and avoid costly mistakes.

At a glance

Best practice | Main benefit |

1. Classify and pay employees correctly | Ensures fair and compliant compensation and benefits, including skills-based compensation |

2. Build a payroll system and process guide | Creates a standardized approach for consistency and efficiency in payroll management |

3. Gather and leverage payroll data | Enables informed decision-making by analyzing payroll trends and patterns |

4. Prioritize data security | Protects sensitive employee and financial data from breaches and unauthorized access |

5. Automate payroll | Frees up HR time to focus on employee engagement and strategic tasks by reducing manual efforts |

1. Classify and pay employees correctly

Classifying and paying employees correctly without software can be challenging.

You’re likely to have different types of employees (full-time, part-time, temporary, contract, or freelance), different types of pay structures (hourly, salary, commission, bonus, overtime, or differential pay), and different types of tax status (single, married, dependent, or exempt).

This becomes even more difficult for remote teams, where tax rates may vary from employee to employee. But good payroll software keeps track of local taxes and does tax calculations for you – making it a crucial piece of remote working technology.

Your employees also have different skill levels.

Payroll software plays a crucial role in facilitating skills-based compensation. HR departments can align employee pay with their specific skills and the tangible results they deliver for the company.

Payroll processing software helps you classify and pay employees correctly based on skills, pay structure, tax status, and employee type.

Paying your employees correctly helps you retain top talent and boosts their motivation because their compensation is directly related to the effort they’re putting in.

Finally, payroll software can help with pay transparency, which can make recruitment easier.

It does this by clearly outlining pay packages, including salaries, bonuses, and benefits. By including this information in your job postings, you ensure every candidate has clear expectations for their compensation.

Such transparency not only attracts applicants who are a good fit for the role in terms of expectations and qualifications but also promotes a culture of trust and openness within the organization.

2. Build a payroll system and process guide

A payroll system and process guide is a document outlining the steps and procedures involved in running payroll, as well as the roles and responsibilities of the payroll team and other stakeholders.

You can use it to ensure consistency, accuracy, and efficiency in your payroll operations.

A basic payroll system and process guide should include the following elements:

A payroll calendar that specifies the dates and deadlines for each payroll cycle, such as pay periods, pay dates, and tax filing dates.

A payroll checklist that lists the tasks and actions that need to be completed for each payroll cycle, such as collecting and verifying timesheets, calculating and approving payroll, managing payment methods, processing and distributing payments, and filing and paying taxes.

A payroll workflow that shows the sequence and flow of the payroll tasks and actions, as well as the roles and responsibilities of the payroll team and other stakeholders, such as managers, employees, and accountants. A vendor management system can be used for vendors or contractors.

A payroll policy that defines the rules and regulations that govern the payroll process, such as pay types, pay frequency, pay methods, overtime, deductions, benefits, and tax payments.

Implementing these elements helps streamline payroll management, contributing to a more organized experience for HR professionals.

3. Gather and leverage payroll data

Gathering and leveraging payroll data goes beyond mere efficiency in payroll; it empowers HR processes and decision-making.

Payroll data can offer deep insights and drive improvements in various HR areas. Many payroll software uses AI in HR to gather this information and map trends in your payroll.

Here are some ways you can use it:

Workforce planning and budgeting: Payroll data provides crucial insights into labor costs, which are essential for effective workforce planning and budgeting. By analyzing trends in overtime, bonuses, and overall compensation, you can make informed decisions about hiring, promotions, and budget allocations.

Performance management: Linking payroll data with performance metrics can help in assessing the effectiveness of pay structures and incentives. HR professionals can analyze whether compensation is aligned with performance outcomes and employee productivity, leading to more strategic pay decisions.

Compliance and risk management: Payroll data can help identify compliance issues related to wages, overtime, and benefits. Regular analysis of this data ensures adherence to labor laws and regulations, reducing the risk of legal penalties.

Employee engagement and retention: Understanding patterns in payroll, such as pay disparities, frequency of raises, and bonus distributions, can provide insights into employee satisfaction and retention rates. You can use this in conjunction with employee experience software to develop strategies for improving employee engagement and reducing turnover.

You can tap into a wealth of data through payroll software. Features like time tracking, payroll processing, and integrations with other systems can provide a seamless flow of useful information that, when used with your HR analytics software, greatly enhances the efficiency of HR processes.

4. Prioritize data security

Prioritizing data security isn’t just a best practice; it's a necessity.

Payroll data, encompassing sensitive information like personal details, financial records, and tax information, demands stringent protection against unauthorized access, theft, or damage.

Comprehensive security means you’re safeguarding data, maintaining trust, ensuring compliance, and preventing fraud and identity theft.

Payroll processing software equips HR professionals with essential tools for robust data security. Encryption is key, transforming sensitive data into unreadable code accessible only to authorized individuals.

Authentication and authorization are also vital, verifying user identities and controlling access based on their roles. This ensures sensitive information is only accessible to those who legitimately need it.

Here are two other important factors in data security:

Implementing backup systems: Many modern payroll software services come equipped with built-in backup capabilities, but it’s advisable to use external backups as well as an extra layer of security. You can do this through cloud storage services or external hard drives.

Setting up audit trails: Most comprehensive payroll systems include audit trail bookkeeping, which automatically tracks and records all changes made within the system. It’s best to regularly monitor these logs for unusual activities or inconsistencies to detect and prevent potential security breaches.

5. Automate payroll so you can focus on the human side of things

Automating payroll is a key best practice, enabling HR professionals to shift their focus toward the human aspects of their role.

By using payroll processing software, mundane tasks can be streamlined, reducing the need for manual intervention. Automated payroll not only saves time but also enhances the overall efficiency of your payroll process.

Here’s how you can do it:

Choose the right payroll software: Select a software that aligns with your business size and needs. Features like software integrations, user-friendly interfaces, and scalability are important factors to consider.

Set up and customize: Configure the software according to your company's payroll policies, including pay schedules, employee information, tax details, and benefits.

Integrate with other systems: Connect the payroll software with other HR systems like time tracking and benefits management for seamless data flow and reduced manual entry.

Train your team: Ensure your team is well-trained in how to use the software effectively. This includes understanding its features and staying updated on any new functionalities.

However, be aware of the potential pitfalls that come with automation, and take the necessary steps to avoid them:

Data inaccuracy: Regularly verify the accuracy of the data being fed into the system. Errors in employee hours, tax rates, or benefits can lead to incorrect payroll processing.

Compliance issues: Stay informed about changing payroll laws and regulations to ensure your system remains compliant.

System failures: Have a backup plan in place in case of software downtime or failures to avoid delays in payroll processing.

With all the time saved from automation, you can engage more deeply in activities such as employee communication, training and development, motivation and recognition, as well as performance evaluations.

3 examples of companies succeeding with HR payroll software

We’ve outlined three case studies to show you how payroll software is used in the real world.

When reading through these examples, pay attention to how payroll software is helping these HR teams focus on more important matters, such as:

Engaging with employees

Reducing costs and boosting productivity

Supporting client acquisition

1. Rise Marketing

Rise Marketing is a digital marketing agency that works with top remote talent in the U.S. and around the world to meet client needs.

The agency faced challenges in hiring and paying employees and contractors across different states and countries while ensuring compliance with tax regulations and deadlines.

It started using Gustoand was able to achieve the following outcomes:

Quickly and compliantly hired employees in other states, such as New Jersey and Delaware, by using Gusto's state tax registration feature

Saved 8 hours a month on managing international contractor payments by using Gusto's integration with TransferWise, which handles currency conversions and transfers automatically

Fueled client growth by 125%, by tapping into a global talent pipeline and meeting clients' needs with different skills

In the future, Rise plans on using Gusto's performance reviews and goal-tracking features to further develop team culture and engagement.

2. La Porte County Public Library

The La Porte County Public Library (LPCPL) faced challenges with shift scheduling, recruitment, and employee management due to the complexity of its operations.

It implemented Paylocity, which provided advanced scheduling features, recruitment automation software and onboarding processes, and integrated benefits administration.

The library experienced significant improvements. These include:

A more efficient recruiting and onboarding process, which reduced administrative costs

Around 300 more candidates applying to open positions every year

A boost to overall productivity by converting to automatic HR processes, saving time, and reducing manual workload

One day saved per new hire on administration, as workers don’t need to spend 4 hours sitting in HR filling out paperwork on the first day

One employee of LPCPL said they can do the work of three to four HR people with the new software.

Paylocity helped LPCPL enhance its operational efficiency, staff management, and HR processes, directly benefiting both employees and the library's service capabilities.

3. Veneer Chip Transport

Veneer Chip Transport faced challenges in managing payroll and HR for its employees and its clients, as it had to deal with complex tax regulations, different pay codes, and inefficient processes.

Veneer switched to Paylocity, which provides features such as online employee access, time and attendance tracking, and benefits administration that helped the company improve its internal operations and client satisfaction.

Veneer Chip Transport has achieved the following outcomes:

Saved 15 hours a week on payroll processing by using Paylocity’s online platform and dedicated support team

Able to turn its HR department into an “engine for growth”

As one of its employees stated:

“I have been able to spend quality time with the team, which has helped to facilitate the acquisition process. This has been huge for me, saving me having to make trips on weekends, and huge for the company as we continue to grow.”

Use payroll software to transform HR operations

The right payroll software transforms the way your HR department operates.

Adopting easy payroll software isn’t just a convenience but a necessity for HR professionals.

You can enhance efficiency and accuracy in payroll management and mitigate compliance risks. It also gives your team the time to focus more on strategic initiatives like reducing employee turnover and people management rather than administrative tasks.

Curious about how TestGorilla can help you screen candidates for payroll duties?

Watch a live demo or jump straight in and sign up for a free forever account today!

Payroll software FAQs

Here are some of the most common questions regarding payroll software.

Which software is mostly used for payroll?

The most widely used payroll software depends on the region and specific industry needs.

However, platforms like ADP, QuickBooks, and Gusto are prominent in the market due to their comprehensive features, reliability, and user-friendly interfaces – you can learn more about these in our best payroll software tools section above.

What is the best small business payroll software?

For small businesses, selecting the best payroll software typically involves considering ease of use, cost, and features. QuickBooks and Gusto are often favored for their affordability and robust set of tools tailored to small business requirements.

Can I do my own payroll for my small business?

You’re better off using software tools that provide step-by-step guidance for setting up payroll, calculating taxes, and paying employees, enabling you to maintain control over payroll management. This is much easier than doing it yourself and it helps avoid wage-related pitfalls.

Can you run payroll for free?

Although most comprehensive payroll services require a subscription, there are some free payroll software options available. Most paid tools also offer a free trial. These might offer basic functionalities that could be suitable for small businesses or startups with minimal payroll needs.

Sources

Epstein, Daniel. “How To Improve Productivity With Payroll & Attendance Software”. (September 7, 2023). Finances Online. Retrieved January 22, 2024. https://financesonline.com/how-to-improve-productivity-with-payroll-attendance-software/

Brooke, Connor. “Payroll Errors That Cost You Money and How to Fix Them”. (January 9, 2023). Business 2 Community. Retrieved January 22, 2024. https://www.business2community.com/human-resources/payroll-errors-cost-money-fix-01906305

“Cost savings associated with global payroll software”. (September 27, 2023). LinkedIn. Retrieved January 22, 2024. https://www.linkedin.com/pulse/cost-savings-associated-global-payroll-software-payslipsoftware/

Related posts

You've scrolled this far

Why not try TestGorilla for free, and see what happens when you put skills first.

Latest posts

The best advice on pre-employment testing, in your inbox.

No spam. Unsubscribe at any time.

Hire the best. No bias. No stress.

Our screening tests identify the best candidates and make your hiring decisions faster, easier, and bias-free.

Free resources

This checklist covers key features you should look for when choosing a skills testing platform

This resource will help you develop an onboarding checklist for new hires.

How to assess your candidates' attention to detail.

Learn how to get human resources certified through HRCI or SHRM.

Learn how you can improve the level of talent at your company.

Learn how CapitalT reduced hiring bias with online skills assessments.

Learn how to make the resume process more efficient and more effective.

Improve your hiring strategy with these 7 critical recruitment metrics.

Learn how Sukhi decreased time spent reviewing resumes by 83%!

Hire more efficiently with these hacks that 99% of recruiters aren't using.

Make a business case for diversity and inclusion initiatives with this data.