Every business needs compliance officers to keep it in check and prevent breaches of governmental or industry regulations. These officers are responsible for establishing compliance strategies and implementing them effectively.

Compliance officers are often the best problem solvers on any team because they encounter multiple challenges at work. These challenges require critical thinking and creativity to arrive at solutions that favor the business.

Undoubtedly, compliance officers are relevant to the corporate world. In fact, most companies have a specific department just for them. Thus, for such a vital role, you must ensure a thorough and effective strategy for their recruitment.

To help you achieve a successful recruitment, we will discuss how to hire a compliance officer in this article. We will also explain how to test their skills and draft a job description to attract the best compliance officers to your company.

Table of contents

- What is a compliance officer?

- Why hire a compliance officer?

- Compliance officer hard skills

- Compliance officer soft skills

- How to test compliance officer skills

- Where to find compliance officers

- Compliance officer job description template

- How much does a compliance officer cost?

- Compliance officer interview questions

- Hire your next compliance officer with TestGorilla

What is a compliance officer?

A compliance officer is an employee who ensures that your company’s corporate process is in line with the law. In other words, they make sure your business transactions are ethical and follow government regulations.

Much like internal auditors, compliance officers ensure your company’s corporate processes align with internal policies and regulations. This helps maintain order and due process in the organization, thus promoting efficiency.

Furthermore, compliance officers work directly with management to determine and assess potential risks. They perform advisory roles by being involved in business decisions.

At times, compliance officers constitute a team called the compliance department, which chief compliance officers lead. The main goal of the chief compliance officer and the compliance department is to minimize the company’s chances of violating laws.

In the US, the role of a compliance officer appears more in the finance and tech sectors. That’s because these sectors require strict adherence to federal legislation on data privacy and money laundering.

Technically, compliance officers are a link between the specialist department and management because they help regulate how information flows between the two departments. They do all this while respecting the firm’s confidentiality requirements.

Why hire a compliance officer?

With numerous regulations nationally and internationally, oversights are possible and can pose significant risks. A compliance officer takes responsibility for understanding these regulations and ensuring your company doesn’t breach them.

Also, it’s easier to follow these regulations when you have someone on your team who is well-versed in them. Such a person will keep your firm in line, regularly updating you with industry-related laws.

Compliance officer hard skills

The job of a compliance officer demands critical hard skills like knowledge of industry regulations and expertise in IT. As such, to find an efficient compliance officer, you must keep an eye out for these skills.

Below are some compliance officer hard skills to look out for during recruitment:

1. Knowledge of risk assessment

Assessing risks is one of the primary roles a compliance officer performs. Knowledge of risk assessment gives the compliance officer an edge when planning, identifying, monitoring, and managing risks.

A compliance officer must be familiar with the stages of risk assessment to guide their interpretation of potential risks to your company. They also need this knowledge to solve problems associated with any risks that might arise.

Those with an understanding of the rules that guide risk management can help you make critical decisions. They can effectively introduce and implement risk management methods because they know which business risks are worth taking and which aren’t.

2. Understanding of security issues

While performing an audit, the compliance officer must have a firm understanding of the security policies associated with that audit.

For example, to audit a telecommunication process, compliance officers need to know the security policies related to telecommunication. This ensures they do not overlook any regulations and risk breaching them.

Essentially, efficient compliance officers are familiar with different security standards like ISO standards, interception regulations, and monitoring and evaluation techniques.

Understanding these policies allows them to deal with security issues as they arise.

3. Knowledge of IT guidelines

Many companies today rely heavily on technology to manage their operations. To this effect, information technology (IT) has become the center of regulatory compliance.

Information technology (IT) means using computers to create, store, or exchange information. In relation to compliance, it involves using these devices in line with existing regulations.

For example, in the financial industry, compliance officers need to be familiar with the use of specialized software to monitor transactions. With their knowledge, they can prevent potential risks of money laundering and fraud.

As a field of compliance, IT guidelines ensure companies employ the appropriate IT security requirements and best practices. This way, they can incorporate IT rules in their everyday procedures.

Knowledge of information technology also helps the compliance officer protect sensitive information. This means compliance officers must be familiar with IT fields such as cyber security.

4. Industry knowledge

Different sectors and industries, such as engineering, legal, and tech, have their respective regulations which compliance officers must be acutely familiar with. Otherwise, your company would be at risk of breaching multiple laws.

Additionally, industry knowledge helps compliance officers to understand the risks associated with the company’s operations. It helps them identify potential issues that could arise with a company’s products and develop strategies to address the problems.

5. Conduct audits

Compliance officers must occasionally conduct audits to ensure your company still adheres to industry standards. Audits are periodic assessments to check and make sure things are going smoothly.

These audits inform the compliance officer of any changes in the firm contrary to the required regulations. In return, the compliance officer can act on this information and solve the issue.

Compliance officers skilled in conducting audits save you the cost and time of inviting external auditors to assess your firm’s conduct.

Compliance officer soft skills

Compliance officers need to have various soft skills to face the challenges of compliance implementation. These skills determine how well they can contribute positively to your firm. Here are some soft skills your compliance officer should have:

1. Critical thinking skills

KPMG, in one of its reports, placed critical thinking as one of the top skills needed for internal auditing. In essence, the ability to think rationally and clearly about risk analysis distinguishes top compliance officers from the rest.

Primarily, compliance officers need critical thinking skills to develop ways to ensure your firm obeys compliance regulations.

Also, critical thinking lets your compliance officer understand the connection between your company’s policies and compliance regulations. This opens their minds to potential risks and helps them find effective solutions.

2. Research skills

In order to stay up-to-date with the recent compliance regulations, compliance officers need the sharpest research skills. These skills help them track regulation development in your industry.

Research skills enable compliance officers to create programs and policies that will make it easier for your firm to follow regulations.

Furthermore, research skills are crucial to find loopholes in regulations. These loopholes give the firm an extra industry advantage, allowing it to bend the regulations to its advantage slightly.

3. Communication skills

Effective communication skills are one of the hallmarks of a great compliance officer. They need these skills to explain compliance regulations and expectations to staff and management clearly.

With workplace communication skills, the compliance officer can build trust with their coworkers and supervisors. This makes it much easier to ensure everyone is up-to-date with the compliance policies and can maintain them effectively.

4. Management skills

Compliance officers manage both people and resources. While this is no small task, compliance officers can categorize and perform their tasks properly with good management skills.

Moreover, a great compliance officer must be able to coordinate the development and implementation of compliance procedures. This demands they manage their teams and work collaboratively to ensure the process is risk-proof.

Management skills include the ability of your compliance officer to delegate tasks and direct various operations. These skills allow them to track progress, get results, and report findings to superiors.

5. Organizational skills

Often, compliance officers juggle multiple tasks and targets. Having a well-organized routine to help manage these responsibilities comes with top organizational skills.

Compliance officers need organizational skills to develop clear goals and agendas before the compliance process. These goals clarify the target for your team, allowing your staff to focus on what’s essential.

How to test compliance officer skills

To hire the best compliance officers, you must identify those with the vital soft skills and hard skills. While it might seem easy, the process of identifying these skilled compliance officers can be tricky.

Often, it’s never enough to judge a candidate by their resume. Some candidates could have a resume that doesn’t do justice to how skilled they are. On the other hand, some candidates might exaggerate their expertise on their resumes.

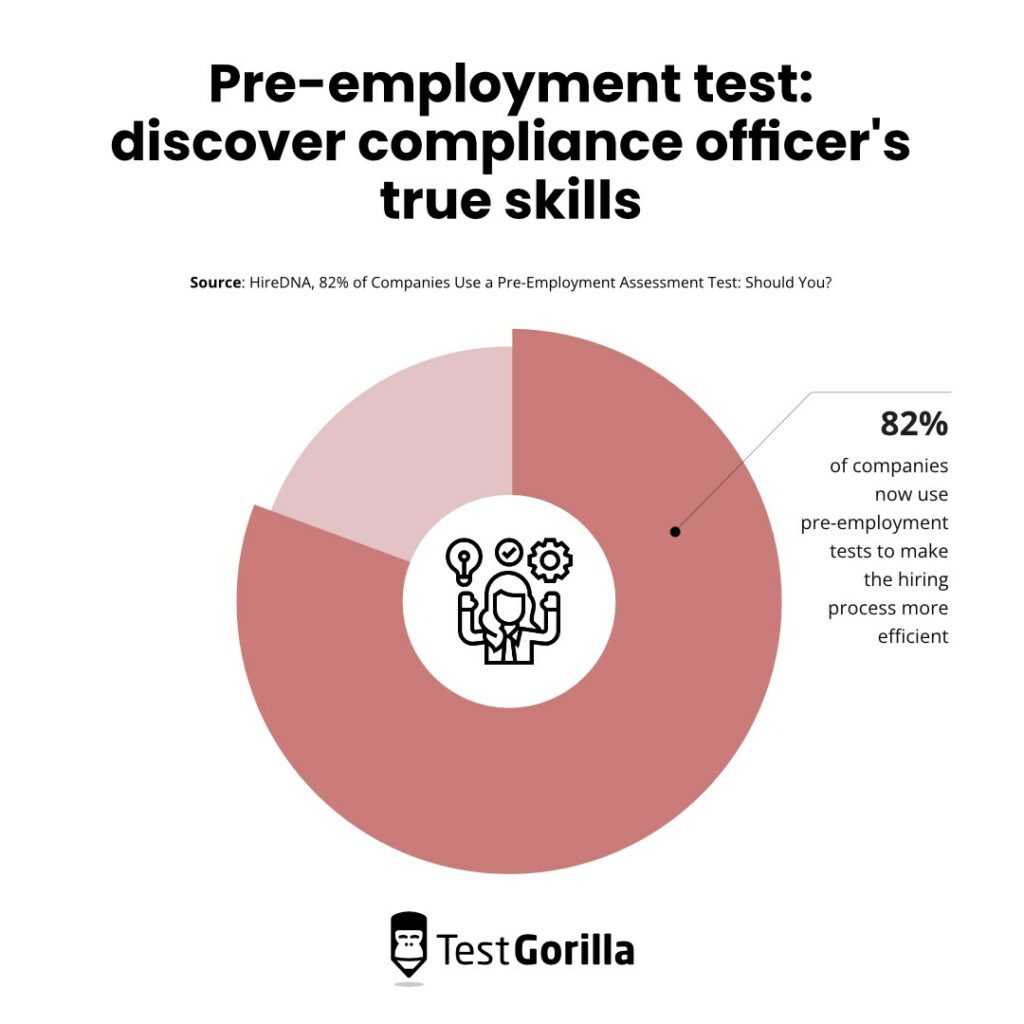

So, trusting what a resume says may not be the best idea. Thankfully, there are more effective ways to evaluate your candidates’ skills. Applying pre-employment tests is one of these techniques.

Pre-employment testing makes a difference in the quality of employees you hire. It reduces bad hires and allows you to identify candidates who are the perfect fit for the vacant position.

In fact, 82% of companies now use pre-employment tests because they make the hiring process much more efficient. Pre-employment tests help you discover which candidates have the value your company seeks.

Just as administering pre-employment tests is essential, finding the perfect testing platform is also important. It’s critical to use a platform that gives you access to all the tests you need to find the right compliance officer, while delivering effective results.

TestGorilla is a pre-employment testing platform with multiple tests to help examine your candidates’ skills. With our tests, you can identify skilled compliance officers easily.

Here are some tests we recommend to assess compliance officer skills:

1. Market Research skills test

With TestGorilla’s Market Research test, you can discover candidates with relevant knowledge of your industry’s compliance regulations. This test is excellent for identifying candidates who can prepare and present data.

Additionally, this test evaluates a candidate’s knowledge of the different research methodologies. It also ensures applicants know how to plan research and manage data derived from research.

This 10-minute intermediate test identifies the candidates who can help your company enjoy the benefits of detailed research.

2. Communication skills test

Compliance officers must clearly communicate with staff and management to ensure they execute their compliance plan. Our Communication skills test ensures you hire compliance officers with excellent workplace communication skills.

This test examines both the verbal and written communication skills of candidates. Applicants who do well on this test have no problem leading teams. This is because proper communication places everyone on the same page.

This test ensures candidates can listen attentively, are open-minded, empathetic, and offer constructive feedback. Additionally, applicants who pass this test have professional communication etiquette and can summarize messages effectively.

3. Critical Thinking skills test

TestGorilla’s Critical Thinking test evaluates the applicant’s ability to develop solutions using deductive and inductive reasoning. It helps you identify candidates that can make sound judgments using analytical skills.

The critical thinking test uses real-life scenarios in which candidates are to pick the correct answers. To pass, they must use logic to identify the right answers and recognize those that are mere distractions.

Essentially, this test identifies candidates who can think independently and solve complex problems. With the critical thinking test, you can find compliance officers who can skillfully devise new solutions to problems as they arise.

4. Leadership and People Management test

Our Leadership and People Management test examines candidates’ ability to delegate tasks and authority. This test is ideal for discovering compliance officers who can unite their teams to meet targets.

Ultimately, this test helps you identify applicants who can positively influence staff and help your organization grow. Candidates who pass this test can plan, delegate authority, take responsibility, and provide guidance to their teams.

Where to find compliance officers

The first step in finding compliance officer candidates is deciding which kind of compliance officer you want to hire. The type you hire is dependent on your budget and the kind of work they would perform.

Essentially, there are two types of compliance officers: full-time and freelance. Full-time compliance officers are part of your staff and have regular working hours. Conversely, freelance compliance officers work on a contract basis.

Let us thoroughly look into these both:

Full-time compliance officer

A full-time compliance officer is one who works with a company over a long period. These compliance officers clock in and out of work like regular employees. Typically, they work an average of 40 hours per week.

The role of a full-time compliance officer usually comes with added benefits like medical insurance. These benefits vary from company to company, but the main idea is they are not contract staff. They can enjoy legal protection if they are unduly fired.

The following are some of the pros of hiring a full-time compliance officer:

They have defined working hours and are mostly available to carry out projects

They are not employed on a project-to-project basis, so you don’t have to continue looking for staff whenever you get a project

Since they are regular members of your everyday staff, they provide your business with service consistently

Here are the cons of hiring a full-time compliance officer:

Your company spends more on the employment benefits of full-time compliance officers

In instances of no new regulations or changes, they will still be paid as full-time employees

They might be entitled to overtime pay if they work after their working hours

Freelance compliance officer

Freelance compliance officers work on a part-time basis. In other words, they work fewer cumulative hours than full-time compliance officers.

Smaller businesses prefer to hire freelance compliance officers because their budgets are smaller than larger companies. They employ them on short contracts to run assessments on their business and ensure it hasn’t breached any regulations.

Here are some of the pros of hiring a freelance compliance officer:

Since they are hired on a project-to-project basis, they cost less

They can bring unique perspectives because of their experience with other firms

You don’t have to offer them extra benefits or provide a working space for them

Here are some of the cons of hiring a freelance compliance officer:

They might not be available when you need them

Their dedication to your company is not as much as full-time compliance officers

They may not be ideal for bigger organizations

Here are some platforms where you can find both freelance and full-time compliance officers:

Compliance officer job description template

Knowing how to draft a job description can save you a lot of stress during compliance officer recruitment. Job descriptions are critical to recruitment because they are one of the first things candidates see.

To a large extent, the quality of your job description determines how many and how qualified your applications will be. You should conduct a job analysis and apply a job description template to help you draft it appropriately.

A job description template saves you a lot of time when trying to come up with a job description for a role. It’s basically an adjustable outline that you can tweak to fit the vacant position.

Below is a compliance officer job description template to guide you when drafting your job description:

[JOB TITLE]

The job title is the position applicants will occupy if they get the job. In other words, here you state what title the role comes with. For example:

“Chief compliance officer at [NAME OF INSTITUTION]”

[COMPANY INTRODUCTION]

In this section, you inform applicants about your company. This includes stating the company’s purpose and how long it has been in the industry. The goal of this section is to capture the candidate’s attention.

“[FIRM NAME] is a financial institution that has been around for 60 years. Our goal is to provide top financial services to our clients. We are looking for a chief compliance officer to head our compliance department.”

[JOB RESPONSIBILITIES]

In this section, you’ll need to highlight the tasks that come with the role of a compliance officer at your company. It gives potential applicants an idea of what will be expected from them. For example:

“As the compliance officer at [COMPANY NAME], you will:

Perform compliance reviews on relevant regulations in the finance industry

Assist in the implementation of new regulations

Oversee and monitor the implementation of the corporate compliance program

Develop a compliance training plan

Present written evaluations to the upper management.”

[QUALIFICATIONS]

This section involves stating what level of qualification you expect applicants to have. Qualification level varies based on the kind of compliance officer you are hiring. Here is an example for chief compliance officers:

For this role, you must have:

BSc/LLB/BA in law, finance, business administration, or a related field

Professional certification [Certified Compliance & Ethics Professional (CCEP)]

Excellent communication skills

Familiarity with industry regulations

Attention to detail

[SALARY AND BENEFITS]

In this section, you include the incentives and salary that come with the role. A bit of research is needed here to find out what rate of incentives will attract suitable applicants. Here is an example:

As a chief compliance officer at [NAME OF COMPANY], you’ll enjoy the following:

401(k) retirement plan

Health insurance

Dental insurance

Employee assistance program

Pay: $69,000 per year.

[JOB COMMITMENTS]

Finally, in this section, include the working hours. Also, you can insert arrangements for instances where there is bonus pay for overtime. For example:

“This role requires that you work five times a week from 10 am – 5 pm.”

How much does a compliance officer cost?

According to Payscale, compliance officers in the United States earn about $90,300 annually. However, this figure varies depending on the industry.

Here are the average salaries of various kinds of compliance officers:

Chief compliance officers earn about $239,701 annually

Finance compliance officers earn $86,304 per year

Legal compliance officers earn an average of $82,055 per year

Regulatory compliance officers make about $65,315 per year

Compliance officer interview questions

Interviews are a critical part of recruitment in which you observe your candidates’ skills and personalities in person. Since they are so important, it’s always best to apply an interview template while conducting an interview.

A comprehensive interview template allows you to identify the type of compliance officer you are looking for. Usually, the interview template includes the timeline and stages of the interview, as well as pre-planned questions.

Having interview questions ready shows vision and preparation. It shows the candidate how seriously you take the process, thus urging them to be coordinated and professional.

Moreover, the interview stage is a lot quicker when you’ve prepared questions ahead of time. These questions also come with ideal answers, allowing you to filter candidates who don’t give appropriate responses.

General questions

Why do you want to work for our firm?

How did you hear about this opening?

Which skills are essential in compliance?

Why did you become a compliance officer?

Why do you think companies need compliance officers?

Questions about experience and background

What experience do you have in compliance?

What is the most challenging task you’ve taken as a compliance officer?

How have you handled confidentiality issues?

What strategy can you use to solve conflict within compliance teams?

What educational background do you have in compliance?

In-depth questions

What plans do you have to implement the new regulations?

What makes compliance systems effective?

Tell me about the time you had to manage risk.

How do you research when learning about new industry standards?

How would you conduct an audit to promote compliance?

Hire your next compliance officer with TestGorilla

Recruiting compliance officers can be challenging, but it doesn’t have to be. With pre-employment testing, you can remove the difficulty associated with hiring great compliance officers.

TestGorilla offers you access to top-quality pre-employment tests, which can help you identify the best candidates for your company. You can administer multiple tests from our test library for a full compliance officer skills evaluation.

With our tests, you can eradicate bias from your recruitment and reduce the chances of mis-hiring. Sign up with us for free today and start enjoying a seamless and efficient recruitment process.

Related posts

Hire the best candidates with TestGorilla

Create pre-employment assessments in minutes to screen candidates, save time, and hire the best talent.

Latest posts

The best advice in pre-employment testing, in your inbox.

No spam. Unsubscribe at any time.

Hire the best. No bias. No stress.

Our screening tests identify the best candidates and make your hiring decisions faster, easier, and bias-free.

Free resources

This checklist covers key features you should look for when choosing a skills testing platform

This resource will help you develop an onboarding checklist for new hires.

How to assess your candidates' attention to detail.

Learn how to get human resources certified through HRCI or SHRM.

Learn how you can improve the level of talent at your company.

Learn how CapitalT reduced hiring bias with online skills assessments.

Learn how to make the resume process more efficient and more effective.

Improve your hiring strategy with these 7 critical recruitment metrics.

Learn how Sukhi decreased time spent reviewing resumes by 83%!

Hire more efficiently with these hacks that 99% of recruiters aren't using.

Make a business case for diversity and inclusion initiatives with this data.