Wealth management is a high-stakes job, and hiring the wrong candidate into this role can lead to financial losses, strained customer relationships, and even legal and compliance issues. That’s why hiring only the most qualified and talented applicants for this role is critical.

Crafting a well-written job description is the first step to achieving this. It clearly lists the specific skills and traits required for the role, helping to attract the right candidates.

In this guide, you’ll learn how to write an effective wealth manager job description and the pitfalls to avoid. We also share a free template you can use to get started ASAP.

Table of contents

- What is a wealth manager?

- Key skills to look for in wealth managers

- How to write an effective wealth manager job description

- Wealth manager job description template

- 3 things to avoid when writing a wealth manager job description

- Next steps: Attracting and assessing wealth managers

- FAQs

- Hiring the best wealth managers with TestGorilla

What is a wealth manager?

Wealth managers provide financial advisory services to high-net-worth individuals (HNWIs), families, and organizations. Their primary role is to help grow, manage, and protect their client’s wealth while simultaneously achieving the financial goals of the bank or investment firm they work for.

Here are some examples of what wealth managers do for their clients:

Create customized financial plans based on investment goals, risk appetites, and more

Manage investment portfolios, make investment decisions, and monitor asset performance

Develop and implement retirement plans and estate plans, including wills, trusts, and other asset protection strategies

Minimize tax liabilities through tax-efficient investments

Build and maintain strong client relationships on behalf of their organization

Key skills to look for in wealth managers

Wealth managers possess a range of hard and soft skills. These include the following.

Technical expertise

Proficient in financial management and analyzing investment opportunities, risks, and performance

Strong grasp of different types of asset classes, including alternative investments like private equity, hedge funds, and other structured products

Experienced in asset allocation and managing diversified investment portfolios

Expertise in creating trusts and wills and knowledge of inheritance laws

Familiar with financial and compliance regulations and fiduciary responsibilities

Proficient in using financial tools such as Bloomberg Terminal, Morningstar, Microsoft Excel, and other financial modeling software

Soft skills and attributes

Exceptional interpersonal skills to build and maintain strong client relationships

Strong written and verbal communication to explain complex financial information to clients

Empathy to understand clients’ concerns and needs, supporting and reassuring them when necessary

Problem-solving skills so they can proactively identify and address financial challenges

Adaptability to adjust to changing market conditions, client needs, and financial landscapes

How to write an effective wealth manager job description

These best practices can elevate your wealth manager job description and help attract top talent.

Tailor it to your company’s needs

Start by conducting a job analysis to consider what specific skills and knowledge gaps you want to fill with this hire. For instance, you may be entering a new market and want to hire wealth managers who can interact with clients in the local language.

Collaborate with your hiring managers and leadership team to understand the key requirements for the role. Include these in your wealth manager job description to prevent applications from unqualified individuals.

Highlight your company’s strengths

Financial markets are becoming increasingly complex, and wealth managers are in high demand across banks and other investment institutions. To attract top talent, you must outline why your company is the best place for wealth managers to work.

In your job description, discuss your company’s unique selling points – achievements, employee benefits, growth opportunities, positive culture, and more. This can help your company stand out among competing firms.

Use a template

A template can provide a solid foundation for writing your wealth manager job description. It gives you a better understanding of what skills and knowledge to look for and saves you the hassle of starting from scratch.

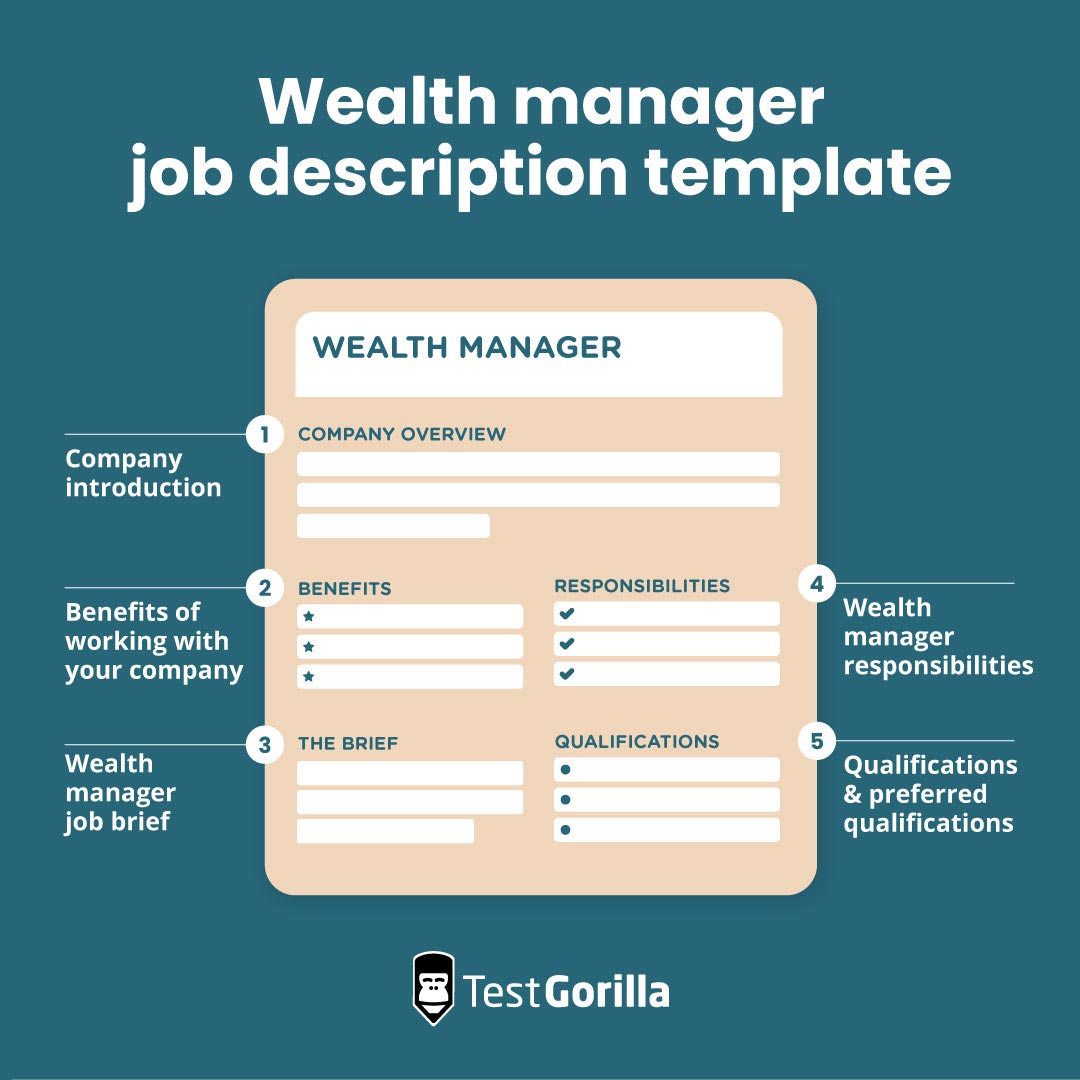

Wealth manager job description template

Below is a wealth manager job description template you can tailor to your needs.

Company introduction

Introduce your company, including its name, date of formation, and products and services. Also, outline assets under management (AUM), awards, performance metrics, and other key achievements.

Benefits of working with your company

Discuss employee benefits such as healthcare, retirement plans, paid time off, wellness initiatives, and career development opportunities.

Wealth manager job brief

[Company name]

Job title: [For example, Wealth Management Director]

Reports to: [For example, Head of Wealth Management]

Position type: [For instance, full-time, part-time, or consultant]

Location: [Such as on-site, hybrid, or remote]

[Salary and benefits information]

Wealth manager responsibilities

Conduct in-depth assessments to understand clients’ goals, current financial situations, and risk tolerance levels

Create and implement customized investments, estate and retirement plans, tax strategies, and other financial plans that align with client's needs and evolving market conditions

Optimize asset allocation and manage and monitor investment portfolios

Regularly communicate client portfolio performance, provide ongoing guidance, and make adjustments

Adhere to legal, compliance, and fiduciary responsibilities, and conduct thorough financial due diligence before making recommendations

Qualifications

Bachelor's degree in finance, economics, or a related field

Minimum of 10 years of experience in wealth management or financial advisory

Highly proficient in Bloomberg Terminal, Morningstar, and Microsoft Excel

Preferred qualifications

MBA or CFA designation

Familiarity with compliance standards (Series 7 and Series 66 licenses a plus)

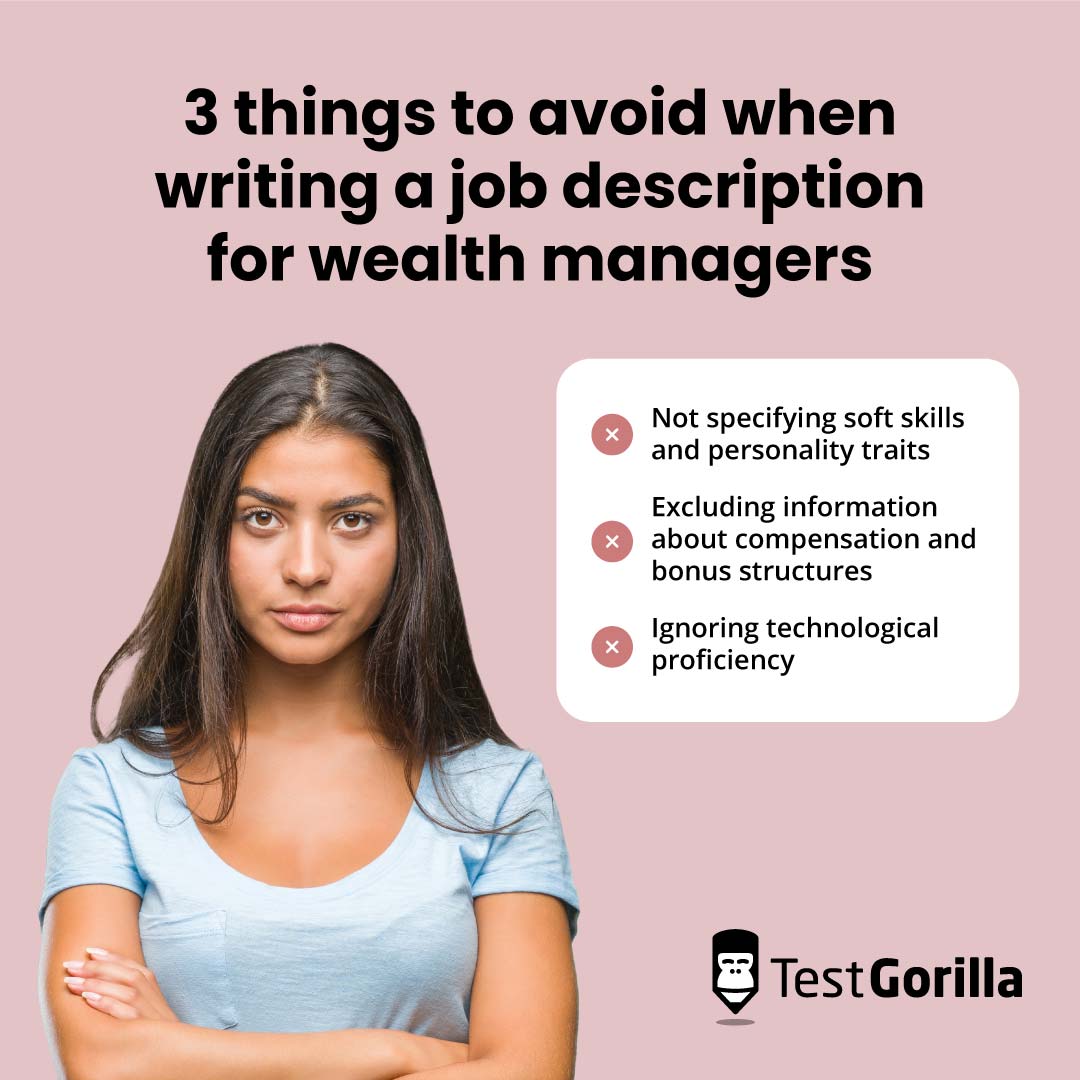

3 things to avoid when writing a wealth manager job description

Be mindful of these common mistakes when crafting your wealth manager job description.

1. Not specifying soft skills and personality traits

Although wealth management requires a highly technical skill set, a candidate’s soft skills and behavioral traits are also critical to their success in the role.

Ignoring these could leave you with candidates who, for instance, are great at financial analysis but lack the interpersonal skills required to build and maintain client relationships.

2. Excluding information about compensation and bonus structures

The high-paying nature of the role drives most wealth manager candidates. Consider including some information about the salary range for the role, especially if you’re paying above market.

Another strategy is highlighting bonuses or other incentives wealth managers can expect if hired. Without this, you could risk losing applicants to firms that are more transparent about compensation.

3. Ignoring technological proficiency

Today’s wealth managers must be well-versed in using digital platforms and software to analyze data, manage portfolios, engage with clients, and more.

Emphasize this requirement in your job description, or you risk hiring someone lacking the necessary tech skills to keep your firm running smoothly and your clients satisfied.

Next steps: Attracting and assessing wealth managers

Wealth managers are highly coveted, so you need to move quickly and keep talent engaged. The fastest and most effective way to shortlist your wealth manager candidates is through pre-employment testing.

With TestGorilla, you can put your wealth manager candidates through the following tests to objectively evaluate their expertise, soft skills, and traits.

Wealth management test that looks at capital markets knowledge, risk management, portfolio construction, and other technical skills

Our financial modeling and Excel tests to evaluate candidates’ experience with building financial models

TestGorilla’s financial math test to assess computation skills and candidates’ ability to identify and evaluate financial outcomes

The problem-solving test to determine how candidates can identify challenges and devise innovative solutions for their clients

Enneagram, Big 5 (OCEAN), and any of our other personality tests to check for empathy, adaptability, and other traits required for the role

Also, consider adding custom questions to assess candidates’ management skills. Then, use TestGorilla to conduct one-way video interviews for even more insight into your candidates’ experience and abilities.

FAQs

What is the difference between a wealth manager and a private banker?

A wealth manager takes a holistic approach to managing a client’s wealth. This includes investment management, financial planning, estate planning, tax optimization, risk profiling, and more. A private banker primarily focuses on banking services such as lending, credit, and wealth preservation solutions. Both roles focus on high-net-worth clients.

What kinds of bonuses are offered in wealth management?

There are several types of bonuses offered in wealth management. Some firms offer discretionary performance bonuses based on metrics such as revenue generated, client retention, AUM targets, and more. Other wealth managers receive fee bonuses based on fees generated from their managed assets. Some also receive retention bonuses, encouraging them to stay with the firm longer.

Hiring the best wealth managers with TestGorilla

Skilled wealth managers are vital to growing and protecting client wealth, generating revenue for your business, and maintaining a positive reputation among high-net-worth customers. With a well-written job description, you can attract wealth managers with the right experience, skills, and personality traits to succeed in the role.

Once you’ve gathered applications, pre-employment testing is the best way to identify your highest-skilled candidates. TestGorilla offers an extensive library of tests to evaluate candidates’ technical skills, personality traits, cognitive abilities, and more, so you can shortlist applications quickly and effectively before progressing them to the interview stages.

Get started with TestGorilla today by exploring our product tour, booking a live demo, or signing up for a free account.

Related posts

Hire the best candidates with TestGorilla

Create pre-employment assessments in minutes to screen candidates, save time, and hire the best talent.

Latest posts

The best advice in pre-employment testing, in your inbox.

No spam. Unsubscribe at any time.

Hire the best. No bias. No stress.

Our screening tests identify the best candidates and make your hiring decisions faster, easier, and bias-free.

Free resources

This checklist covers key features you should look for when choosing a skills testing platform

This resource will help you develop an onboarding checklist for new hires.

How to assess your candidates' attention to detail.

Learn how to get human resources certified through HRCI or SHRM.

Learn how you can improve the level of talent at your company.

Learn how CapitalT reduced hiring bias with online skills assessments.

Learn how to make the resume process more efficient and more effective.

Improve your hiring strategy with these 7 critical recruitment metrics.

Learn how Sukhi decreased time spent reviewing resumes by 83%!

Hire more efficiently with these hacks that 99% of recruiters aren't using.

Make a business case for diversity and inclusion initiatives with this data.